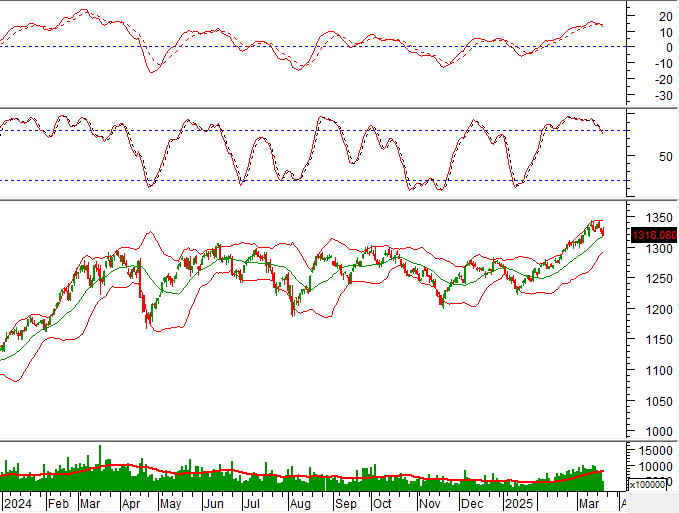

Technical Signals for the VN-Index

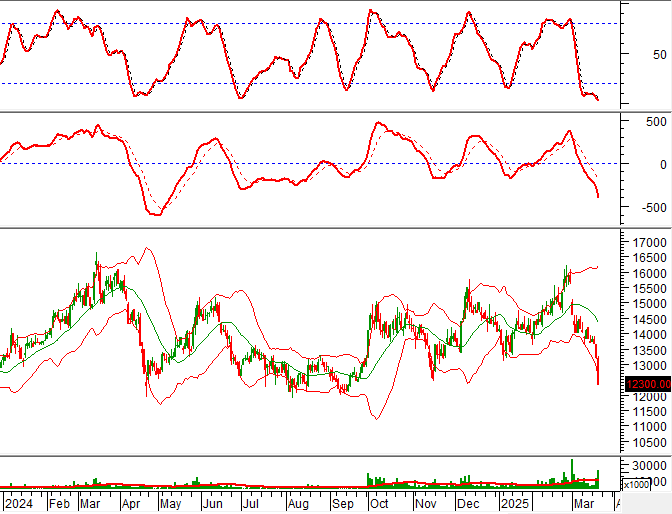

During the trading session on the morning of March 20, 2025, the VN-Index witnessed a decline, along with a slight increase in trading volume. This indicates a lack of optimism among investors.

Additionally, the VN-Index returned to test the Middle line of the Bollinger Bands, while the MACD indicator signaled a resumption of selling. If the index falls below this support level, the risk of a correction will increase in the upcoming sessions.

Technical Signals for the HNX-Index

On March 20, 2025, the HNX-Index experienced a drop, coupled with a significant increase in liquidity during the morning session, reflecting the pessimistic sentiment of investors.

Furthermore, the HNX-Index is testing the Neckline of the Rounding Bottom pattern (equivalent to the 247-252-point region) while the Stochastic Oscillator indicator signals a resumption of selling in the overbought region. If the selling signal is maintained and the index falls below this zone, the risk of a correction will heighten in the forthcoming sessions.

ORS – Tien Phong Securities Joint Stock Company

On the morning of March 20, 2025, ORS witnessed a sharp decline and formed a Black Marubozu candlestick pattern, with trading volume surpassing the 20-session average. This indicates the pessimistic sentiment among investors.

Currently, the stock price continues to closely follow the Lower Band of the Bollinger Bands, while the MACD indicator is consistently widening the gap with the Signal line after previously signaling a sell, further reinforcing the downward trend of the stock in the short term.

IJC – Infrastructure Development Joint Stock Company

During the morning session of March 20, 2025, IJC experienced a significant drop and formed a Black Marubozu candlestick pattern, with liquidity surpassing the 20-session average, reflecting the investors’ pessimistic outlook.

Additionally, the stock price continued its downward spiral, returning to test the SMA 50-day line, while the Stochastic Oscillator indicator exhibited a Bearish Divergence. Should the stock price fall below this support level, the risk of a correction will increase in the upcoming sessions.

Technical Analysis Department, Vietstock Consulting

– 12:02, March 20, 2025

Market Beat: Foreign Investors Exit FPT, Leaving the Market in the Red

The market closed with the VN-Index down 6.34 points (-0.48%) to 1,324.63, while the HNX-Index fell 1.75 points (-0.71%) to 245.28. The market breadth tilted towards decliners with 466 losers and 300 gainers. The large-cap stocks in the VN30 basket painted a similar picture, with 20 stocks declining, 8 advancing, and 2 unchanged.

Technical Analysis for March 19: Risk Signals Emerge

The VN-Index and HNX-Index both witnessed a decline, alongside a significant surge in trading volume during the morning session, indicating a prevailing sense of pessimism among investors.

The Ultimate Headline: Short-Term Adjustment Risks Linger

The VN-Index declined with the emergence of a High Wave Candle pattern. The persistent low trading volume, below the 20-day average, indicates cautious trading among investors. Currently, the index is testing the Middle line of the Bollinger Bands. If this level is breached in upcoming sessions, the situation will turn more pessimistic, and a retreat to the old peak breached in June 2024 (1,290-1,310 points) is highly likely. Meanwhile, the Stochastic Oscillator and MACD continue their downward trajectory after issuing sell signals, suggesting that short-term correction risks persist.

The Cautious Investor: Navigating Market Uncertainty

The VN-Index declined with trading volume dipping below the 20-day average, indicating a cautious sentiment among investors. If this scenario persists in the upcoming sessions, the index is likely to retest the old peak breached in June 2024 (corresponding to the 1,290-1,310 point range). This zone will also serve as strong support for the index. Presently, the MACD indicator is poised to generate a sell signal again as it narrows the gap with the Signal Line. Should this materialize in the coming sessions, the short-term outlook would turn rather pessimistic.