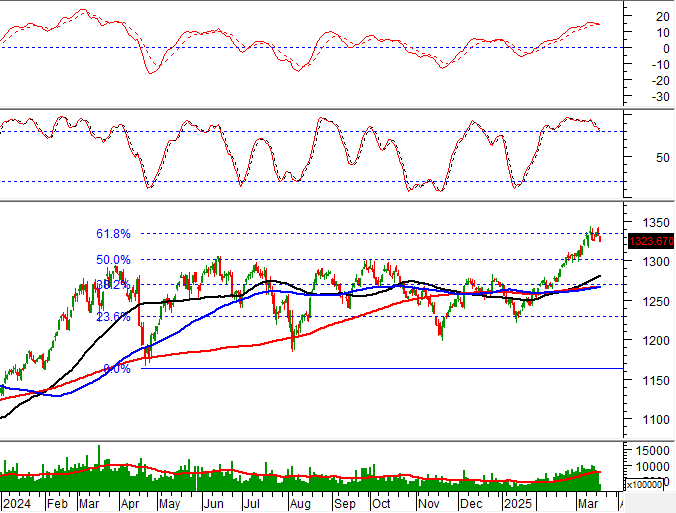

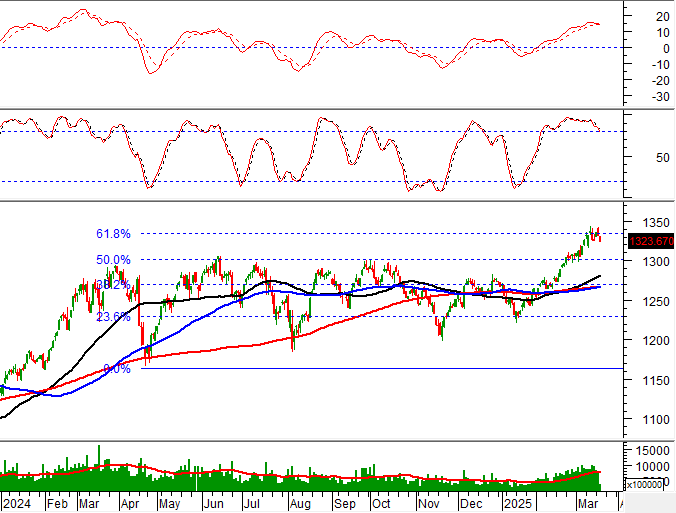

Technical Signals for VN-Index

In the trading session on the morning of March 19, 2025, the VN-Index declined, while trading volume slightly increased, indicating a pessimistic sentiment among investors.

Additionally, the MACD indicator gave a sell signal again, suggesting that the risk of short-term adjustments is gradually materializing.

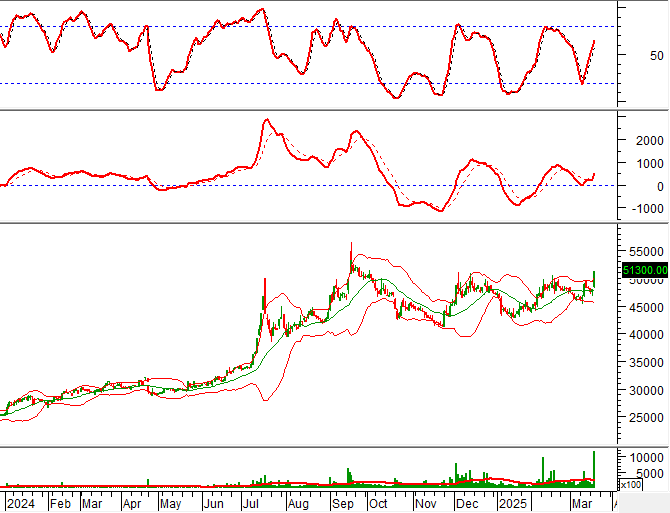

Technical Signals for HNX-Index

On March 19, 2025, the HNX-Index declined, while liquidity significantly increased in the morning session, indicating that investors were quite pessimistic in their transactions.

In addition, the HNX-Index is testing the Neckline of the Rounding Bottom pattern (equivalent to the 247-252-point region) again, while the Stochastic Oscillator indicator gives a sell signal again in the overbought region. If the sell signal is maintained and falls out of this region, the risk of adjustments in the next sessions will increase.

KBC – Kinh Bac City Development Holding Corporation

On the morning of March 19, 2025, KBC rose in price, along with a significant increase in trading volume, and is expected to exceed the 20-day average at the end of the session, indicating active trading by investors.

Additionally, the stock price is testing the lower edge of the short-term rising price channel (Bullish Price Channel) while the MACD indicator gradually narrows the gap with the Signal line after giving a sell signal earlier. If the buy signal reappears, the short-term uptrend will be further reinforced and may continue in the next sessions.

IMP – Imexpharm Pharmaceutical Joint Stock Company

On the morning of March 19, 2025, IMP hit the ceiling price and formed a White Marubozu candlestick pattern, with trading volume exceeding the 20-session average, indicating investors’ optimistic sentiment.

Moreover, the stock price rebounded after breaking above the Middle line of the Bollinger Bands, while the Stochastic Oscillator indicator continued to rise after giving a buy signal earlier, suggesting that the short-term upside potential is gradually materializing.

Technical Analysis Department, Vietstock Consulting

– 12:04 19/03/2025

The Ultimate Headline: Short-Term Adjustment Risks Linger

The VN-Index declined with the emergence of a High Wave Candle pattern. The persistent low trading volume, below the 20-day average, indicates cautious trading among investors. Currently, the index is testing the Middle line of the Bollinger Bands. If this level is breached in upcoming sessions, the situation will turn more pessimistic, and a retreat to the old peak breached in June 2024 (1,290-1,310 points) is highly likely. Meanwhile, the Stochastic Oscillator and MACD continue their downward trajectory after issuing sell signals, suggesting that short-term correction risks persist.

Technical Analysis for March 18: Indecision Prevails in the Market

The VN-Index and HNX-Index both climbed, while trading liquidity took a significant dip in the morning session, indicating investors’ hesitation in their transactions.

The Cautious Investor: Navigating Market Uncertainty

The VN-Index declined with trading volume dipping below the 20-day average, indicating a cautious sentiment among investors. If this scenario persists in the upcoming sessions, the index is likely to retest the old peak breached in June 2024 (corresponding to the 1,290-1,310 point range). This zone will also serve as strong support for the index. Presently, the MACD indicator is poised to generate a sell signal again as it narrows the gap with the Signal Line. Should this materialize in the coming sessions, the short-term outlook would turn rather pessimistic.

The Ultimate Headline: “The Looming Threat of Market Correction: Navigating the Storm”

The VN-Index witnessed another day of decline with trading volume below the 20-day average. This indicates a heightened sense of caution among investors as the index approaches the old peak of June 2024 (1,290-1,310 points). Currently, the Stochastic Oscillator indicates a sell signal, departing from the overbought region. Similarly, the MACD indicator also suggests a sell signal. Investors are advised to exercise prudence in their investment decisions if the corrective phase persists.

Market Beat: Green Dominance, VN-Index Nears 1,270 Points

The market ended the session on a positive note, with the VN-Index climbing 4.93 points (0.39%) to reach 1,269.61; the HNX-Index also rose, by 1.37 points (0.6%), closing at 227.98. The market breadth tilted slightly in favor of the bulls, with 451 gainers against 255 decliners. The VN30 basket saw a relatively balanced performance, with 15 gainers, 14 losers, and 1 stock finishing unchanged.