The Vietnamese stock market witnessed a downward adjustment during the March 19 session. Large-cap stocks faced significant selling pressure, causing a lack of support for the VN-Index. At the close, the VN-Index dropped 6.34 points to 1,324.63 points. Liquidity remained high, with the matching value on HoSE reaching approximately VND 20,200 billion.

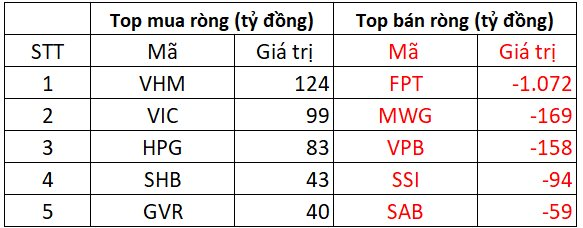

In terms of foreign investors’ activities, they net sold an abrupt VND 1,516 billion in the market, marking the most aggressive selling session since the beginning of the year. Specifically:

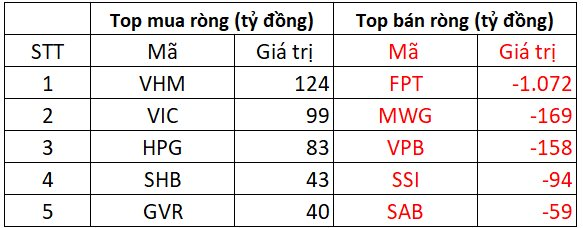

On HoSE, foreign investors net sold nearly VND 1,406 billion

FPT was the stock that foreign investors net sold the most on the market, with an abrupt value of VND 1,072 billion. Additionally, MWG and VPB were net sold VND 169 billion and VND 158 billion, respectively. Other securities stocks like SSI and SAB experienced net selling between VND 59 billion and VND 94 billion.

Conversely, VHM witnessed robust net buying of VND 124 billion, followed by VCI with net buying of VND 99 billion. HPG, SHB, and GVR also enjoyed net buying of around VND 40-83 billion each.

On HNX, foreign investors net sold approximately VND 76 billion

In terms of net buying, BVS, VFS, and MBS led the pack with values ranging from VND 1-2 billion. Following them, a range of stocks, including VIG, PVB, and others, experienced net buying of a few hundred million VND each.

On the opposite side, IDC faced the most substantial net selling from foreign investors, amounting to VND 30 billion. DL1 and PVS also experienced net selling of around VND 14-28 billion each.

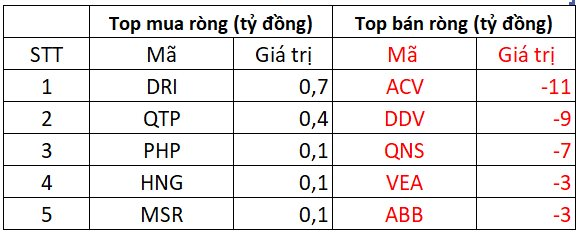

On UPCOM, foreign investors net sold over VND 34 billion

Regarding net buying, QTP, DRI, PHP, and HNG were the top choices, although the values were not significant, ranging from a few hundred million VND.

Conversely, ACV and DDV experienced substantial net selling of VND 11 billion and VND 9 billion, respectively. QNS, VEA, and ABB also faced net selling of a few billion VND each.

Market Beat: Foreign Investors Exit FPT, Leaving the Market in the Red

The market closed with the VN-Index down 6.34 points (-0.48%) to 1,324.63, while the HNX-Index fell 1.75 points (-0.71%) to 245.28. The market breadth tilted towards decliners with 466 losers and 300 gainers. The large-cap stocks in the VN30 basket painted a similar picture, with 20 stocks declining, 8 advancing, and 2 unchanged.

The Ultimate Headline: Short-Term Adjustment Risks Linger

The VN-Index declined with the emergence of a High Wave Candle pattern. The persistent low trading volume, below the 20-day average, indicates cautious trading among investors. Currently, the index is testing the Middle line of the Bollinger Bands. If this level is breached in upcoming sessions, the situation will turn more pessimistic, and a retreat to the old peak breached in June 2024 (1,290-1,310 points) is highly likely. Meanwhile, the Stochastic Oscillator and MACD continue their downward trajectory after issuing sell signals, suggesting that short-term correction risks persist.