Market liquidity decreased compared to the previous trading session, with the matching trading volume of VN-Index reaching more than 710 million shares, equivalent to a value of more than 15.5 trillion dong; HNX-Index reached more than 64.3 million shares, equivalent to a value of more than 1.1 trillion dong.

In the afternoon session, VN-Index gradually weakened due to continued selling pressure despite the return of buying pressure to stop the decline, but the index still closed in the red at the end of the session. In terms of impact, CTG, VCB, STB, and MBB were the codes that had the most negative impact on VN-Index, with a decrease of more than 1.6 points. On the other hand, FPT, GVR, HPG, and VIC were the codes that remained in the green and contributed more than 2.1 points to the overall index.

| Top 10 stocks with the most significant impact on VN-Index on 02/26/2025 |

On the contrary, HNX-Index had a rather positive performance, with the index being positively impacted by the codes NVB (+1.74%), VIF (+3.3%), NTP (+2.05%), and OCH (+9.33%)…

|

Source: VietstockFinance

|

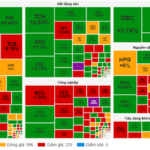

The telecommunications sector was the group with the strongest increase in the market, with a gain of 3.88%, mainly driven by the codes VGI (+3.42%), FOX (+8.72%), CTR (+1.27%), and FOC (+2.39%). Following the recovery were the information technology and materials sectors, with increases of 1.94% and 0.89%, respectively. On the other hand, the utilities sector saw the largest decline in the market, falling by 0.96%, mainly due to the code GAS (-0.44%), REE (-0.94%), POW (-1.22%), and VSH (-0.93%).

In terms of foreign trading, they continued to net sell more than 367 billion dong on the HOSE exchange, focusing on the codes STB (182.84 billion), CTG (156.03 billion), HPG (67.4 billion), and VHM (57.28 billion). On the HNX exchange, foreigners net sold more than 11 billion dong, focusing on the code IDC (18.29 billion), VTZ (1.56 billion), TIG (1.53 billion), and NVB (1.25 billion).

| Foreign trading buying and selling dynamics |

Morning Session: Weakness in pillar stocks, VN-Index turns red

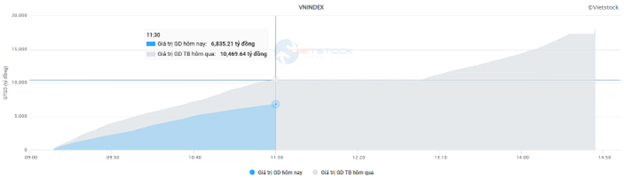

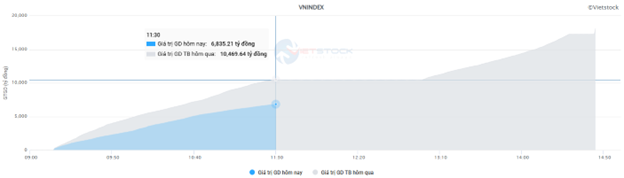

The fluctuation continued around the 1,300-point threshold. At the end of the morning session, the VN-Index temporarily stood at 1,302.92 points, down slightly by 0.02%. Meanwhile, the HNX-Index performed better, gaining 0.36% to reach 239.17 points.

This morning’s liquidity was significantly lower than in previous sessions, with the matching trading volume of the VN-Index reaching more than 320 million units, equivalent to a value of 6.8 trillion dong, a decrease of nearly 35% compared to yesterday morning. The HNX-Index recorded a matching volume of more than 30 million units, with a value of more than 542 billion dong, a decrease of 31%.

Source: VietstockFinance

|

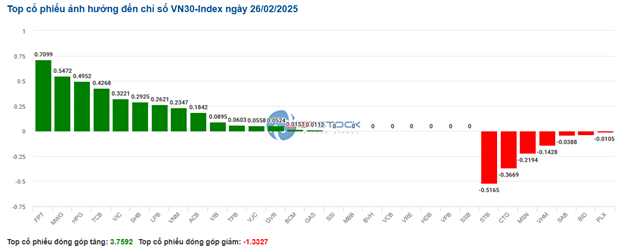

The weakness in pillar stocks was the main factor causing the VN-Index to return to negative territory. Among the top 10 stocks with the most negative impact on the index, the banking group accounted for six names, of which the top five codes took away nearly 2 points from the VN-Index, including CTG, VCB, BID, STB, and MBB. On the other hand, GVR, FPT, and VIC tried to hold the index but recovered less than 1 point for the VN-Index.

Most industry groups were mixed within a narrow range, except for the telecommunications group, which recovered quite evenly, temporarily leading the market with a remarkable increase of 3.24%. Healthcare was the next group, but the green color was only concentrated in a few large-cap stocks in the industry, such as DHG, IMP, DVN, TRA, TNH, DHT, AGP, etc. The rest mostly stood at the reference level, and a few codes even fell sharply, such as DMC (-3.98%), VDP (-2.27%), DBT (-1.24%), and NDP hitting the floor price.

In the financial sector, the red color dominated the banking stocks, while securities and insurance saw a few notable gainers, such as BSI (+1.18%), BVS (+2.42%), FTS (+0.77%); MIG (+1.89%), BMI (+0.92%), and BLI (+1%).

The utilities group recorded the sharpest decline in the morning session, as sellers dominated the stocks with significant capitalization, such as REE (-0.67%), GAS (-0.15%), DNH (-13.24%), NT2 (-1.18%), GEG (-1.5%), DNW (-3.87%), etc.

Foreigners continued to net sell with a value of more than 485 billion dong on the three exchanges this morning. The stocks facing significant net selling pressure were CTG (98.74 billion), HPG (94.12 billion), and STB (63.4 billion). Meanwhile, buying was rather modest, with VNM (41.47 billion) and TCB (+29.79 billion) leading in terms of net buying value.

10:40 am: VN-Index fluctuates around the 1,300-point threshold with cautious sentiment

Investor caution caused the main indices to fluctuate within a narrow range around the reference level. As of 10:30 am, the VN-Index increased by 1.16 points, trading around 1,304 points. The HNX-Index rose by 0.91 points, trading around 239 points.

The breadth of stock performance in the VN30 basket was mixed, with a slight advantage for the buying side. Notably, some codes positively impacted the overall index, such as FPT contributing 0.71 points, MWG contributing 0.55 points, HPG contributing 0.49 points, and TCB increasing by 0.43 points. Conversely, the codes STB, CTG, MSN, and VHM remained in the red and took away more than 1.2 points from the VN30-Index.

The telecommunications group led the gains, with a strong recovery of more than 4% after four consecutive declining sessions. Specifically, buying interest mainly focused on VGI, which rose by 3.8%, FOX by 7.69%, CTR by 1.52%, and SGT by 1%, among others.

From a technical analysis perspective, the telecommunications sector index rebounded after touching the SMA 200-day moving average, accompanied by the Stochastic Oscillator entering the oversold region. If the indicator signals a buy and exits this region in the future, and there is an improvement in money flow, the recovery will likely be more sustainable.

Source: https://stockchart.vietstock.vn/?stockCode=50

|

The securities group of stocks reversed course and fell sharply, with most codes in the red. Notably, VDS declined by 1.88%, MBS by 1.86%, VIX by 1.81%, and BSI by 1.54%…

Following the upward momentum was the materials sector, which was in a state of fluctuation, with the buying side having a slight advantage. Specifically, the buying interest was concentrated in codes such as HPG, which rose by 0.36%, GVR by 1.87%, MSR by 6.22%, and DCM by 0.97%…

In contrast, the essential consumer goods sector was highly mixed, and selling pressure dominated the large-cap stocks in the industry, such as MSN falling by 0.29%, SAB by 0.38%, and QNS by 0.2%… On the other hand, the codes that maintained their gains included VNM, which increased by 0.16%, MCH by 0.27%, and VHC by 0.28%…

Compared to the opening, the buying side still had the upper hand. There were 384 gainers and 234 decliners.

Source: https://finance.vietstock.vn/

|

Opening: Green color dominates most industry groups

At the start of the session on February 19, as of 9:30 am, the VN-Index increased quite positively, reaching 1,305.47 points. The HNX-Index edged higher, reaching 239.31 points.

The S&P 500 fell for the fourth consecutive session on Tuesday (February 25) as investors weighed concerns about global economic growth and trade. Specifically, at the close of the session on February 25, the S&P 500 fell by 0.47% to 5,955.25 points. The Nasdaq Composite lost 1.35% to 19,026.39 points. Nvidia shares fell by 2.8%, leading the decline in the Nasdaq Composite, which also fell into negative territory for the year. The Dow Jones was the exception, advancing 159.95 points (equivalent to 0.37%) to 43,621.16 points.

As of 9:30 am, the green color temporarily dominated the VN30 basket, with 6 declining codes, 16 gaining codes, and 8 codes unchanged. Among them, CTG, MWG, GAS, and BID were the most negatively impacted stocks. On the other hand, SHB, HPG, BVH, and VIC were the stocks with the strongest gains.

Additionally, the telecommunications services sector was the group with the most positive impact on the market this morning, with a gain of 2.19%. Specifically, the prominent codes included FOX, which rose by 4.21%, VGI by 2.28%, CTR by 0.84%, YEG by 0.63%, and SGT by 2%, among others.

Market Beat 27/02: Stocks, Steel and Real Estate Surge to Keep VN-Index Above 1,300

The VN-Index took investors on a wild ride as it breached the 1,300-point threshold in the early afternoon session, only to swiftly rebound and close at 1,307.8 points, a gain of 4.84 points. This dramatic turnaround came after a pressured morning session that saw the index hovering just above the 1,300 mark.

The Market Tug-of-War

The VN-Index declined, sustaining a tug-of-war stance as the High Wave Candle pattern emerged. This reflects investors’ cautious sentiment as the index retests the old peak from October 2024 (1,290-1,305 points territory). Unless the index breaks out of this range soon, a resumption of the downward trend is highly likely. Notably, the Stochastic Oscillator is venturing deep into overbought territory, suggesting a sell signal in the upcoming sessions. Should this materialize, the risks of a market correction intensify.

The Market Tug-of-War: Vietstock Weekly Analysis 03-07/03/2025

The VN-Index continued its impressive upward trajectory, closely hugging the upper band of the Bollinger Bands. Accompanying this rise was a trading volume above the 20-week average, indicative of strong participation and a healthy flow of capital into the market. However, the index’s persistent volatility last week revealed that the 1,300-point mark is a significant resistance level. For the VN-Index to sustain its bullish momentum, breaking through this threshold in the coming period is essential.

Vietstock Daily Recap: Shaking Things Up at the 1,300-Point Threshold

The VN-Index witnessed a slight dip as it faced persistent pressure around the crucial resistance level of 1,300 points, indicating investors’ cautious sentiment. With the index struggling to break free from this range, there’s a significant possibility of a return to a downward trend. Adding to this, the Stochastic Oscillator, a key indicator, has already signaled a sell-off within the overbought territory. This suggests that the risk of a market correction intensifies if the indicator falls out of this zone.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)