A Buzz of Activity: Kicking Off, Signing, and Launching…

Southern Vietnam’s real estate businesses are in overdrive as they kick off, sign deals, and launch new projects. With the market showing signs of recovery, companies are eager to seize the momentum and accelerate their operations. While ensuring legal compliance, they’re also gearing up for a busy second quarter in 2025, anticipating a strong rebound in demand.

The years 2024–2025 are seen as a pivotal period for real estate developers to gain momentum for the new growth phase. A flurry of activities, including kickoff events, new launches, and strategic partnerships with banks, indicate a positive outlook for the Southern market. The expected revival of the real estate sector in 2026–2027 seems well within reach.

Notable developers with substantial land banks, such as Nam Long, Masterise Homes, and Vingroup, are actively launching new phases, forging bank partnerships, and expanding their land banks. For instance, Masterise Homes is preparing to introduce the SOLA subdivision in The Global City, Thu Duc City. The company aims to accelerate project activities in the second quarter of 2025 to capture the new cycle’s demand.

Similarly, Nam Long recently entered a strategic partnership with Vietinbank for financial solutions and support throughout the project development process. This collaboration also opens up opportunities for Nam Long to develop integrated townships and key projects in the future, especially as the real estate market enters a new cycle with positive changes. Moving forward, Nam Long will strengthen its strategic alliances with banks, including long-term partner VietinBank, to offer a range of financial solutions for homebuyers. In 2025, Nam Long plans to focus on large-scale urban areas like Waterpoint Phase 1 (165ha – Long An), Nam Long – Dai Phuoc (45ha – Dong Nai), Izumi City (170ha – Dong Nai), and Nam Long – Can Tho (43ha), releasing over 2,000 products…

In Binh Duong, developers such as Phu Dong Group, TT Capital, Le Phong, Conteccons, Bcons, and An Gia are also gearing up for a busy period starting in late March 2025. Kickoff events and project introductions are buzzing, with some affordable condo projects already seeing strong reservations despite their recent market entry post-Tet.

In Long An and Dong Nai, developers are joining the race, introducing large-scale projects like Eco Retreat Long An, Waterpoint, and La Home at the beginning of 2025. Although supply has yet to catch up, the market sentiment is upbeat, adding vibrancy to the real estate landscape.

The developers’ rush to accelerate is understandable. The real estate sector has endured challenging times, but 2024 brought positive changes with interest rate adjustments and the stabilization of rates over an extended period. This period also witnessed the rapid implementation of three crucial laws directly impacting the market. Now, in 2025, there’s a sense of optimism about a new cycle, prompting businesses to seize the opportunity.

Strong Demand for Real Estate Persists

Despite lingering challenges like legal hurdles, supply imbalances, and high prices in certain areas, Vietnam’s real estate market holds promise for the coming period.

According to Vo Huynh Tuan Kiet, Director of Residential CBRE Vietnam, the demand for housing among Vietnamese, especially in major cities, remains robust. This underlying demand has helped the market navigate through difficult times. Additionally, infrastructure developments and the government’s focus on public investment plans will significantly benefit the market in the coming period.

“As the market enters a new cycle of development, it presents immense potential for future value growth. I have always held a positive view of the demand for purchasing and investing in real estate in the Southern market in recent years…”, emphasized the CBRE expert.

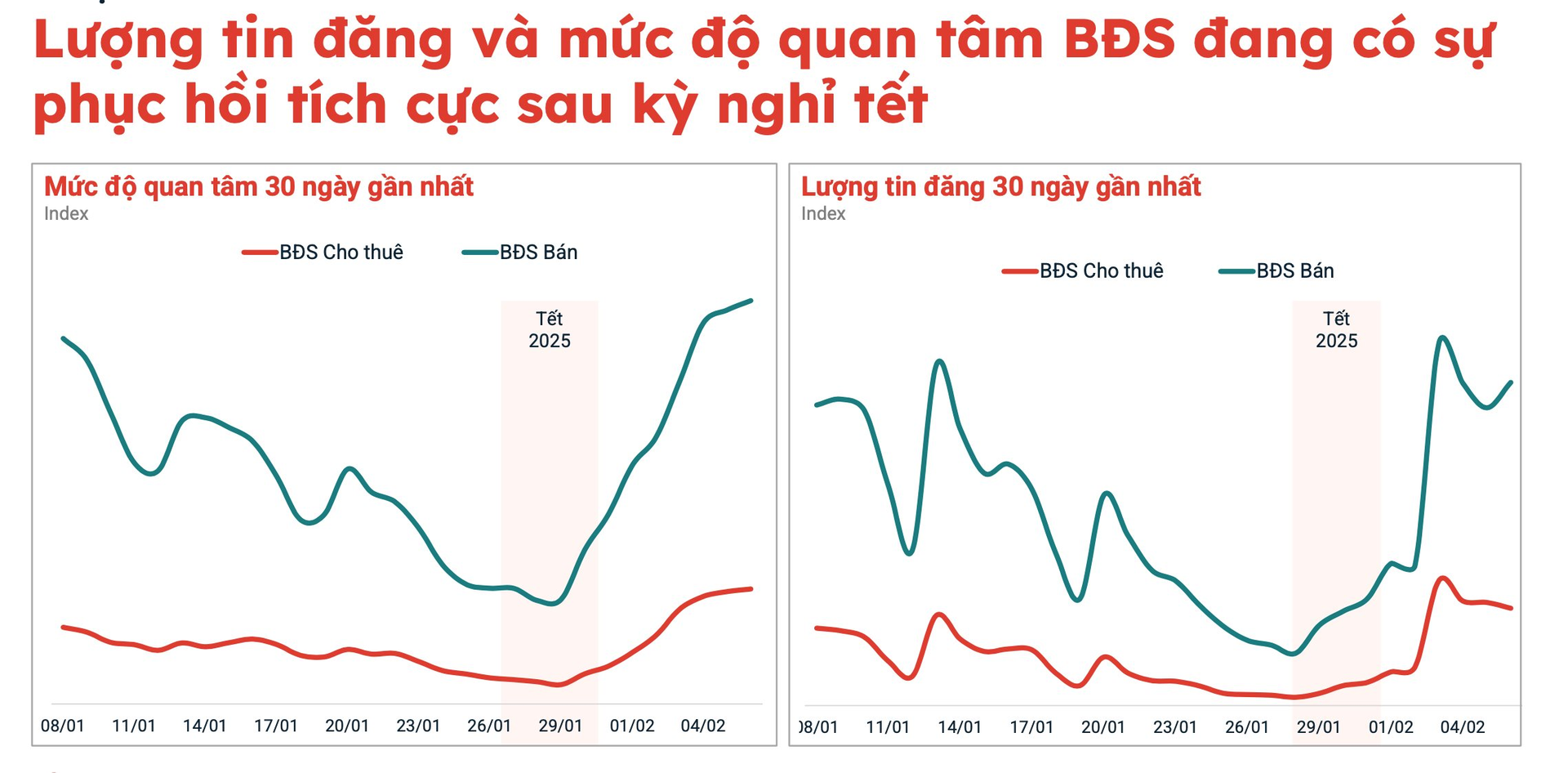

Strong demand in early 2025. Source: Batdongsan.com.vn

At a recent workshop, Lucas Loh, CEO of Nam Long Group, acknowledged the challenges faced by Vietnam’s real estate sector, particularly the legal obstacles in the commercial housing segment, which have constrained supply and affected both homebuyers and developers.

However, he noted that the market began to show positive signs in the second half of 2024 due to legal changes and the authorities’ efforts to address issues. Mr. Loh expressed his optimism about the recovery of genuine home-buying demand, as consumer sentiment improves following the implementation of new legal regulations.

Sharing this sentiment, Nguyen Nhat Hoang, Senior Manager of Corporate Ratings at FiinRatings, observed that the Vietnamese real estate market is regaining momentum. Transaction volumes are stabilizing, and investor and homebuyer sentiments are witnessing a noticeable upturn.

“While challenges remain, the industry is moving towards a more sustainable recovery as the new legal framework takes effect and is applied in practice in the coming period. This is expected to improve new supply from 2025 in major cities and their surrounding areas,” said Mr. Hoang.

He predicts a shift in real estate credit allocation, favoring homebuyers instead of primarily focusing on developers, as seen previously. This shift is particularly evident in the satellite cities of Ho Chi Minh City, which offer abundant supply, more affordable prices, and faster-growing incomes compared to larger urban centers.

The Rising Dragon: Vietnam’s Property Prices Soar Above the Rest

“Over a 5-year period, Vietnam’s property price growth reached an impressive 59%, outperforming many other countries such as the US (54%), Australia (49%), Japan (41%), and Singapore (37%). The high rate of price increase has led to a rental yield of just 4% for Vietnamese properties, while many other countries, including the Philippines, Malaysia, Thailand, Indonesia, the UK, Australia, and the US, enjoy rental yields ranging from 5% to 7%.”

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)