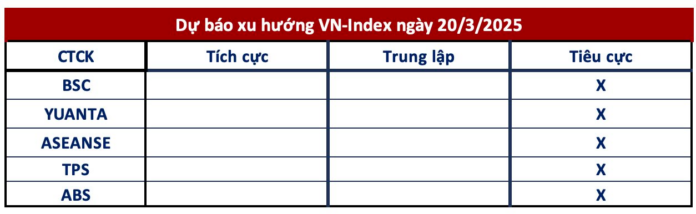

The stock market traded poorly on March 19th. Market indices continued to face selling pressure, mainly from large-cap stocks. The VN-Index closed 6.34 points lower (-0.48%) at 1,324.63. Foreign investors net-sold a significant 1,516 billion VND, marking the most aggressive selling session since the beginning of the year.

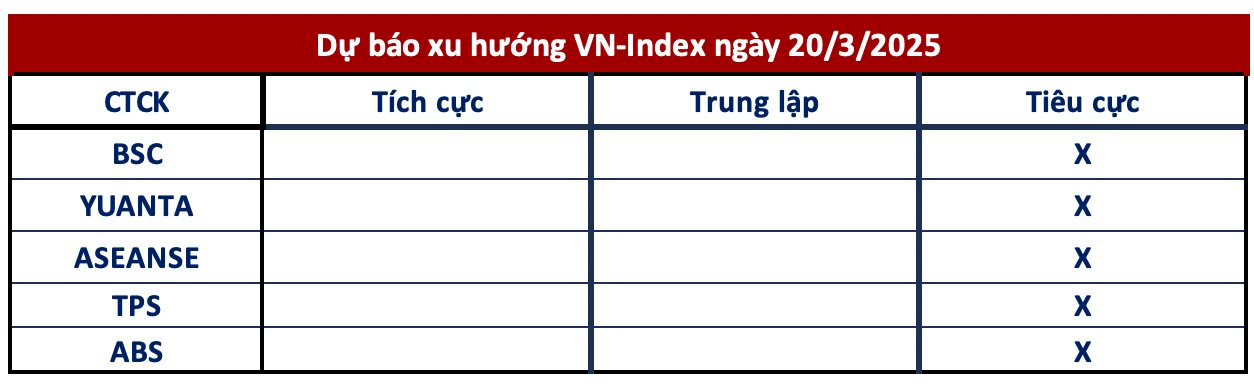

Most securities companies remain cautious about the market in the next trading session. Investors are advised to be cautious and refrain from active buying in the current phase.

BSC Securities assessed that bottom-fishing demand emerged at the 1,320 threshold, preventing the VN-Index from falling further. However, liquidity remained high in both consecutive declining sessions, indicating the possibility of a continued downward trend.

Yuanta Securities suggested that the market might continue to adjust, with the VN-Index fluctuating around 1,320 points in the next session. Short-term risks remain elevated, and the market may experience further polarization in the upcoming sessions. Investors are still pessimistic about the current market conditions.

Yuanta recommended investors maintain a low stock proportion of 40-50% in their portfolios and refrain from buying at this juncture.

According to Asean Securities, there is a possibility of market fluctuations after a robust growth period. Investors need to maintain a stable mindset for long-term growth. They can consider further strong investments in large-cap stocks with solid fundamentals and positive business prospects, always keeping cash reserves ready for strategic positioning when necessary.

TPS Securities assessed that if the market continues to decline in the next session and closes below today’s closing level (1,324.x points), there could be a short correction with support levels at 1,314 or, more deeply, at 1,300 points, depending on market conditions. However, TPS maintains a neutral-optimistic view, considering healthy corrections as suitable investment opportunities before confirming any adjustments.

ABS Securities anticipated that adjustment and fluctuation pressures might persist in the next session, but the risk of a sharp decline is not imminent. The VN-Index is likely to find support in the 1,317-1,323 range. Short-term investors with high stock proportions or those using margin can consider profit-taking and reducing their positions if the market rallies.

Market Beat: Foreign Investors Exit FPT, Leaving the Market in the Red

The market closed with the VN-Index down 6.34 points (-0.48%) to 1,324.63, while the HNX-Index fell 1.75 points (-0.71%) to 245.28. The market breadth tilted towards decliners with 466 losers and 300 gainers. The large-cap stocks in the VN30 basket painted a similar picture, with 20 stocks declining, 8 advancing, and 2 unchanged.

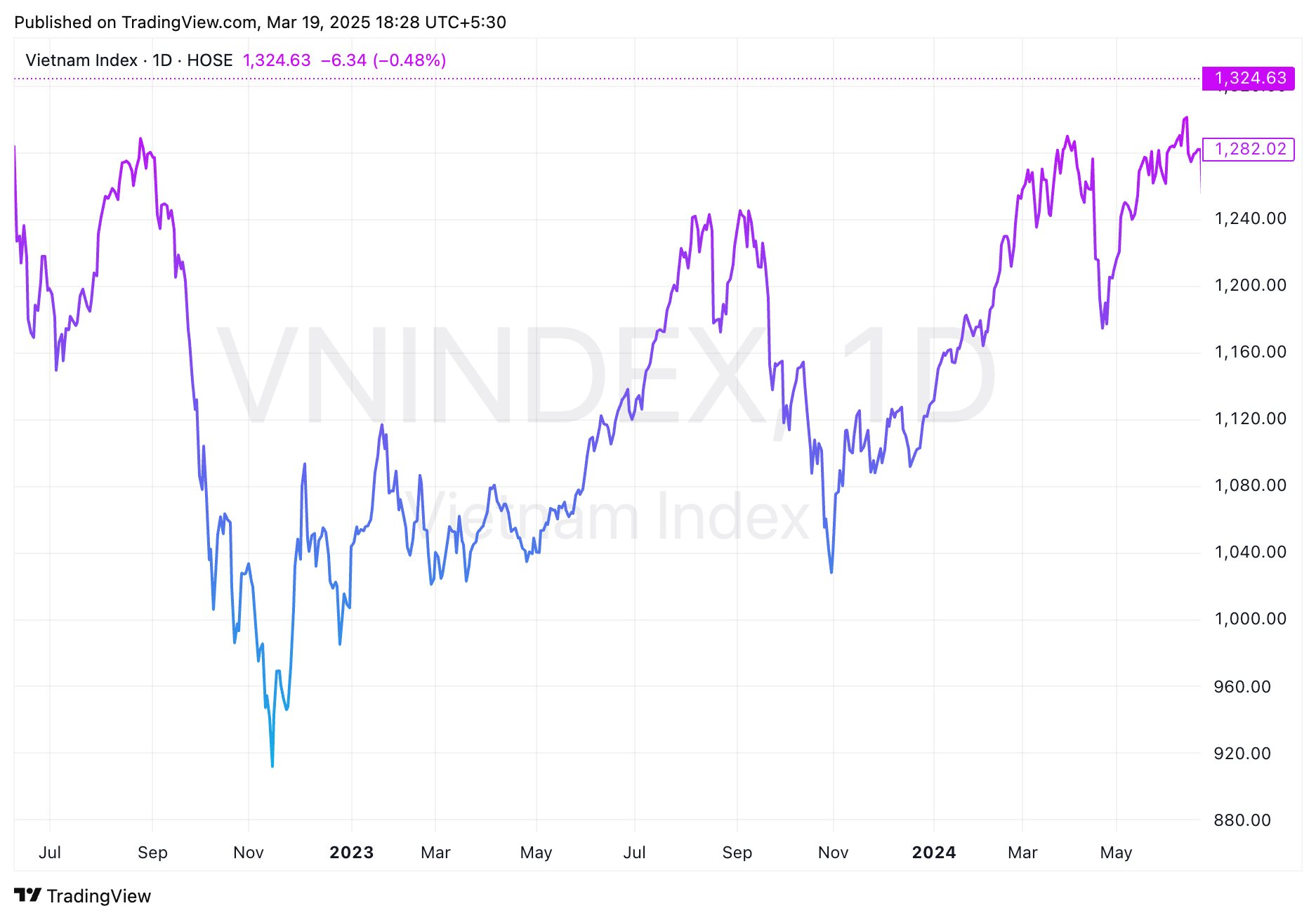

Technical Analysis for March 19: Risk Signals Emerge

The VN-Index and HNX-Index both witnessed a decline, alongside a significant surge in trading volume during the morning session, indicating a prevailing sense of pessimism among investors.

The Ultimate Headline: Short-Term Adjustment Risks Linger

The VN-Index declined with the emergence of a High Wave Candle pattern. The persistent low trading volume, below the 20-day average, indicates cautious trading among investors. Currently, the index is testing the Middle line of the Bollinger Bands. If this level is breached in upcoming sessions, the situation will turn more pessimistic, and a retreat to the old peak breached in June 2024 (1,290-1,310 points) is highly likely. Meanwhile, the Stochastic Oscillator and MACD continue their downward trajectory after issuing sell signals, suggesting that short-term correction risks persist.

The Cautious Investor: Navigating Market Uncertainty

The VN-Index declined with trading volume dipping below the 20-day average, indicating a cautious sentiment among investors. If this scenario persists in the upcoming sessions, the index is likely to retest the old peak breached in June 2024 (corresponding to the 1,290-1,310 point range). This zone will also serve as strong support for the index. Presently, the MACD indicator is poised to generate a sell signal again as it narrows the gap with the Signal Line. Should this materialize in the coming sessions, the short-term outlook would turn rather pessimistic.