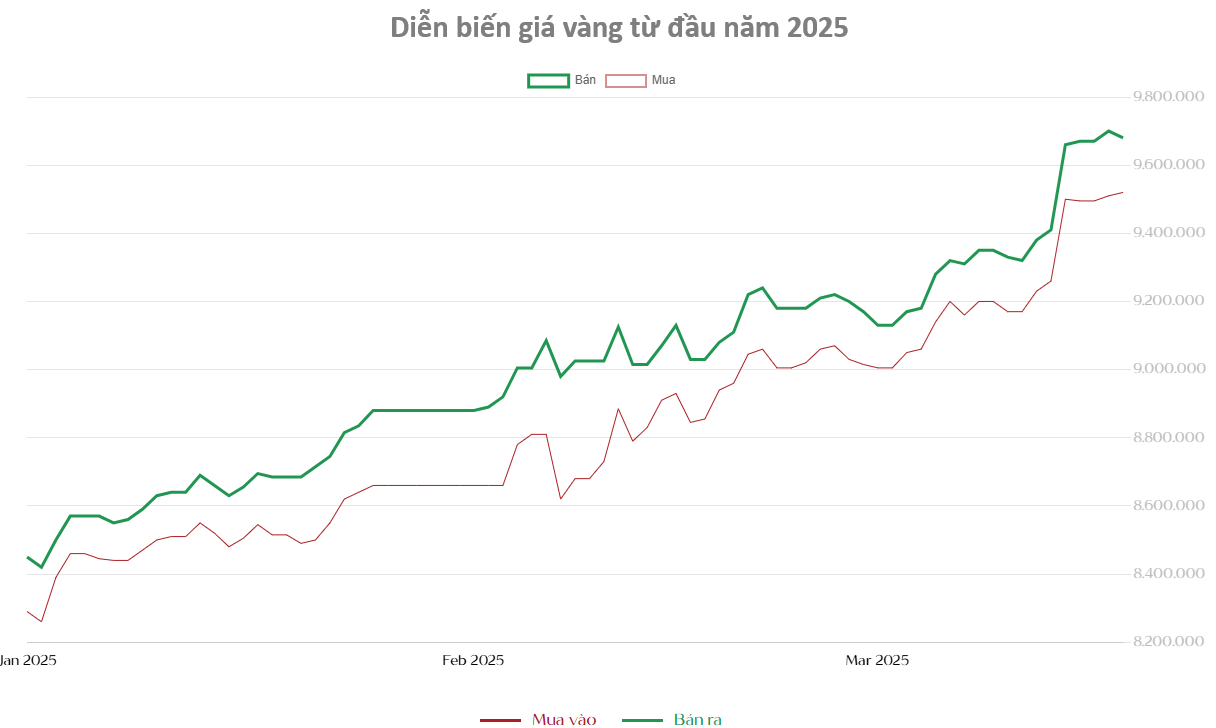

The stock market has been on a robust recovery path, with vibrant trading sessions pushing the VN-Index past the 1,300-point mark, the highest in nearly three years. However, for Minh Hằng, a 35-year-old individual investor, this excitement falls short of being completely exhilarating. She had sold gold to buy stocks, and while gold prices soared, her stock investments dipped.

Seated in front of her computer screen, she quietly monitors the electronic board. “I’m averaging down on stocks I bought a long time ago, even though I know the market is hot,” shares Minh Hằng. What troubles her the most is the price of gold – the asset she once sold to pour money into the stock market – which has now reached a staggering 98 million VND per tael.

Minh Hằng is no novice when it comes to investing. As a bank employee with over a decade of experience, she ventured into the stock market in 2021 when it was recovering from the pandemic and paused her investments in mid-2022. Although she made profits then, her investments were relatively small, and the market adjustments left her with minimal gains. In 2024, when gold prices hovered around 75 million VND per tael, she decided to sell all 20 taels of gold she had accumulated to re-enter the stock market.

“At that time, I thought gold had already reached its peak, while the stock market was on an upward trajectory, offering potentially higher long-term gains,” she recalls. The approximately 1.5 billion VND from the gold sale was invested in Bluechip stocks like MWG (The Gioi Di Dong), HPG (Hoa Phat), and FPT (FPT Corporation) – companies with solid fundamentals that inspired her confidence.

Initially, this decision seemed prudent. Soon after purchasing the stocks, Minh Hằng’s portfolio witnessed significant growth. MWG shares rose from the 60,000 VND region to briefly touch 70,000 VND per share, while FPT, with the highest weight in her portfolio, climbed from around 135,000 VND to 150,000 VND per share. Although HPG lagged a bit, it still managed to yield a profit of nearly 10%. Coupled with leverage, her total assets at the peak surpassed 2 billion VND, representing a profit of approximately 35% in just a few months. “I was thrilled, and my friends advised me to take profits, but I didn’t sell. I wanted to invest for the long term, believing that these companies would continue to rise,” Minh Hằng reminisces.

However, as 2025 dawned, the tide began to turn. While the stock market continued to climb in terms of points, Minh Hằng’s portfolio took a significant hit. MWG shares retreated to around 60,000 VND, FPT plunged to approximately 130,000 VND, and HPG remained largely unchanged from its purchase price. Additionally, her attempts at “trading” resulted in buying high and selling low, further diminishing her total assets to approximately 1.3 billion VND, lower than her initial investment.

FPT Share Price on the Stock Market

“I never anticipated that while the market kept surging, the stocks in my portfolio, which were once performing exceptionally well, would undergo such deep corrections. Since the beginning of the year, I’ve been consistently averaging down and buying more at lower prices to recoup my losses. However, the share prices of the stocks I hold remain relatively high, limiting my ability to purchase substantial amounts,” Minh Hằng explains.

As the stock market plunged, gold prices skyrocketed. From the 75 million VND per tael when Minh Hằng sold, gold has now breached the 98 million VND per tael mark – an all-time high. Had she retained her gold holdings, her assets would have been close to 2 billion VND by now, sparing her the current worries. “Watching the gold price climb daily fills me with sadness. When I sold my gold to buy stocks, I believed I had made the right choice, but now I feel a sense of disappointment. Even though I understand that investing is a long-term game, it’s challenging to shake off the feeling of regret,” Minh Hằng confides.

Minh Hằng’s experience is not unique. Many individual investors in Vietnam had high hopes for the stock market’s performance in 2025, but market fluctuations and incorrect stock picks have left some with paper losses. For Minh Hằng, averaging down on her stock holdings serves as a form of self-comfort and a way to maintain faith in her long-term strategy. “I still believe in the potential of the companies I’ve chosen. Even though I’m currently in the red, I don’t want to sell off my holdings. The market will eventually recover, and the fundamentals of these businesses remain strong; it’s just a matter of time,” she adds.

Nevertheless, this patience doesn’t diminish the pang of regret when comparing her situation to the soaring gold price. Minh Hằng acknowledges that her decision to sell gold last year was a risky move, and she is now facing the consequences of that bold choice. “If I had held on to my gold, I would have made almost 500 million VND in profits without lifting a finger. Meanwhile, my stock investments have resulted in losses and demanded considerable effort to monitor,” she reflects.

Despite the setbacks, Minh Hằng remains steadfast. She dedicates her evenings to studying financial reports, analyzing the market, and strategizing about buying more stocks when prices hit rock bottom. “I don’t want my emotions to dictate my decisions. Investing is a long-term endeavor, and temporary setbacks don’t signify the end,” she asserts. For her, averaging down is not just a way to reduce losses but also an opportunity to accumulate more quality stocks at bargain prices.

Minh Hằng embodies the spirit of thousands of individual investors in Vietnam – individuals who dare to take risks and stand by their choices, even if it means enduring sleepless nights and witnessing those daunting red figures on the electronic board. Amid the frenzy surrounding the stock market and gold in 2025, her story serves as a reminder that investing requires not only knowledge but also perseverance and a resilient heart to weather the fluctuations.

A Word of Caution: Considering VN-Index’s Downward Trend, Investors Should Refrain from Buying

The ABS Securities team anticipates a volatile trading session ahead, with potential corrective pressures and market jitters lingering.

The Ultimate Headline: Short-Term Adjustment Risks Linger

The VN-Index declined with the emergence of a High Wave Candle pattern. The persistent low trading volume, below the 20-day average, indicates cautious trading among investors. Currently, the index is testing the Middle line of the Bollinger Bands. If this level is breached in upcoming sessions, the situation will turn more pessimistic, and a retreat to the old peak breached in June 2024 (1,290-1,310 points) is highly likely. Meanwhile, the Stochastic Oscillator and MACD continue their downward trajectory after issuing sell signals, suggesting that short-term correction risks persist.

The Market Beat – 28/02: Foreigners’ Robust Sell-off Continues in the Final Trading Session of February

The market closed with slight losses, as the VN-Index dipped by 2.44 points (-0.19%) to end the day at 1,305.36. Similarly, the HNX-Index edged lower by 0.2 points (-0.08%), finishing at 239.19. The market breadth tilted towards decliners, with 408 tickers in the red versus 390 in the green. The large-cap segment mirrored this sentiment, as reflected in the VN30 basket, where 18 stocks retreated, seven advanced, and five remained unchanged.

Is the Uptrend Supported?

The VN-Index rebounded with a Hammer candlestick pattern, reflecting investors’ optimism as the index broke through the old peak of October 2024 (1,290-1,305 points). This bullish sentiment is further reinforced by the MACD indicator, which continues to trend upward, providing a buy signal. If the index sustains levels above this threshold, accompanied by high trading volume, the upward trajectory will be solidified.