On March 10th, the National Assembly’s Standing Committee continued its 43rd meeting, providing opinions on the explanation, adoption, and editing of the draft Law on Special Consumption Tax amendments.

Explanation Needed for Keeping the Special Consumption Tax on Gasoline

Although the summary report presented by Chairman Phan Văn Mãi of the Economic and Financial Committee did not mention the special consumption tax on gasoline and air conditioners, Vice President of the National Assembly Vũ Hồng Thanh requested the Standing Committee’s opinion. He argued that there had been diverse discussions and opinions from the National Assembly’s delegates on this matter during the 8th session and other debates.

Regarding the special consumption tax on gasoline, Vice Chairman of the National Assembly’s Committee for Petitions and Supervision, Lê Thị Nga, stated that the nature of this tax is to impose levies on luxury items and those that are not encouraged for consumption. In contrast, gasoline is an essential commodity, and taxing it with the special consumption tax contradicts its essential nature.

Vice Chairman Lê Thị Nga proposed removing the special consumption tax on gasoline and air conditioners. Photo: QH |

“Many opinions on mass media also suggested removing the special consumption tax on gasoline,” said Ms. Nga.

Concerning air conditioners, she argued that ten years ago, they were considered luxury items. However, air conditioners with regular capacity are no longer luxury goods.

“We propose removing the special consumption tax on these items. If it is to be retained, a clear explanation is needed,” she asserted.

Chairman of the National Assembly’s Committee for Law and Judiciary, Hoàng Thanh Tùng, expressed his agreement with Ms. Lê Thị Nga regarding gasoline and air conditioners. He emphasized that everyone needs to use gasoline, and it is already subject to various taxes and charges. Similarly, the special consumption tax on air conditioners should also be reconsidered, as it has been extensively discussed by the National Assembly’s delegates during the 8th session.

Special Consumption Tax on Cigarettes, Alcohol, and Beer

For cigarettes, the draft law presents two options. One option is to not provide a specific list of cigarettes but to refer to the Law on Prevention and Control of Tobacco Harm. The other option is to provide a detailed list.

Mr. Hoàng Thanh Tùng supported the first option to ensure consistency with the structure of the law and its compatibility with other laws.

Chairman of the National Assembly Trần Thanh Mẫn noted that many associations and businesses had expressed concerns about the potential impact of sudden tax increases on carbonated drinks and sugary beverages on economic growth. Some suggested the need to “ease the burden on businesses.”

Mr. Trần Thanh Mẫn requested the Ministry of Finance and the reviewing agency to provide further explanations.

Chairman Trần Thanh Mẫn suggested “easing the burden” on businesses to allow them to develop and contribute to the country’s overall growth. Photo: QH |

The Chairman acknowledged that businesses are highly interested in this law as it directly affects their production, operations, and growth rate. He requested the drafting and reviewing agencies to continue providing explanations and adoptions to ensure the law’s approval by the National Assembly.

He also suggested that they listen to the opinions of enterprises in the fields of alcohol, beer, carbonated drinks, and cigarettes.

“Decree 168, which has been in effect for over two months, has been very effective in reducing traffic accidents before, during, and after the Lunar New Year holidays. Initially, there were concerns about revenue loss if such penalties were imposed. However, tax collection has reached 25% in the last few months,” the Chairman noted, recalling the initial concerns about banning driving under the influence of alcohol.

Articulating his perspective, the Chairman emphasized that the discussions should focus on tax rates and schedules to provide convincing explanations to the National Assembly and the people. The primary goal should be to strike a balance of interests without hindering businesses’ production and operations while learning from and applying international best practices.

Regarding electronic cigarettes, the Chairman insisted on strict compliance with the National Assembly’s Resolution on this issue. He requested the Committee for Culture and Society to work with the government to guide the public and manufacturers to implement the National Assembly’s Resolution correctly.

“If further action is needed, submit it to the Standing Committee of the National Assembly for the issuance of a decision. Law amendments to promote development should consider multiple dimensions,” he concluded.

|

Maintaining the Special Consumption Tax on Gasoline and Air Conditioners In response to the discussions, Deputy Minister of Finance Cao Anh Tuấn provided explanations regarding the special consumption tax on cigarettes, carbonated drinks, and air conditioners. He stated that air conditioners have undergone improvements over the years but still primarily use cooling agents that harm the environment and deplete the ozone layer. The advancements in air conditioners mainly relate to energy efficiency. According to Mr. Tuấn, the Prime Minister has also issued a decision on measures to reduce ozone layer depletion.

Some countries, such as South Korea, Japan, and several European nations, have even stricter regulations for air conditioner installations. For example, obtaining a permit to install an air conditioner in Switzerland is not a simple process. “Therefore, it is necessary to maintain the special consumption tax on air conditioners with a capacity of 9000 BTU or higher,” said Deputy Minister Cao Anh Tuấn. Regarding gasoline, he stated that it is still a fossil fuel. In line with energy conservation policies, many countries impose high special consumption taxes on gasoline and lower taxes on biofuels. Vietnam has been applying the special consumption tax on gasoline since 1995, and this policy remains stable. “We propose not to raise this issue regarding the special consumption tax on gasoline,” concluded Deputy Minister Cao Anh Tuấn. |

CHÂN LUẬN

– 15:46 10/03/2025

Unlocking the Potential: Unraveling the Details of Da Nang’s Resort Projects with Resolution 170

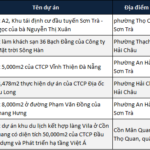

With the National Assembly’s resolution on special mechanisms, 49 projects in Da Nang were named and given guidance to overcome obstacles.