Liquidity in the market increased compared to the previous trading session, with the VN-Index matching volume reaching over 835 million shares, equivalent to a value of more than 20.2 trillion VND; HNX-Index reached over 45.1 million shares, equivalent to a value of more than 830 billion VND.

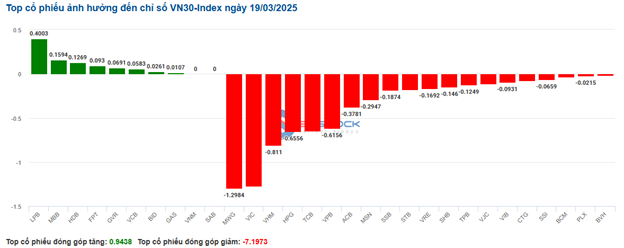

VN-Index opened the afternoon session with continued tug-of-war between buyers and sellers, with the latter dominating, preventing the index from recovering and closing in the red. In terms of impact, FPT, MWG, VPB, and CTG were the most negative influences on the VN-Index, causing a drop of more than 3.9 points. On the other hand, GVR, VIC, LPB, and IMP remained in the green and contributed over 2.5 points to the overall index.

| Top 10 stocks with the highest impact on the VN-Index on 19/03/2025 |

Similarly, the HNX-Index also witnessed a rather pessimistic performance, with the index negatively impacted by KSV (-2.4%), KSF (-3.85%), SCG (-5.17%), and PVS (-1.51%)…

|

Source: VietstockFinance

|

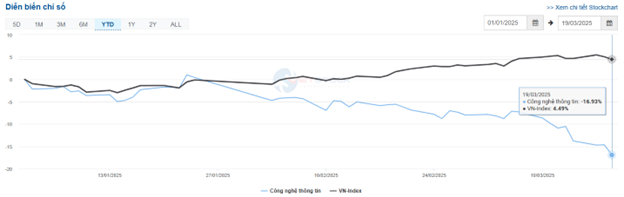

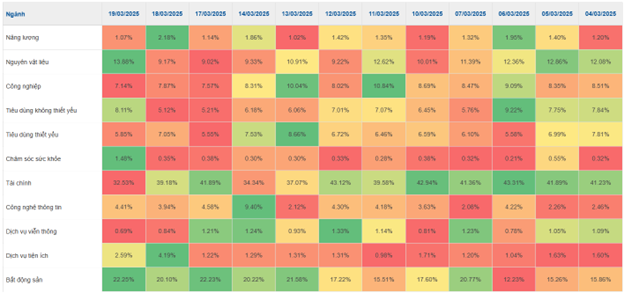

The information technology sector was the market’s worst-performing group, falling 3.99%, mainly due to losses in FPT (-4.15%), CMG (-1.32%), ITD (-0.35%), and VTB (-0.98%). This was followed by the telecommunications and non-essential consumer sectors, which fell by 2.36% and 1.25%, respectively. In contrast, the healthcare sector was the best-performing group, rising 1.12%, driven by gains in IMP (+6.88%), DHG (+0.1%), DVN (+2.72%), and DBD (+2.64%)

In terms of foreign investors’ activities, they continued to be net sellers on the HOSE, offloading more than 1,440 billion VND, focusing on FPT (1,072.91 billion), MWG (168.6 billion), VPB (147.27 billion), and SSI (93.07 billion). On the HNX, foreign investors net sold over 76 billion VND, mainly offloading IDC (30.29 billion), DL1 (29.14 billion), PVS (14.34 billion), and SHS (5.33 billion)

| Foreign investors’ net buying/selling activities on 19/03/2025 |

Morning Session: Foreigners continued to dump FPT

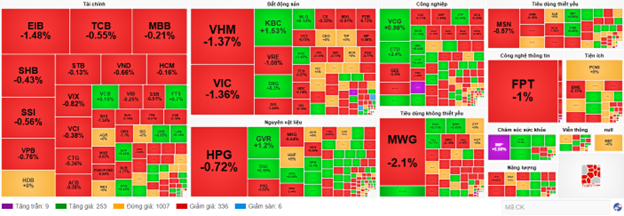

The main indices continued their downward trend throughout the morning session as selling pressure from large-cap stocks persisted. The VN-Index ended the morning session at 1,323.67 points (-0.55%), while the HNX-Index fell 1.07% to 244.39 points. The market breadth was negative, with 423 declining stocks and 213 advancing stocks.

The stocks with the most negative impact on the VN-Index were mainly large-cap stocks from the VN30 basket, with FPT, MWG, and CTG leading the decline, resulting in a loss of more than 2.5 points for the index. On the positive side, VCB and GVR were the only notable contributors, adding nearly 1 point to the index.

Most sectors were painted in red. The information technology sector continued its turbulent period as selling pressure weighed heavily on the industry leader, FPT (-2.77%), with no signs of abating. The sector index lost 2.67% in the morning session, bringing the year-to-date decline to nearly 17%.

Source: VietstockFinance

|

The real estate sector also extended its correction, falling nearly 1.5% as selling pressure spread across the board. Many stocks plunged, notably SSH and KSF, which hit their daily lower limits, while VRE (-1.63%), NVL (-1.83%), BCM (-1.22%), SIP (-2.24%), KDH (-1.53%), DIG (-2.16%), DXS (-2.68%), HDC (-1.3%), and KHG (-1.56%) all weakened.

The healthcare sector was the only bright spot in the market, as many stocks rallied despite the overall gloomy sentiment. These included IMP, which hit its upper limit, DVN (+3.5%), DBD (+2.11%), FIT (+3.1%), DTP (+2.79%), DMC (+1.8%), and PBC (+1.28%)

Foreign investors intensified their net selling, offloading more than 689 billion VND on the HOSE in the morning session. FPT remained the top net sold stock, with nearly 410 billion VND worth of shares sold in the morning session alone, far surpassing the other stocks. Since the beginning of March 2025, this stock has witnessed a net outflow of over 2.4 trillion VND by foreign investors amid a period of strong corrections in its share price. On the buying side, VHM and VIC were the most purchased stocks, with net buying values of 92.6 billion and 58.85 billion VND, respectively.

On the HNX exchange, foreign investors net sold nearly 33 billion VND, with IDC being the most sold stock, offloading 16.48 billion VND worth of shares.

10:40 am: Selling pressure intensifies, SSH hits lower limit after 5 consecutive gaining sessions

Pessimism prevailed in the market, causing the main indices to decline sharply. As of 10:30 am, the VN-Index fell 4.24 points to around 1,326 points, while the HNX-Index dropped 1.98 points to around 245 points.

Stocks in the VN30 basket faced strong selling pressure, resulting in a loss of more than 7 points for the index. Notably, MWG, VIC, VHM, and HPG declined by 1.29 points, 1.27 points, 0.81 points, and 0.65 points, respectively. Only a few stocks managed to stay in the green, including LPB, MBB, HDB, and FPT, but their gains were insignificant.

Source: VietstockFinance

|

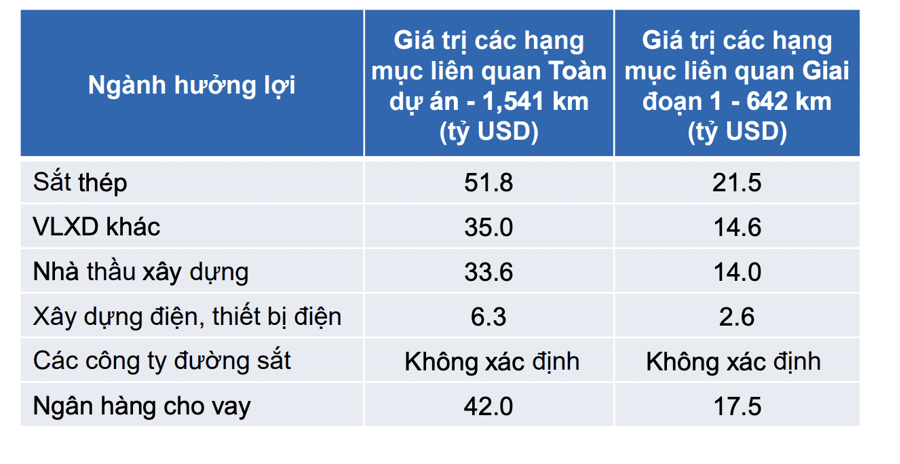

According to sector liquidity data for the last 3 sessions, the Finance and Telecommunications sectors have consistently recorded a decrease in trading liquidity compared to the overall market. This suggests that capital may be shifting to other sectors, such as the Materials sector, which is the only group that has seen an increase in liquidity in the last 2 sessions.

Source: https://finance.vietstock.vn/du-lieu-nganh.htm

|

Currently, the Finance sector is experiencing some divergence, with selling pressure dominating. Specifically, selling is concentrated in large-cap stocks such as TCB, which fell 0.55%, CTG down 0.12%, VPB down 0.76%, and ACB down 0.38%… It is worth noting that the declines are generally not significant. If buying demand returns soon to this sector, the negative market sentiment could quickly subside.

Next, the real estate sector also witnessed a sea of red, with leading stocks such as VIC down 1.95%, VHM down 1.37%, BCM down 0.98%, and VRE down 1.08%… Notably, SSH hit its lower limit after 5 consecutive gaining sessions. Moreover, the trading volume of this stock has decreased significantly in recent sessions, falling more than 90% compared to the average volume during the price fluctuation period in the range of 66,500-69,100 before March 11, 2025, indicating less active trading by investors.

Additionally, since the beginning of the year, CTCP Phat Trien Sunshine Homes (SSH) has seen changes in its board of directors, with Mr. Nguyen Xuan Anh becoming the Chairman of SSH in February 2025. Prior to this, he was appointed as a member of the board in October 2020.

Source: VietstockFinance

|

Compared to the opening, sellers continued to dominate the market. There were 336 declining stocks and 253 advancing stocks.

Opening: VN-Index opens with a tug-of-war

At the start of the trading day on March 19, as of 9:30 am, the VN-Index fluctuated below the reference level, reaching 1,330.02 points. The HNX-Index also edged lower, falling to 246.66 points.

Gold prices hit a new record high above $3,000 per ounce on Tuesday (March 18) as investors sought the safe-haven asset amid rising tensions in the Middle East and US President Donald Trump’s continued push for tariffs. Spot gold ended the trading day up 1.2% at $3,037.38 per ounce after hitting a high of $3,028.24 earlier in the session.

As of 9:30 am, the market was slightly negative, with 16 declining stocks, 9 advancing stocks, and 5 unchanged stocks in the VN30 basket. Among them, MWG, VIC, VHM, and BCM were the top losers, while GVR, GAS, LPB, and BID were the top gainers.

The telecommunications services sector showed positive signals from the beginning of the session, rising 0.83%. The gains were driven by stocks such as CTR, which increased by 1.27%, VGI up 1.29%, and DST up 1.72%… On the other hand, some stocks in the sector, such as YEG, ELC, and FOX, were slightly in the red, falling by 0.66%, 0.2%, and 1.17%, respectively.

In contrast, the real estate sector was in negative territory, weighing on the overall market performance. The decline was led by stocks such as VIC, which fell by 1.75%, VHM down 1.06%, DXG down 0.3%, BCM down 0.49%, and NVL down 1.37%…

– 15:24 19/03/2025

The Ultimate Headline: Short-Term Adjustment Risks Linger

The VN-Index declined with the emergence of a High Wave Candle pattern. The persistent low trading volume, below the 20-day average, indicates cautious trading among investors. Currently, the index is testing the Middle line of the Bollinger Bands. If this level is breached in upcoming sessions, the situation will turn more pessimistic, and a retreat to the old peak breached in June 2024 (1,290-1,310 points) is highly likely. Meanwhile, the Stochastic Oscillator and MACD continue their downward trajectory after issuing sell signals, suggesting that short-term correction risks persist.

The Cautious Investor: Navigating Market Uncertainty

The VN-Index declined with trading volume dipping below the 20-day average, indicating a cautious sentiment among investors. If this scenario persists in the upcoming sessions, the index is likely to retest the old peak breached in June 2024 (corresponding to the 1,290-1,310 point range). This zone will also serve as strong support for the index. Presently, the MACD indicator is poised to generate a sell signal again as it narrows the gap with the Signal Line. Should this materialize in the coming sessions, the short-term outlook would turn rather pessimistic.

The Ultimate Headline: “The Looming Threat of Market Correction: Navigating the Storm”

The VN-Index witnessed another day of decline with trading volume below the 20-day average. This indicates a heightened sense of caution among investors as the index approaches the old peak of June 2024 (1,290-1,310 points). Currently, the Stochastic Oscillator indicates a sell signal, departing from the overbought region. Similarly, the MACD indicator also suggests a sell signal. Investors are advised to exercise prudence in their investment decisions if the corrective phase persists.