Services

According to CKG, the company will offer 47,629,680 shares with a par value of VND 10,500 per share. The total expected capital mobilization is VND 500,111,640,000.

Distribution Method: Offered to existing shareholders through the exercise of subscription rights as detailed in the Prospectus. The ratio of exercising the right is 2:1 (on the record date of shareholders, one share owned corresponds to one right, and two rights entitle the holder to buy one new share).

Expected timeline: From May 14, 2025, to June 4, 2025

The proceeds will be used to repay maturing bank loans, partially repay maturing bonds, and supplement working capital.

20250318 -CKG -Public-Offering-Announcement- released-to-the-public.pdf

– 19:58 18/03/2025

The Growing Gap Between Credit and Deposits: A Record-Breaking Divide

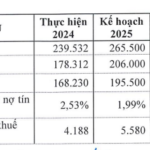

While credit debt soared, banks’ capital mobilization lagged in 2024, creating an unprecedented gap between supply and demand.

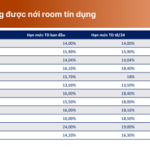

What are the 5 banks that have received a second credit limit increase?

On November 28, 2024, the State Bank of Vietnam (SBV) announced its decision to provide additional credit limits to banks that have utilized 80% of their previously allocated credit limits. This is the second time in 2024 that the SBV has taken such action, the first being in August 2024. With this move, the SBV demonstrates its unwavering commitment to achieving the ambitious 15% credit growth target for the year.

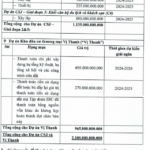

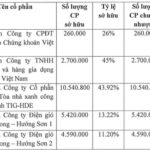

“TIG to Divest from Five Subsidiaries, Delays Stock Dividend Payment”

The Hanoi-based Thang Long Investment Group JSC (HNX: TIG) has recently unveiled three resolutions passed by its Board of Directors. These resolutions pertain to the company’s capital investments in its subsidiaries and associated companies, as well as a plan to issue bonus shares as dividends.