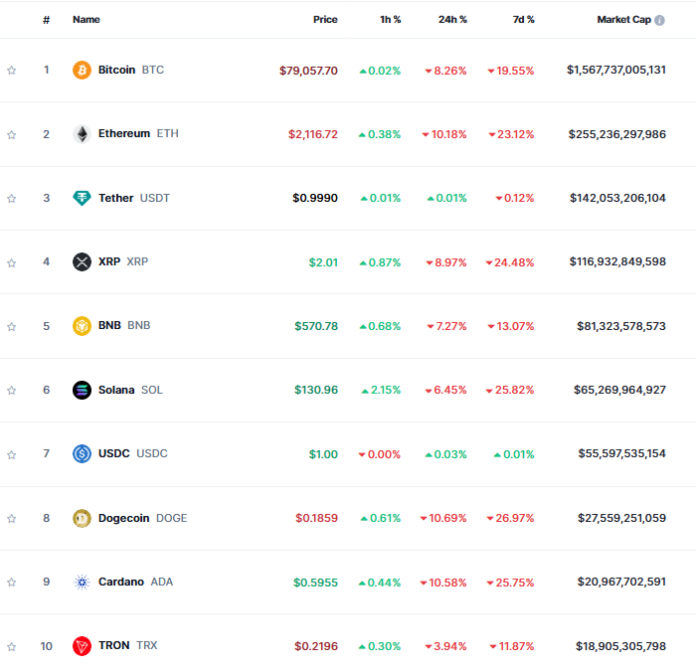

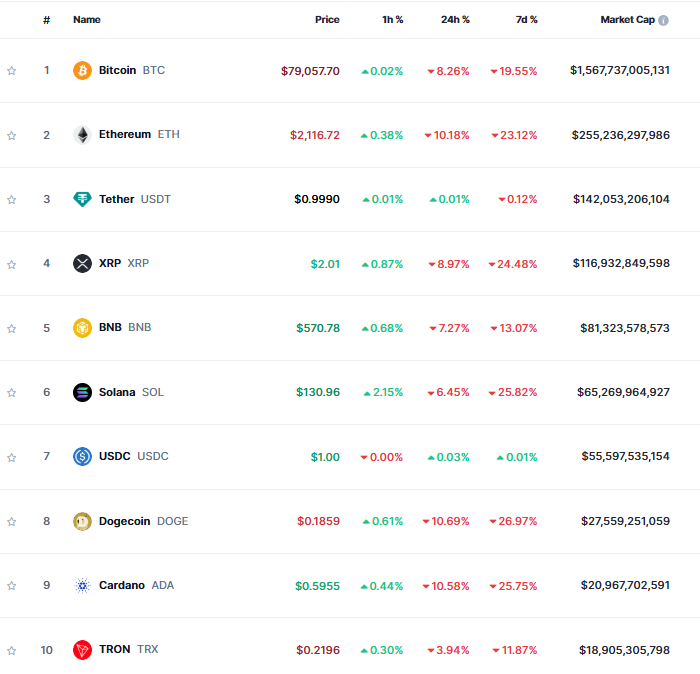

As of 4 pm on February 28, 2025 (Vietnam time), Bitcoin is trading at $79,057, marking an 8.26% decrease over the past 24 hours and a staggering 19.55% drop in the last seven days.

Source: CoinMarketCap

|

This sell-off is occurring amidst a broader market downturn, with top cryptocurrencies like Ethereum, Dogecoin, and Cardano all experiencing double-digit percentage losses within the last 24 hours.

The decline marks a turning point in the “Trump effect” – the sharp rise in cryptocurrency prices following the election victory of President Donald Trump. Bitcoin had peaked at a record-high of $109,241 on January 20, the day of the presidential inauguration, but has been on a downward trajectory since, amid concerns over his tariff agenda and growing worries about the US economy.

According to data from traders, Bitcoin has now fallen nearly 28% from its peak, reflecting a notable shift in investor risk appetite. Bitcoin options are indicating that investors are hedging against the possibility of the digital currency falling further, with the open interest for put options at a strike price of $70,000 ranking second in terms of volume among all expiries.

Selling pressure is mounting as investors pull money out of Bitcoin ETFs. Data shows that over $1 billion was withdrawn from spot Bitcoin ETFs on Tuesday, the largest single-day outflow since these funds launched in January last year. In total, these funds have witnessed approximately $2.1 billion in outflows over the past six days.

Trump’s trade policies are also contributing to the pressure on the cryptocurrency market. The imposition of new tariffs on China, Canada, and Mexico, which will take effect on March 4, has raised concerns about global growth and inflation, prompting investors to seek safer assets.

– 16:16 28/02/2025

Digital Asset Management: An ASEAN-6 Perspective on Vietnam’s Lagging Progress

While we are still grappling with the intricacies of formulating a comprehensive approach to managing digital assets, the five remaining countries in the ASEAN-6 bloc (Singapore, Thailand, Indonesia, Malaysia, and the Philippines) have made significant strides in this arena.

The Roaring Five: Bitcoin’s Record-Breaking Years

The crypto market closed out 2024 with a historic milestone as Bitcoin, yet again, asserted its dominance, outperforming traditional investment avenues such as stocks, bonds, and gold.