|

Source: VietstockFinance

|

The market closed on March 20 with 415 declining stocks, including 17 floor prices, outnumbering the 358 gainers, of which 25 hit the ceiling price. Meanwhile, 838 stocks remained unchanged.

Despite this, the VN-Index closed down just 0.7 points at 1,323.93 points, witnessing a significant recovery in the afternoon session, true to the nature of a futures expiry session. The total trading value of the market exceeded 21,450 billion VND, lower than the recent average.

The VN30-Index still gained 1.32 points to 1,378.95, indicating that the driving force holding up the VN-Index came from large-cap stocks, with most faces from banking and securities groups, alongside tech giant FPT.

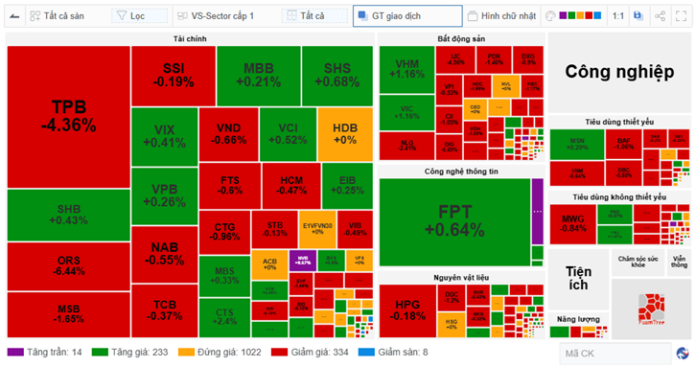

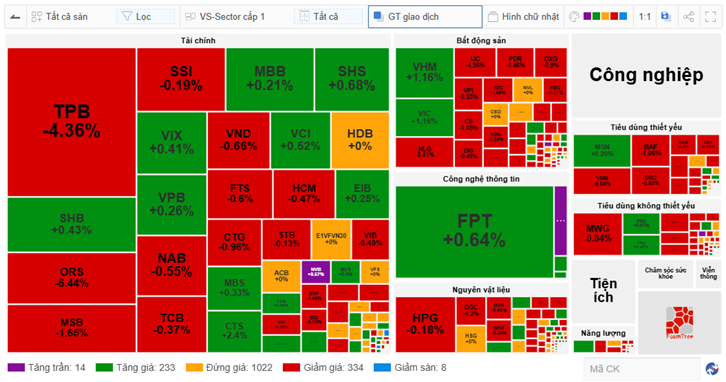

The number of declining stocks dominated, as evident on the market map, with the duo of TPB and ORS falling sharply and occupying large areas, attracting significant investor interest. TPB, in particular, was the stock that took the most points away from the VN-Index, at over 0.5 points.

Today’s sharp decline in these two stocks was predicted by many investors to be related to the Bamboo Capital group of stocks.

By examining the financial statements of TPB and ORS, it is clear that ORS‘ guarantees for BCG, alongside TPB‘s loans to BCG, are quite large. Therefore, at least from a psychological perspective, investors will be affected and lead to strong selling orders.

Looking at a broader perspective, in addition to TPB, other banks that have lent to BCG include CTG and NAB. Of these two stocks, NAB closed down 3.84%, while CTG also spent most of the trading session in the red, turning green only in the latter half of the afternoon session.

In relation to the Bamboo Capital group of stocks, three more bond lots have recently been temporarily suspended from trading, including TCDH2227002 of TCD with an issuance value of 990 billion VND, GKCCH2124001 and GKCCH2124002 of Gia Khang Trading and Service Investment, with issuance values of 1,500 billion VND and 1,000 billion VND, respectively. According to the previous plan, these bonds were not due until 2026-2027.

TCD stock itself fell 3.11%, while BCG declined 2.73%.

Foreign investors also had a strong net selling session of nearly 1,488 billion VND, almost equal to the previous session’s net selling. The market recorded five stocks with net selling in the hundreds of billions, including FPT with more than 279 billion VND, HPG with nearly 185 billion VND, TPB with over 173 billion VND, VHM with nearly 120 billion VND, and DIG with nearly 101 billion VND.

Morning Session: Pressure Increases, VN-Index Falls to 1,318

VN-Index faced pressure for most of the morning session, despite briefly rising more than 7 points to the 1,332 mark. At the end of the morning session, the index fell 6.55 points to 1,318.08. Additionally, the HNX-Index lost 0.22 points to 245.06, and the UPCoM-Index dropped 0.39 points to 98.97.

The market’s liquidity was recorded at nearly 583 million shares traded, corresponding to a value of nearly 11,236 billion VND. Overall, this liquidity level was not significantly different from the recent average.

Among the top 10 stocks with the most negative impact on the index, banks dominated, with CTG taking away nearly 0.6 points, TPB nearly 0.5 points, VCB nearly 0.3 points, and MSB nearly 0.2 points. The remaining stocks were other large-cap stocks such as BCM, VNM, GVR, HPG, GAS, and VJC. In total, the top 10 stocks took away 3.6 points from the VN-Index.

This also reflected the overall market sentiment during the morning session, with financial stocks creating the main pressure, notably TPB falling 4.98% and ORS hitting the floor price. The trading volume of these two stocks also surged compared to previous sessions, attracting more attention from investors. These fluctuations also spread to many other stocks in the banking and securities sectors.

Additionally, real estate stocks exerted pressure on the market, with a series of stocks drowning in red, such as IJC falling 5.54%, NLG dropping 3.27%, VIC declining 0.19%, DIG falling 1.96%, and DXG losing 1.49%… Meanwhile, VHM made efforts to support the index with a gain of 0.21%.

One stock that has attracted much attention recently due to its sharp decline, FPT, was up 0.48% today.

Foreign investors ended the morning session with net selling of over 825 billion VND, focusing on TPB with nearly 135 billion VND and FPT with nearly 119 billion VND. On the buying side, SHB led, but the scale was only over 60 billion VND.

10:30 AM: Financial Stocks Exert Pressure, TPB and ORS Fall Sharply

After a fairly positive start, as of 10:30 AM, the VN-Index suddenly turned south and fell 1.9 points to 1,322.73. Meanwhile, the UPCoM also retreated to the reference level, while the HNX-Index edged up 0.47 points to 245.75.

The main pressure came from a series of financial and real estate stocks that performed negatively.

In the financial sector, the duo of TPB and ORS fell 4.36% and 6.44%, respectively, with ORS even touching the floor price at one point. The trading volume of these two stocks also surged compared to previous sessions, with ORS reaching a volume of over 17 million shares and TPB reaching a volume of over 38 million shares. Additionally, they were among the top net sold stocks by foreign investors, with net selling of over 44 billion VND in ORS, ranking second in the market.

|

TPB and ORS exerted significant pressure

Source: VietstockFinance

|

This downward movement somewhat created a ripple effect on other stocks in the same sector. Currently, many bank stocks are trading lower, such as MSB falling 1.65%, NAB down 0.55%, TCB declining 0.37%, CTG losing 0.96%, and VIB dropping 0.49%… Similarly, securities stocks like SSI fell 0.19%, VND lost 0.66%, FTS declined 0.6%, and HCM dropped 0.47%…

In the real estate sector, apart from VHM and VIC, which rose 1.16% and 1.35%, respectively, the majority of stocks were in the red, including NLG falling 2.41%, IJC dropping 4.56%, CII declining 1.05%, PDR losing 1.46%, and KDH falling 1.33%…

Opening: Mild Gain at Futures Expiry Session

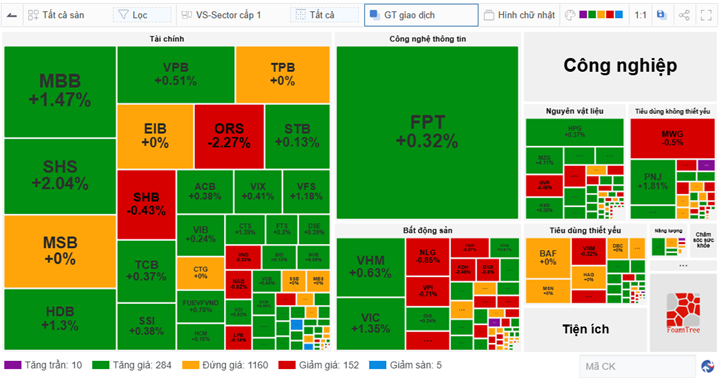

As of 9:30 AM, the VN-Index rose 3.31 points to 1,327.94, the HNX-Index gained 1.37 points to 246.65, and the UPCoM climbed 0.23 points to 99.59. The green hue somewhat reflected a positive reaction to the news that the US Federal Reserve (Fed) projected two rate cuts for 2025.

|

Banking, securities, and technology groups contributed to the indices’ gains

Source: VietstockFinance

|

The market recorded 294 advancing stocks, including 10 ceiling prices, outnumbering 157 declining stocks, of which 5 hit the floor price. However, there were also 1,160 unchanged cases. The market was supported by financial and technology stocks.

In the financial sector, a series of bank stocks performed well, such as MBB rising 1.47%, HDB gaining 1.3%… Additionally, securities stocks like SHS climbed 2.04%, VFS advanced 1.18%, and CTS rose 1.39%… In the information technology group, FPT dominated with a gain of 0.32%.

The real estate sector, however, showed mixed performance, with VHM and VIC increasing by 0.63% and 1.35%, respectively, providing significant momentum to the VN-Index and standing out from many other declining stocks.

Market liquidity was recorded at over 79 million shares, corresponding to a trading value of over 1,733 billion VND. Typically, investors tend to be more cautious during futures expiry sessions, resulting in lower liquidity.

Asian markets opened on a mixed note, with the All Ordinaries rising 1.15%, the Nikkei 225 gaining 0.31%, and the Singapore Straits Times climbing 0.55%, while the Hang Seng fell 1.13% and the Shanghai Composite dropped 0.36%.

Last night, the Dow Jones index rose 383.32 points (or 0.92%) to 41,964.63 points. The S&P 500 index advanced 1.08% to 5,675.29 points, and the Nasdaq Composite added 1.41% to 17,750.79 points.

The Fed decided to keep the benchmark interest rate unchanged at 4.25%-4.5%, a decision widely expected. However, the Fed maintained its projection of two rate cuts for this year, noting that “uncertainty surrounding the economic outlook has increased.”

Fed Chairman Jerome Powell said in a press conference following the decision: “The economy is generally strong and has made substantial progress toward our goals over the past two years. Labor market conditions remain robust, and inflation has moved closer to our 2% longer-run goal, although it remains elevated.”

The Fed’s decision comes amid escalating tensions between the US and its major trading partners.

Source: VietstockFinance

|

– 15:30 20/03/2025

The Ultimate Headline: “The Looming Threat of Market Correction: Navigating the Storm”

The VN-Index witnessed another day of decline with trading volume below the 20-day average. This indicates a heightened sense of caution among investors as the index approaches the old peak of June 2024 (1,290-1,310 points). Currently, the Stochastic Oscillator indicates a sell signal, departing from the overbought region. Similarly, the MACD indicator also suggests a sell signal. Investors are advised to exercise prudence in their investment decisions if the corrective phase persists.

The Market Beat – 28/02: Foreigners’ Robust Sell-off Continues in the Final Trading Session of February

The market closed with slight losses, as the VN-Index dipped by 2.44 points (-0.19%) to end the day at 1,305.36. Similarly, the HNX-Index edged lower by 0.2 points (-0.08%), finishing at 239.19. The market breadth tilted towards decliners, with 408 tickers in the red versus 390 in the green. The large-cap segment mirrored this sentiment, as reflected in the VN30 basket, where 18 stocks retreated, seven advanced, and five remained unchanged.

Market Beat: A Tale of Contrasting Headlines and Cautious Sentiment

The market closed with the VN-Index down 1.54 points (-0.12%) to 1,266.91, while the HNX-Index climbed 0.45 points (+0.2%) to 229.32. The market breadth tilted towards gainers with 349 advancing stocks against 375 declining ones. The large-cap basket, VN30-Index, witnessed a similar performance with 14 losers, 11 gainers, and 5 stocks closing flat, indicating a relatively balanced session.

The Market Beat, February 18th: A Sea of Green, With a Hint of Differentiation

The VN-Index managed to stay in the green at the end of a volatile and tug-of-war afternoon session. While the market opened with a broad rally, it turned slightly “redder” as the session drew to a close.

The Ultimate Headline:

“Vietstock Daily: Halting the Uptrend”

The VN-Index stalled its upward trajectory with a sharp decline, dipping below the 200-day SMA. If, in upcoming sessions, the index falls below the Middle Band of the Bollinger Bands, the outlook turns decidedly bearish. However, the Stochastic Oscillator remains in bullish territory, and the MACD mirrors this sentiment, even hinting at a potential rise above the zero threshold. Should this materialize, it would alleviate the short-term downside risk.