The market closed in the green, with the HNX-Index and UPCoM-Index finishing at 239.39 (up 0.79 points) and 99.81 (up 0.09 points), respectively. Total trading value reached nearly VND 21 trillion, higher than the previous session and the recent average.

Overall, the market was largely supported by real estate, metals and mining, securities, and food stocks in the afternoon session.

In the real estate sector, many stocks posted impressive gains, including DXG (+3.91%), DIG (+2.58%), TCH (+3.52%), PDR (+3.13%), and NVL (+2.02%), in addition to VHM, which rose by 0.86% and contributed significantly to the overall index due to its large market capitalization.

In the metals and mining group, several steel stocks hit the daily limit-up, including HSG, NKG, TLH, and SMC, while industry giant HPG climbed by 2.52%, making it one of the top contributors to the VN-Index. Moreover, strong gains were observed in the mining sector, with KCB surging by 11.11%, followed by TVN (+4.35%), MSR (+2.96%), and KSV and HGM, which both hit the ceiling price.

The food group also witnessed robust gains, with notable mentions including HAG (+4.33%), DBC (+2.61%), and BAF (+5.38%), offsetting the impact of VNM‘s 1.43% decline.

Turning to the securities sector, green dominated, although most gains were modest, below 1%. Nevertheless, their large market capitalization exerted a significant influence on the overall market.

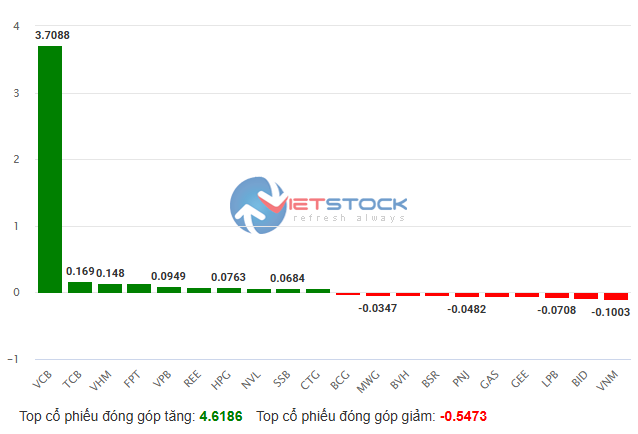

Among large-cap stocks, a mixed performance was observed, with notable gainers including VCB (+1.84%), which emerged as the top contributor to the VN-Index, followed by HPG and VHM.

However, foreign investors’ trading volume contracted compared to previous sessions, with net selling value surpassing VND 621 billion, despite a lower trading volume of over VND 1,363 billion in buying and nearly VND 1,985 billion in selling.

The most significant net sell-off by foreign investors today occurred in STB, with over VND 175 billion, followed by TPB, VCB (approximately VND 90 billion each), and VNM, MSN, and HPG (all above VND 70 billion).

Morning session: Can the 1,300 level hold?

Facing a broad sell-off across the market, Vietnam’s main indices turned red, with the VN-Index falling towards the crucial 1,300 support level.

By the end of the morning session, there were 395 declining stocks, outpacing 286 gainers, reflecting the market’s challenges, especially in the latter half of the morning.

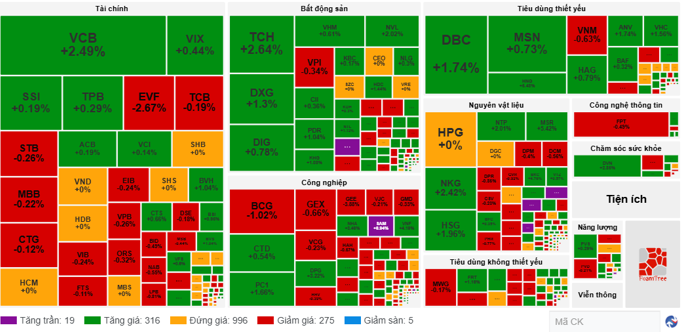

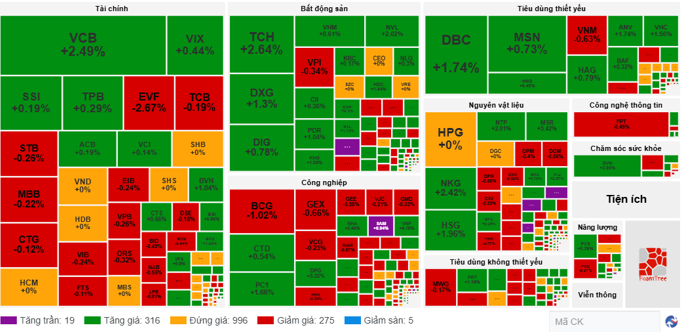

A sea of red emerged across various sectors, including banking, securities, chemicals, and electrical equipment, while real estate and construction exhibited a mixed performance. Food and minerals were among the few sectors predominantly in the green, as evident from the market heat map.

Amid mounting pressure, all three main indices reversed course, with the HNX-Index shedding 1.07 points to 237.53, UPCoM-Index dipping 0.02 points to 99.71, and the VN-Index plunging 2.95 points to 1,301.01. This decline heightened investors’ anxiety ahead of the afternoon session, as the 1,300 level is a critical threshold recently breached.

VCB remained the primary supporter of the VN-Index, contributing 2.88 points. It is worth noting that without VCB‘s resilience, the index would have witnessed a more substantial drop.

Foreign investors added to the market’s woes, net selling over VND 50 billion in STB and TPB and around VND 30 billion in VNM, VCB, and MSN. By the end of the morning session, foreign investors had net sold over VND 276 billion.

Beyond Vietnam, Asian markets mostly retreated, with declines witnessed in the Hang Seng (-0.9%), Nikkei 225 (-0.12%), Shanghai Composite (-0.41%), and Singapore Straits Times (-0.1%).

10:40 AM: Heightened market divergence, VN-Index fluctuates

Following the initial rally, the VN-Index entered a volatile phase and stood at 1,305.11 points as of 10:30 AM.

|

Market divergence intensifies

Source: VietstockFinance

|

The number of advancing stocks expanded to 335, but decliners also held their ground at 280, encompassing several large-cap stocks across sectors such as banking (TCB -0.19%, STB -0.26%, MBB -0.22%, CTG -0.12%, EIB -0.24%…), securities (DSE -0.18%, ORS -0.32%, FTS -0.11%…), and industrials (BCG -1.02%, GEX -0.66%, GEE -1.88%…), along with technology heavyweight FPT, which slipped by 0.49%.

Overall, the market retained a slight edge thanks to the continued strength in VCB (+2.49%), real estate (TCH +2.64%, DXG +1.3%, DIG +0.78%, VHM +0.61%, NVL +2.02%…), essential consumer goods (DBC +1.74%, MSN +0.73%…), and materials (NTP +2.01%, MSR +5.42%, NKG +2.42%, HSG +1.96%…).

Evident market divergence is evident across sectors and even within individual sectors, hindering the formation of a clear trend during the morning session.

Foreign investors were net sellers, offloading approximately VND 170 billion, with prominent sell-offs observed in TPB, VCB, VNM, FPT, SSI, and MSN.

Opening: VCB shines as market advances

As of 9:25 AM, Vietnam’s main indices were in positive territory, with the VN-Index climbing 3.82 points to 1,306.78, the HNX-Index gaining 0.62 points to 239.22, and the UPCoM-Index rising 0.1 points to 99.83. Total trading value reached nearly VND 1,072 billion.

|

Green prevails in early trading

Source: VietstockFinance

|

Advancers outnumbered decliners, with 253 stocks in the green, including 15 at the upper limit. Notable gainers included EVG (Everland Group) in the real estate sector, surging by 7%, TLH (Tien Len Steel Group) in the steel industry, also up by 7%, and LDP (Lam Dong Pharma) in the pharmaceutical sector, soaring by 10%. Conversely, 173 stocks retreated, including 2 at the lower limit.

The VN-Index‘s 3.82-point gain was largely attributable to the strong performance of heavyweight VCB, which climbed by 3.36% and contributed 3.71 points to the index.

|

VCB shines in early trading

Source: VietstockFinance

|

Asian markets exhibited mixed performances, with the All Ordinaries and Nikkei 225 indices advancing, while the Hang Seng, Shanghai Composite, and Singapore Straits Times indices retreated.

On Wall Street, the S&P 500 inched higher to 5,956.06 points, and the Nasdaq Composite rose 0.26% to 19,075.26 points. Conversely, the Dow Jones shed 188.04 points (equivalent to a 0.43% loss) to close at 43,433.12 points. The index had previously climbed by 245.34 points (roughly a 0.6% gain).

U.S. stocks retreated from their highs as uncertainty surrounding President Donald Trump’s trade policies heightened investor concerns. In his first cabinet meeting, President Trump announced that tariffs on Canada and Mexico would take effect. He also stated his intention to expand the trade war to include a 25% tariff on goods from the European Union (EU).

– 09:49 27/02/2025

The Market Tug-of-War: Vietstock Weekly Analysis 03-07/03/2025

The VN-Index continued its impressive upward trajectory, closely hugging the upper band of the Bollinger Bands. Accompanying this rise was a trading volume above the 20-week average, indicative of strong participation and a healthy flow of capital into the market. However, the index’s persistent volatility last week revealed that the 1,300-point mark is a significant resistance level. For the VN-Index to sustain its bullish momentum, breaking through this threshold in the coming period is essential.

Vietstock Daily Recap: Shaking Things Up at the 1,300-Point Threshold

The VN-Index witnessed a slight dip as it faced persistent pressure around the crucial resistance level of 1,300 points, indicating investors’ cautious sentiment. With the index struggling to break free from this range, there’s a significant possibility of a return to a downward trend. Adding to this, the Stochastic Oscillator, a key indicator, has already signaled a sell-off within the overbought territory. This suggests that the risk of a market correction intensifies if the indicator falls out of this zone.

“VISecurities Rebrands as OCBS, Announces Capital Increase to 1,200 Billion”

Vietnam International Securities Joint Stock Company (VISecurities) is gearing up for its upcoming 2025 Annual General Meeting of Shareholders, scheduled for March 14. The company has ambitious plans on the agenda, including a proposed name change and a move to relocate its headquarters from Hanoi to Ho Chi Minh City. VISecurities is also setting its sights on achieving record-high revenue and profit targets, aiming to make this fiscal year the most successful in the company’s 16-year history.

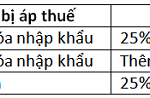

A Nuanced Look at Tariff Policies and Their Market Impact

The US trade policies and their tariffs could have a significant impact on global commerce. This move will undoubtedly affect Vietnam’s exports, a key driver of its economy. While the stock market may experience indirect and limited effects, it is not a primary driver of market trends and thus will not be significantly influenced.