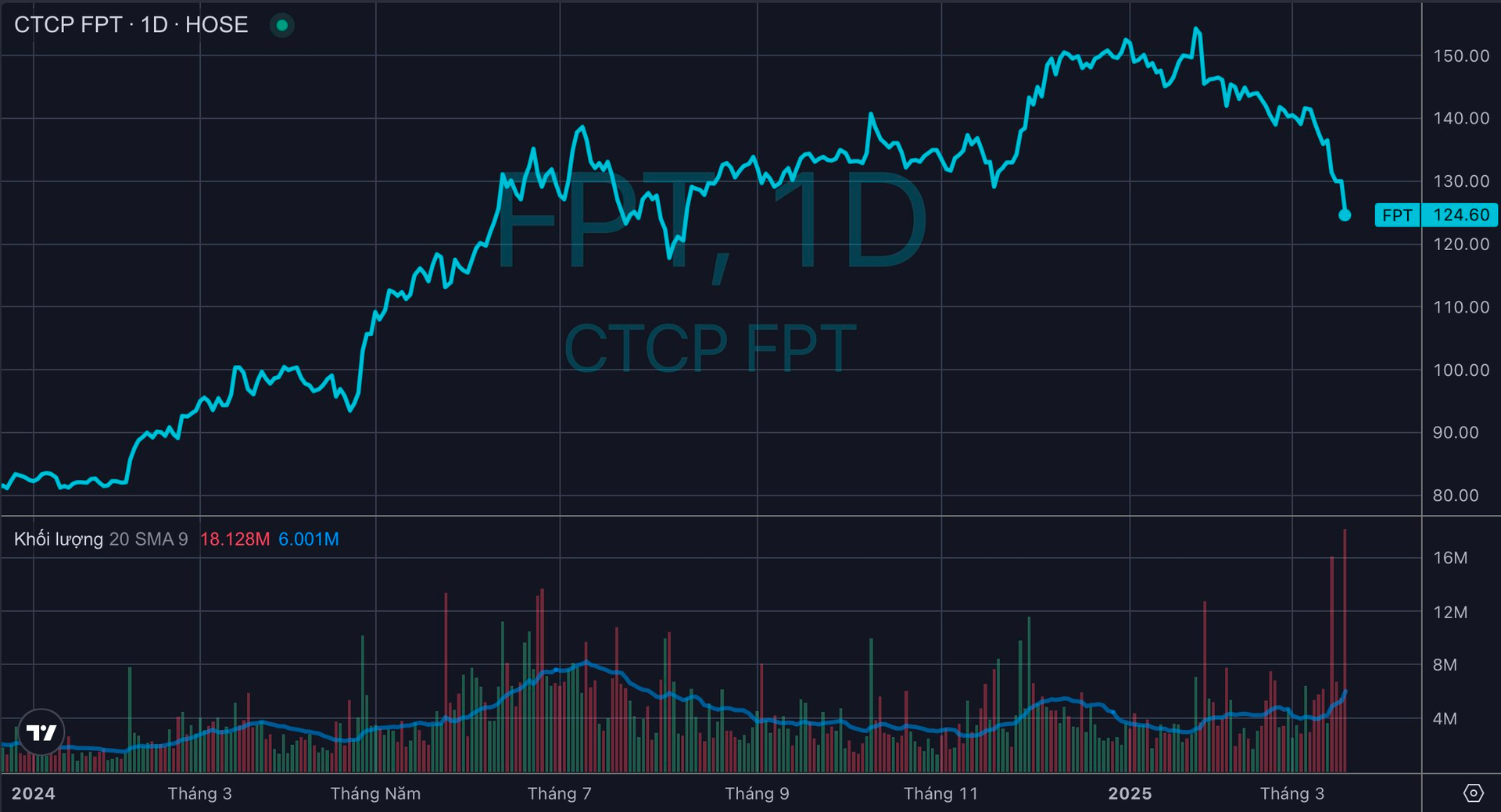

Amid a wave of tech stock sell-offs globally, FPT – Vietnam’s leading technology corporation – has not been spared. This stock has just experienced a drop of more than 4% with record-high liquidity of over 18 million units, with a trading value of nearly VND 2,300 billion, the largest on the stock market on March 19th.

Sliding continuously since the beginning of February (the start of the Lunar New Year of the Tiger), FPT’s stock price has now fallen to VND 124,600/share, the lowest since August 2024. Compared to its peak at the end of last year, FPT has lost more than 19% in market price.

FPT’s market capitalization has also “evaporated” by nearly VND 44 trillion, leaving about VND 183 trillion, and is no longer the largest private enterprise on the stock exchange.

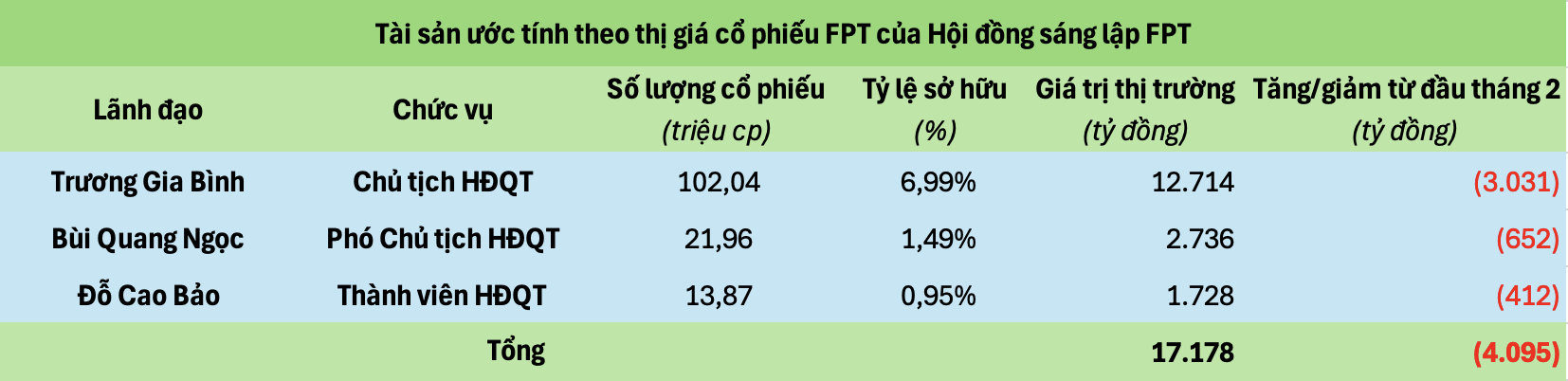

As FPT’s stock price continues to plummet, the stock market wealth of Mr. Truong Gia Binh, Chairman of the Board, has also taken a significant hit. With direct ownership of more than 102 million FPT shares (a ratio of 6.99%), Mr. Binh’s stock market wealth is estimated at about VND 12.7 trillion, a decrease of VND 3 trillion since the beginning of February 2025.

Recall the joyous atmosphere of the Lunar New Year celebration (on February 3rd), when Mr. Truong Gia Binh performed a cover of the hit song “Tái sinh” (“Rebirth”) with the corporation’s employees. However, since then, FPT’s stock has brought mostly disappointment to its shareholders.

For long-term shareholders who have held their positions for an extended period, a 19% drop from the peak may not be a significant concern. However, it is undeniable that the recent downward trend of FPT has impacted the psychology of investors, especially those who bought at high prices or attempted to catch the falling knife early on.

The decline in FPT’s stock price during this period has faced substantial pressure from foreign investors. Foreigners have consistently sold large volumes, even millions of units per session, in contrast to the previous period when FPT’s foreign ownership limit (“room”) was often fully filled (except during ESOP periods, but these were quickly filled afterward).

In addition to profit-taking pressure, the rise of startups from China, such as the low-cost AI model DeepSeek or the world’s first self-governing AI agent, Manus, has also been assessed as a factor influencing global tech stocks. The low-cost AI model is raising investor concerns about a potential decline in the market value of AI, despite lingering doubts about development costs.

However, FPT’s management believes that the emergence of low-cost AI models like DeepSeek may not significantly impact the performance of FPT AI Factory. In fact, the appearance of similar low-cost AI models could encourage greater AI adoption among businesses and organizations, indicating opportunities for technology companies, including FPT’s AI division.

Mr. Truong Gia Binh even used the story of DeepSeek as an inspirational message for FPT’s team. “Like David using a slingshot to bring down the giant Goliath, DeepSeek doesn’t require vast resources but still achieves remarkable results. This is a strong encouragement for us. To succeed like DeepSeek, it’s not about spending a lot of manpower, money, or time, but about finding the optimal way to serve our partners and ourselves. AI before AI, we must move fast,” affirmed the Chairman of FPT.

Expecting profit growth of over 20%

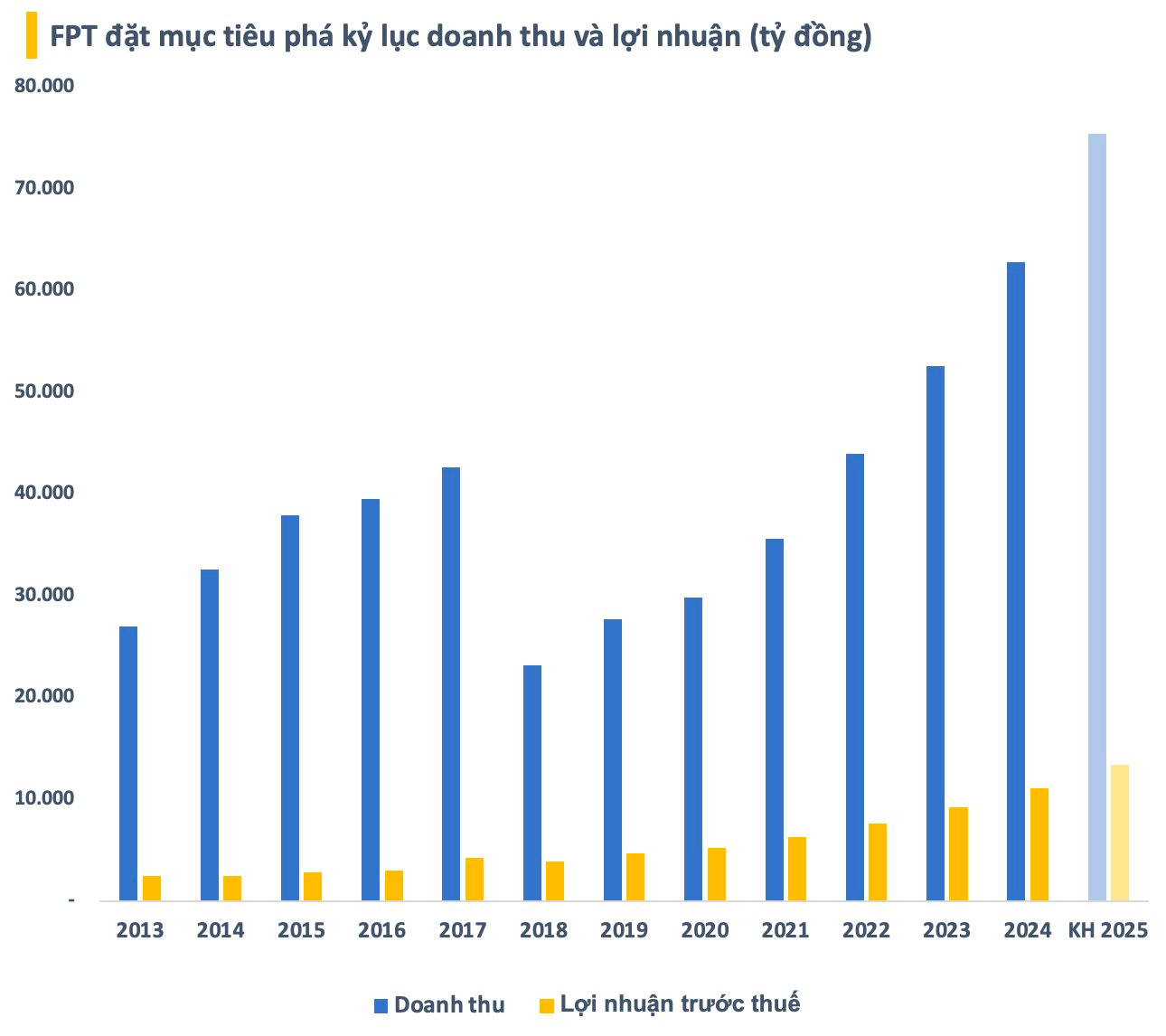

In reality, short-term fluctuations are inevitable for any stock. However, it is undeniable that FPT remains a “rarity” on the Vietnamese stock market, maintaining a stable and high growth rate over the years. Last year, the corporation achieved record-high business results with revenue of VND 62,849 billion and pre-tax profit of VND 11,071 billion, up 19.4% and 20.3%, respectively, compared to 2023.

Entering 2025, FPT sets ambitious business plans, targeting revenue of VND 75,400 billion and pre-tax profit of VND 13,395 billion, up 20% and 21%, respectively, compared to 2024. If achieved, this will be the fifth consecutive year of growth above 20%/year for the leading Vietnamese technology enterprise.

According to various assessments, the information technology (IT) sector is expected to maintain positive growth prospects in the future. Gartner predicts that global spending on software/IT services will grow by 14%/9.4% in 2025 as businesses accelerate digital transformation to adopt new technologies.

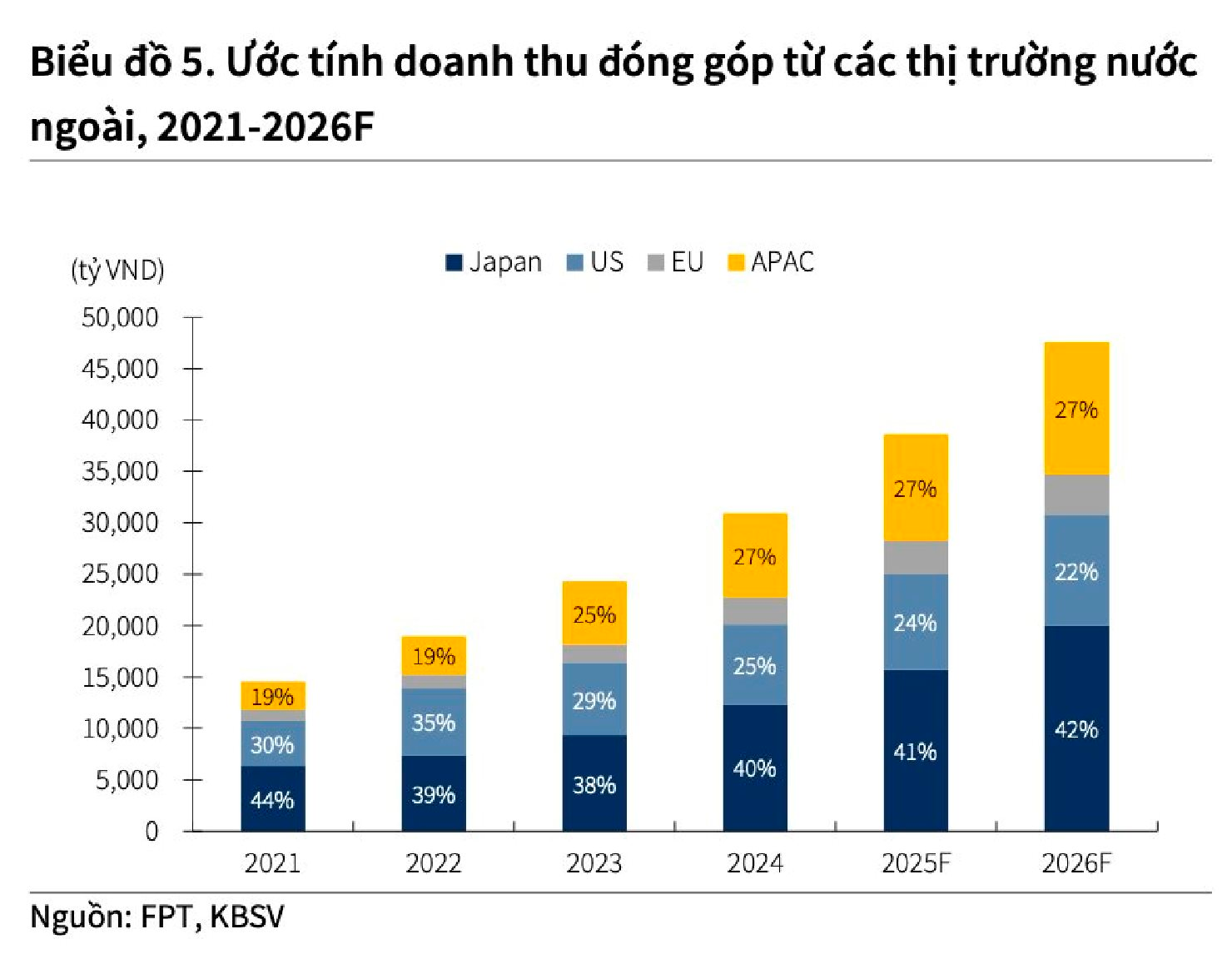

According to a recent analysis report by KBSV, the trend of using AI for content generation in enterprises and organizations will be robust, aiming to improve operational efficiency and drive global spending on software and IT services. The analytics team expects FPT to continue to catch up with new trends to boost investment in key markets.

KBSV projects FPT’s IT segment revenue in 2025 to grow by 24.7% year-over-year, reaching VND 38,597 billion, based on (1) AI Factory completing its product ecosystem and helping FPT reach a wider range of customers, and (2) large-scale contracts continue to be signed, ensuring a significant volume of work in the long term.

The Surprising Common Denominator of Nvidia and FPT

From the first quarter of the 2024 fiscal year, Nvidia has demonstrated a steady growth trajectory in its revenue and net profit, charting an almost linear path.