The Vietnamese stock market faced unexpected corrective pressure after a positive upward trend. Profit-taking selling pressure intensified towards the end of the session on March 18th, overwhelming previous gains. At the close, the VN-Index fell 5.29 points to 1,330.97. Liquidity continued to falter compared to the previous session, with the matching value on HoSE reaching approximately 17,357 billion VND.

In this context, foreign trading was a downside as they net sold heavily, offloading more than 488 billion VND in the market. Specifically:

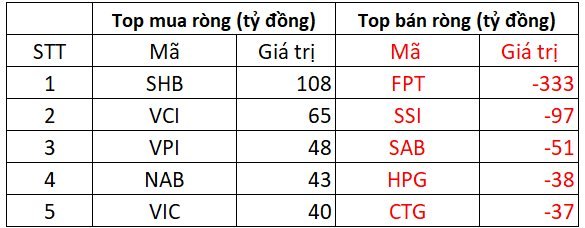

On HoSE, foreign investors net sold approximately 433 billion VND

In the selling side, FPT shares continued to be the most heavily “dumped” stock in the market, with a net sell value of 333 billion VND. Additionally, SSI was also net sold around 97 billion VND. Stocks in the financial sector, including SAB, HPG, and CTG, also experienced notable net selling, ranging from 37 to 51 billion VND.

Conversely, SHB bank shares witnessed robust net buying of 108 billion VND, and VCI was also net bought up to 65 billion VND. Following them, VPI, NAB, and VIC recorded net buying in the range of 40-48 billion VND each.

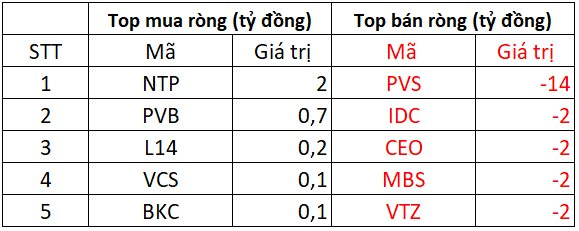

On HNX, foreign investors net sold approximately 26 billion VND

In terms of net buying, NTP shares topped the list with a value of 2 billion VND. Following closely, a range of stocks, including PVB, L14, VCS, and BKC, were net bought in the hundreds of millions of VND each.

On the opposite side, PVS shares experienced the most significant net selling by foreign investors, offloading 14 billion VND. Subsequently, IDC, CEO, MBS, and VTZ also faced net selling of around 2 billion VND each.

On UPCOM, foreign investors net sold nearly 30 billion VND

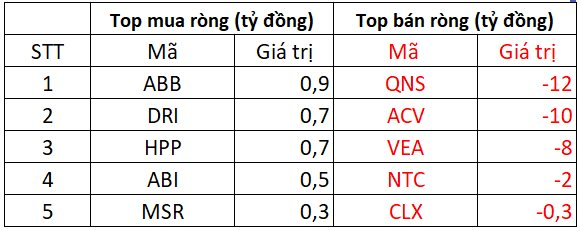

In terms of net buying, stocks like ABB, DRI, HPP, and ABI saw modest net buying of a few hundred million VND each.

Conversely, QNS and ACV faced notable net selling of 12 billion and 10 billion VND, respectively. VEA and NTC were also net sold, with values of 8 billion and 2 billion VND, respectively.

A Word of Caution: Considering VN-Index’s Downward Trend, Investors Should Refrain from Buying

The ABS Securities team anticipates a volatile trading session ahead, with potential corrective pressures and market jitters lingering.

Market Beat: Foreign Investors Exit FPT, Leaving the Market in the Red

The market closed with the VN-Index down 6.34 points (-0.48%) to 1,324.63, while the HNX-Index fell 1.75 points (-0.71%) to 245.28. The market breadth tilted towards decliners with 466 losers and 300 gainers. The large-cap stocks in the VN30 basket painted a similar picture, with 20 stocks declining, 8 advancing, and 2 unchanged.