In a revelation made on his Truth Social platform, Trump disclosed that the executive order on digital assets he signed in January 2025 would create a virtual currency reserve, including Bitcoin (BTC), Ether (ETH), XRP, Solana, and Cardano. This is the first time these specific names have been officially announced.

“And, of course, BTC and ETH, along with other valuable cryptocurrencies, will be central to this reserve,” Trump added in a subsequent post about an hour later.

The cryptocurrency market surges

Bitcoin, the world’s largest cryptocurrency by market value, surged more than 11% to $94,164 USD. Ether, the second-largest cryptocurrency, rose about 13% to $2,516 USD. Notably, Solana jumped 20%, XRP surged over 25%, and Cardano skyrocketed more than 60%.

The total cryptocurrency market cap increased by approximately 10%, equivalent to over $300 billion, according to CoinGecko, a cryptocurrency analysis and data company.

Interestingly, the inclusion of XRP – the token of Ripple Labs – in the list is noteworthy. Previously, Ripple had backed a super Political Action Committee (PAC) to influence the November congressional elections in favor of the cryptocurrency industry, according to Reuters.

“This move signals a shift towards the US government’s active participation in the crypto economy,” said Federico Brokate, head of US business at 21Shares, a digital asset investment management company. “It has the potential to drive institutional adoption, provide greater regulatory clarity, and solidify US leadership in digital asset innovation.”

Meanwhile, James Butterfill, head of research at CoinShares asset management firm, expressed surprise at the inclusion of digital assets other than Bitcoin in the reserve.

“Unlike Bitcoin… these assets resemble technology investments more,” Butterfill remarked. “This announcement reflects a national interest perspective on the crypto-technology space in general, rather than a focus on the fundamental characteristics of these assets.”

Trump’s support for the cryptocurrency industry is not surprising. During his 2024 election campaign, he received strong backing from the crypto community and quickly reciprocated by endorsing their policy priorities. He will even host the first-ever Crypto Summit at the White House on March 7, and his family has also launched their own coins.

This policy marks a sharp departure from his Democratic predecessor, Joe Biden, whose administration tightened control over the industry to protect Americans from fraud and money laundering.

Under Trump, the Securities and Exchange Commission (SEC) has withdrawn investigations into several crypto companies and even dismissed a lawsuit against Coinbase, the largest crypto exchange in the US.

However, in recent weeks, crypto prices have been on a downward trend, with some of the biggest coins erasing nearly all the gains made after Trump’s election victory – an event that had triggered euphoria across the industry.

Analysts believe the market needs fresh catalysts to continue its growth, such as signs that the Fed plans to cut interest rates or a clear pro-crypto regulatory framework from the Trump administration.

Geoff Kendrick, an analyst at Standard Chartered, has set a bold target for Bitcoin to reach $500,000 before Trump’s term ends, a massive leap from its current all-time high of $109,071 USD.

While hedge funds remain the dominant buyers of cryptocurrencies, regulatory filings in the US suggest that banks and national investment funds are also starting to enter the market. Asset managers have increased their allocations to US Bitcoin immediate ETFs in the fourth quarter of 2024.

Nevertheless, legal questions surround this new reserve. Analysts and legal experts are debating whether a congressional act is necessary to establish the reserve. Some argue that the reserve could be created through the Exchange Stabilization Fund of the US Treasury Department, which is typically used for buying or selling foreign currencies.

Trump’s crypto team had previously planned to consider the possibility of creating a reserve with cryptocurrencies seized in law enforcement operations, a potential source of assets that the government has held through forfeitures.

– 09:53 03/03/2025

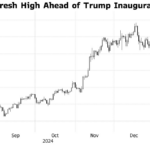

The Rise of Bitcoin: Cryptocurrency Soars Past $109,000 to Reach New Heights Ahead of Trump’s Inauguration

“The world’s largest cryptocurrency, Bitcoin, soared to a new all-time high as the United States prepared for Donald Trump’s second presidential inauguration.”

The Art of the Crypto Deal: The Trumps Talk Binance Investment

The Wall Street Journal (WSJ) reports that representatives of the Trump family are in negotiations to acquire a financial stake in the US arm of the cryptocurrency exchange, Binance. This move would bring Trump into a business relationship with a company that pleaded guilty to violating anti-money laundering regulations in 2023.

The Cryptocurrency Crash: Bitcoin Plunges Below $84,000

The crypto market witnessed a brutal sell-off on February 26, with Bitcoin and Ethereum plunging to multi-month lows as liquidations surpassed $600 million in the past 24 hours.