Technical Signals for the VN-Index

In the trading session on the morning of March 18, 2025, the VN-Index gained points, while trading volume slightly dipped during the morning session, indicating investors’ cautious sentiment.

Additionally, the VN-Index continues to test the Fibonacci Projection 61.8% threshold (equivalent to the 1,330-1,345 point region) as the MACD indicator narrows its gap with the signal line. If the indicator triggers a sell signal, the risk of a downward adjustment will heighten in the upcoming sessions.

Technical Signals for the HNX-Index

On March 18, 2025, the HNX-Index climbed alongside a significant drop in liquidity during the morning session, reflecting investors’ uncertainty.

Moreover, the HNX-Index is heading towards testing the Neckline of the Rounding Bottom pattern (approximately 247-252 points) as the MACD indicator switches to a buy signal. Should the buy signal be sustained and the index successfully surpasses this resistance level, the potential price target for the following session will be the 278-283 point region.

POW – Vietnam Oil and Gas Power Joint Stock Company

On the morning of March 18, 2025, POW soared to the ceiling price, forming a White Marubozu candlestick pattern, and liquidity surpassed the 20-session average, indicating active trading by investors.

Currently, the stock price is testing the 200-day SMA, and the MACD indicator has switched to a buy signal. If the buy signal is maintained and the stock price successfully breaches this resistance level, the long-term upward trend is likely to resume in the upcoming sessions.

VHC – Vinh Hoan Corporation

During the morning session of March 18, 2025, VHC’s share price rose, accompanied by a significant increase in trading volume, which is expected to surpass the 20-day average by the session’s end, reflecting investors’ optimism.

Furthermore, the stock price is heading towards testing the Middle Band of the Bollinger Bands, while the Stochastic Oscillator indicator triggers a buy signal in the oversold region. Should the buy signal be sustained and the stock price breaks above this region, a recovery scenario is possible in the upcoming sessions.

Technical Analysis Team, Vietstock Consulting Department

– 12:06 18/03/2025

The Cautious Investor: Navigating Market Uncertainty

The VN-Index declined with trading volume dipping below the 20-day average, indicating a cautious sentiment among investors. If this scenario persists in the upcoming sessions, the index is likely to retest the old peak breached in June 2024 (corresponding to the 1,290-1,310 point range). This zone will also serve as strong support for the index. Presently, the MACD indicator is poised to generate a sell signal again as it narrows the gap with the Signal Line. Should this materialize in the coming sessions, the short-term outlook would turn rather pessimistic.

The Ultimate Headline: “The Looming Threat of Market Correction: Navigating the Storm”

The VN-Index witnessed another day of decline with trading volume below the 20-day average. This indicates a heightened sense of caution among investors as the index approaches the old peak of June 2024 (1,290-1,310 points). Currently, the Stochastic Oscillator indicates a sell signal, departing from the overbought region. Similarly, the MACD indicator also suggests a sell signal. Investors are advised to exercise prudence in their investment decisions if the corrective phase persists.

Market Beat: Green Dominance, VN-Index Nears 1,270 Points

The market ended the session on a positive note, with the VN-Index climbing 4.93 points (0.39%) to reach 1,269.61; the HNX-Index also rose, by 1.37 points (0.6%), closing at 227.98. The market breadth tilted slightly in favor of the bulls, with 451 gainers against 255 decliners. The VN30 basket saw a relatively balanced performance, with 15 gainers, 14 losers, and 1 stock finishing unchanged.

Market Beat on Feb 24th: VN-Index Surges Past 1,300 Points as Trading Volume Improves

The market closed with strong gains, as the VN-Index rose by 7.81 points (+0.6%), finishing at 1,304.56; while the HNX-Index climbed 0.92 points (+0.39%) to close at 238.49. The market breadth was relatively balanced, with 377 gainers and 373 losers. The large-cap stocks in the VN30 basket painted a positive picture, as 21 stocks advanced, 6 declined, and 3 remained unchanged, tilting the basket towards a green close.

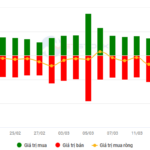

The Market Beat – 28/02: Foreigners’ Robust Sell-off Continues in the Final Trading Session of February

The market closed with slight losses, as the VN-Index dipped by 2.44 points (-0.19%) to end the day at 1,305.36. Similarly, the HNX-Index edged lower by 0.2 points (-0.08%), finishing at 239.19. The market breadth tilted towards decliners, with 408 tickers in the red versus 390 in the green. The large-cap segment mirrored this sentiment, as reflected in the VN30 basket, where 18 stocks retreated, seven advanced, and five remained unchanged.