Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 533 million shares, equivalent to a value of more than 11.9 trillion VND; HNX-Index reached over 48.1 million shares, equivalent to a value of more than 806 billion VND.

| Top 10 stocks with the strongest impact on the VN-Index on February 5, 2025 |

VN-Index opened the afternoon session in a strong tug-of-war, and buyers continued to dominate, helping the index maintain its green color until the end of the session. In terms of impact, VCB, VNM, LPB, and VPB were the most positive influences on the VN-Index, with an increase of over 2.6 points. On the other hand, MSN, HVN, SSI, and FRT faced strong selling pressure, but their impact on the index was not significant.

Similarly, the HNX-Index also had a positive performance, influenced by the gains in KSV (+9.98%), CEO (+4.62%), PVS (+1.82%), and HGM (+8.73%)…

|

Source: VietstockFinance

|

Among these, the telecommunications sector witnessed the strongest growth in the market, surging by 1.75%, mainly driven by VGI (+2.13%), FOX (+0.5%), CTR (+1.1%), and ELC (+4.47%). Following the recovery were the industrial and utilities sectors, with increases of 1.72% and 0.82%, respectively. On the contrary, the healthcare sector witnessed the most significant decline in the market, falling by -0.09%, mainly due to IMP (-0.44%), DBD (-1.02%), DMC (-2.17%), and TNH (-0.25%).

In terms of foreign trading activities, they continued to be net sellers on the HOSE exchange, focusing on SSI (66.64 billion VND), CTG (65.35 billion VND), FRT (61.24 billion VND), and MWG (44.43 billion VND). On the HNX exchange, foreign investors net sold over 13 billion VND, mainly offloading IDC (13.15 billion VND), SHS (5.27 billion VND), VFS (2.34 billion VND), and HUT (2.02 billion VND).

| Foreign Investors’ Buying and Selling Activities |

Morning Session: Maintaining the Green Color

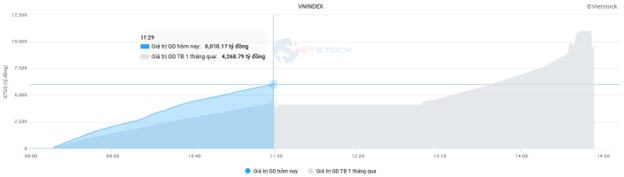

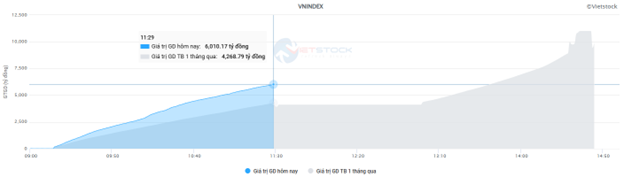

The green color was sustained until the end of the morning session, but the indices were gradually decreasing in height. From the highest increase of nearly 7 points earlier, the VN-Index temporarily paused in the middle of the session, rising by just over 3 points and settling at 1,267.8 points; the HNX-Index increased by 0.47%, reaching 227.67 points.

The morning’s liquidity was similar to that of the previous day, showing a significant improvement compared to the dull period before the Lunar New Year holiday. The matching volume of the VN-Index reached over 277 million units, equivalent to a value of more than 6 trillion VND, an increase of nearly 41% compared to the average liquidity in the past month. The HNX-Index recorded a matching volume of over 32 million units, with a value of over 520 billion VND.

Source: VietstockFinance

|

Buyers remained dominant in most stock groups. The industrial group temporarily led the market with a 1.69% increase, with notable gainers with outstanding liquidity, including HAH (+1.93%), CTD (+1.43%), SCS (+2.5%), PVT (+1.15%), VOS (+1.26%), SGP (+4.24%), PHP (+6.11%), and VEA (+1.01%)…

The real estate group continued to be a highlight, driven by VHM (+1.03%), VRE (+3.37%), DIG (+6.5%), CEO (+5.38%), DXG (+1.64%), PDR (+4.2%), and NLG (+1.74%)… However, the gradual weakening of the financial sector is causing the market’s upward momentum to slow down. In this sector, the red color is gradually spreading, especially in securities and insurance stocks such as SHS (-1.45%), SSI (-0.79%), VIX (-0.99%), and VDS (-1.33%); BVH (-0.78%), MIG (-0.59%), and PVI (-0.94%). Meanwhile, the “king” stocks exhibited mixed performances, with only a few gainers, including LPB (+2.14%), OCB (+1.34%), and VCB (+0.76%).

Another negative factor came from foreign investors, who net sold nearly 285 billion VND on the HOSE exchange in the morning session. DGC and MWG were the two stocks that were net sold the most, with values of 49.83 billion VND and 39.74 billion VND, respectively. On the other hand, the real estate stocks DIG and PDR attracted positive cash flow.

10:30 am: Real Estate Group “Stirs the Market”, VN-Index Maintains Recovery Momentum

The tug-of-war between buyers and sellers continued, with buyers gaining the upper hand, helping the main indices maintain a positive tone. As of 10:30 am, the VN-Index increased by more than 5 points, trading around 1,270 points. The HNX-Index rose by more than 1 point, trading around 228 points.

Stocks in the VN30 basket also performed optimistically, with most codes supported by buying demand and contributing to the overall market gain. For instance, LPB rose by 1.7 points, FPT by 0.87 points, VNM by 0.7 points, and VRE by 0.56 points. Conversely, MWG, MSN, SSI, and SSB continued to face selling pressure, resulting in a loss of nearly 1 point from the overall index.

Source: VietstockFinance

|

Notably, most large-cap stocks in the real estate group turned green early in the session. Specifically, VHM rose by 1.42%, VIC by 0.75%, BCM by 0.14%, and VRE by 4.29%… Only a few codes recorded slight declines, such as QCG, which fell by 0.84%, ITC by 0.48%, and VC3 by 0.36%…

Additionally, from a technical analysis perspective, the real estate sector index formed a strong bullish Marubozu candlestick pattern during the morning session, and the volume was expected to surpass the 20-day average by the end of the day, indicating the presence of bullish sentiment among investors. Furthermore, both the MACD and Stochastic Oscillator indicators generated buy signals and continued their upward trajectory, reinforcing the current recovery trend. Presently, the sector index is approaching the Fibonacci Retracement level of 38.2% (corresponding to the 2,575-2,595 point range), and a successful breakthrough above this level would reinforce the short-term recovery trend.

Source: https://stockchart.vietstock.vn/?stockCode=60

|

The industrial sector also attracted investors’ attention, with most leading stocks in the group posting gains from the beginning of the session, despite some degree of divergence. Notable gainers included ACV, which rose by 0.98%, MVN by 8.23%, VJC by 0.51%, and VEA by 1.26%…

Compared to the opening, buyers continued to dominate. There were 377 gainers and 192 losers.

Source: VietstockFinance

|

9:30 am: Positive Start to the Session

At the opening of the session on February 5, as of 9:30 am, the VN-Index started in the green, climbing to 1,268.24 points. Meanwhile, the HNX-Index edged slightly higher, staying above 228.19 points.

The green color temporarily prevailed in the VN30 basket, with 5 declining stocks, 18 advancing stocks, and 7 stocks remaining unchanged. Among them, CTG, SSI, and MSN were the top losers. Conversely, VHM, VRE, and VNM were the top gainers.

The industrial group was one of the most prominent sectors at the start of the morning session. Stocks in this group witnessed positive momentum from the beginning of the session, such as VTP, which rose by 1.04%, CTD by 2.21%, ACV by 1.47%, and HBC by 3.03%…

Along with this, the telecommunications services group also contributed positively to the market’s performance. Specifically, VGI increased by 1.23%, CTR by 0.55%, MFS by 8.32%, FOX by 0.6%, and ELC by 0.54%…

– 10:40 am, February 5, 2025

Market Beat on Feb 24th: VN-Index Surges Past 1,300 Points as Trading Volume Improves

The market closed with strong gains, as the VN-Index rose by 7.81 points (+0.6%), finishing at 1,304.56; while the HNX-Index climbed 0.92 points (+0.39%) to close at 238.49. The market breadth was relatively balanced, with 377 gainers and 373 losers. The large-cap stocks in the VN30 basket painted a positive picture, as 21 stocks advanced, 6 declined, and 3 remained unchanged, tilting the basket towards a green close.

The Market Beat – 28/02: Foreigners’ Robust Sell-off Continues in the Final Trading Session of February

The market closed with slight losses, as the VN-Index dipped by 2.44 points (-0.19%) to end the day at 1,305.36. Similarly, the HNX-Index edged lower by 0.2 points (-0.08%), finishing at 239.19. The market breadth tilted towards decliners, with 408 tickers in the red versus 390 in the green. The large-cap segment mirrored this sentiment, as reflected in the VN30 basket, where 18 stocks retreated, seven advanced, and five remained unchanged.

Is the Uptrend Supported?

The VN-Index rebounded with a Hammer candlestick pattern, reflecting investors’ optimism as the index broke through the old peak of October 2024 (1,290-1,305 points). This bullish sentiment is further reinforced by the MACD indicator, which continues to trend upward, providing a buy signal. If the index sustains levels above this threshold, accompanied by high trading volume, the upward trajectory will be solidified.

Steady Growth Surge: Vietstock Daily’s Insight for 25/02/2025

The VN-Index has been on a remarkable run recently, with five consecutive sessions in the green, closely hugging the upper band of the Bollinger Bands. What’s more, the index is retesting the old peak from October 2024 (1,290-1,305 points) amid sustained trading volumes above the 20-day average, indicating consistent participation from investors. Should the VN-Index decisively breach this zone, the outlook would turn even more bullish. However, the Stochastic Oscillator, now deeply embedded in overbought territory, suggests that the risk of a correction will heighten if sell signals reemerge.

Market Beat: Caution Creeps In at the 1,300-Point Threshold

The market closed with the VN-Index down 0.2 points (-0.02%), settling at 1,302.96, while the HNX-Index gained 0.29 points (+0.12%), closing at 238.6. The market breadth tilted slightly in favor of advancers, with 411 gainers against 365 decliners. However, the large-cap stocks in the VN30 basket witnessed a dominance of red, as 18 stocks fell, 10 advanced, and 2 remained unchanged.