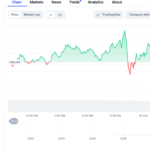

Bitcoin dipped to lows of $83,724 USD before rebounding to nearly $84,800 USD at 9:33 am on February 27. Over the past week, Bitcoin has dropped by more than 12%.

|

Bitcoin Price Action

|

Bitcoin hasn’t been this low since early November, just days after President Trump’s election win. At the current price, Bitcoin is down 23% from its peak of over $108,000 USD set just over a month ago.

However, Ethereum has been hit harder, falling to $2,275 USD – its lowest since September last year. Compared to its all-time high of $4,878 USD set in 2021, Ethereum is down by 53%.

Overall, the crypto market was down about 4% on the day, continuing a poor start to the week amid concerns about inflation, Trump’s tariff expansion, meme coin trading momentum cooling off, and last week’s $1.4 billion hack of the Bybit crypto exchange.

“The tariff confusion, interest rate outlook, and Nvidia earnings report are causing jitters among investors,” Strahinja Savic, Head of Data and Analytics at FRNT Financial, a financial services and consulting firm focused on crypto, told Decrypt. “Given how much Nvidia has driven the broader market in the past few months, the volatility we’re seeing in BTC today could also be traders positioning themselves ahead of Nvidia’s results.”

“Nonetheless, these broad-based pullbacks are a common feature of Bitcoin bull markets,” he added. “We had a major pullback in August and then went on to breach $100,000 USD in November. The important level to watch now is the 200-day moving average of $81,700 USD and whether the world’s largest cryptocurrency can hold above this level.”

Over $613 million USD worth of futures contracts were liquidated in the past 24 hours, according to data from CoinGlass, with Bitcoin leading at $335 million USD. Ethereum was second with $115 million USD worth of liquidations.

– 09:39 27/02/2025

The Cryptocurrency Comeback: Will Bitcoin Bounce Back in January 2025?

As investors look ahead to 2025, historical market data suggests that January could be a bullish month for Bitcoin and the broader digital asset market.

The Rise of Bitcoin: Breaking Records Post-Trump Announcement

Former President Trump has once again expressed his intention to open a national strategic reserve of Bitcoin, akin to the country’s strategic oil reserves.