|

Recent TVS stock transactions by Ms. Dinh Thi Hoa

Source: Author’s compilation

|

During the period of Ms. Hoa’s above-mentioned transactions, TVS shares maintained a stable price level around VND 20,000 per share, following a recovery from below VND 18,000 per share.

On the days when Ms. Hoa was buying, large-volume matched transactions of TVS shares were also recorded, with 950,000 shares traded on March 7 and an equal volume to Ms. Hoa’s purchases on the remaining days, at an average price of VND 20,050-20,350 per share.

|

Large matched transactions on the same days as Ms. Dinh Thi Hoa’s transactions

Source: VietstockFinance

|

Following these transactions, Ms. Hoa increased her personal holdings in TVS from nearly 22 million shares (13.16%) to over 26 million shares (15.57%). Based on the closing prices of the above-mentioned trading sessions, it is estimated that Ms. Hoa spent a total of over VND 80 billion.

|

In addition, Ms. Hoa is related to four other shareholders at TVS, including Mr. Dinh Hung (her brother) holding 112 shares, Mr. Dinh Dung (her brother) holding nearly 789,000 shares (0.47%), Ms. Nguyen Thi Bich Thu (her sister-in-law) holding nearly 3,000 shares, and Ms. Do Kim Phuong (her sister-in-law) holding nearly 241,000 shares (0.14%). The total number of shares held by Ms. Hoa and related parties amounts to over 27 million shares (16.19%).

Thus, it is highly likely that a significant portion of Ms. Hoa’s transactions were conducted through matched trades.

Ms. Dinh Thi Hoa, born in 1961, previously served as a member of the Board of Directors of TVS before being relieved of her duties in April 2024. According to the 2024 Annual Report of Asia Commercial Joint Stock Bank (HOSE: ACB), as of December 31, 2024, Ms. Hoa was a member of the Board of Directors of ACB.

In another development, in February 2025, following the results of a written poll with a 68.26% approval rate of the voting shares, the Extraordinary General Meeting of Shareholders of TVS approved the plan to offer nearly 33.4 million shares to existing shareholders, expecting to raise nearly VND 334 billion.

In terms of financial performance, in Q4 2024, TVS reported a net profit of over VND 105 billion, four times higher than the same period in 2023, thanks to more effective proprietary trading and significant reductions in financial and management expenses. As a result, the company’s full-year net profit reached nearly VND 282 billion, meeting its annual plan.

In the stock market, TVS shares have been recovering after a prolonged correction phase from September 2024 to January 2025. Compared to the beginning of this year, TVS’s market price has increased by more than 6%.

– 11:28 19/03/2025

“Billion-Dollar Bet: Vincom Retail’s Bold Move to Acquire 1,200 Shophouses”

Vincom Retail is set to launch these shophouses in 2025, with plans to commence revenue recognition from 2026 onwards.

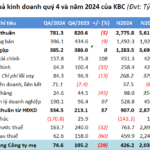

Industrial Land Rental Revenue Plummets, KBC Loses Nearly 80% of 2024 Profits

In 2024, Kinh Bac City Development Holding Corporation (HOSE: KBC) experienced a less impressive performance compared to the previous year, with a 51% and 79% decline in revenue and profit, respectively. This was largely due to a significant 77% drop in land and industrial infrastructure leasing revenue. Consequently, the enterprise achieved only 12% of its profit plan.