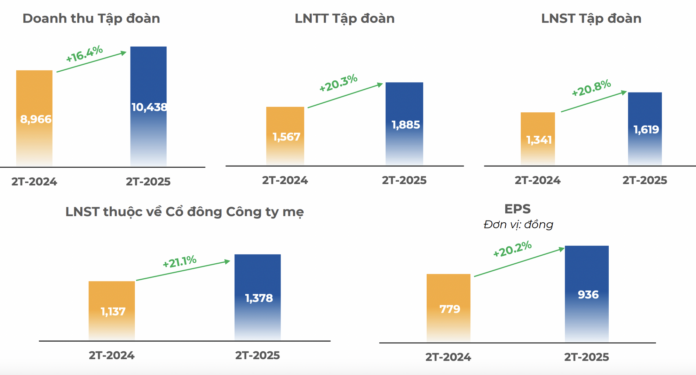

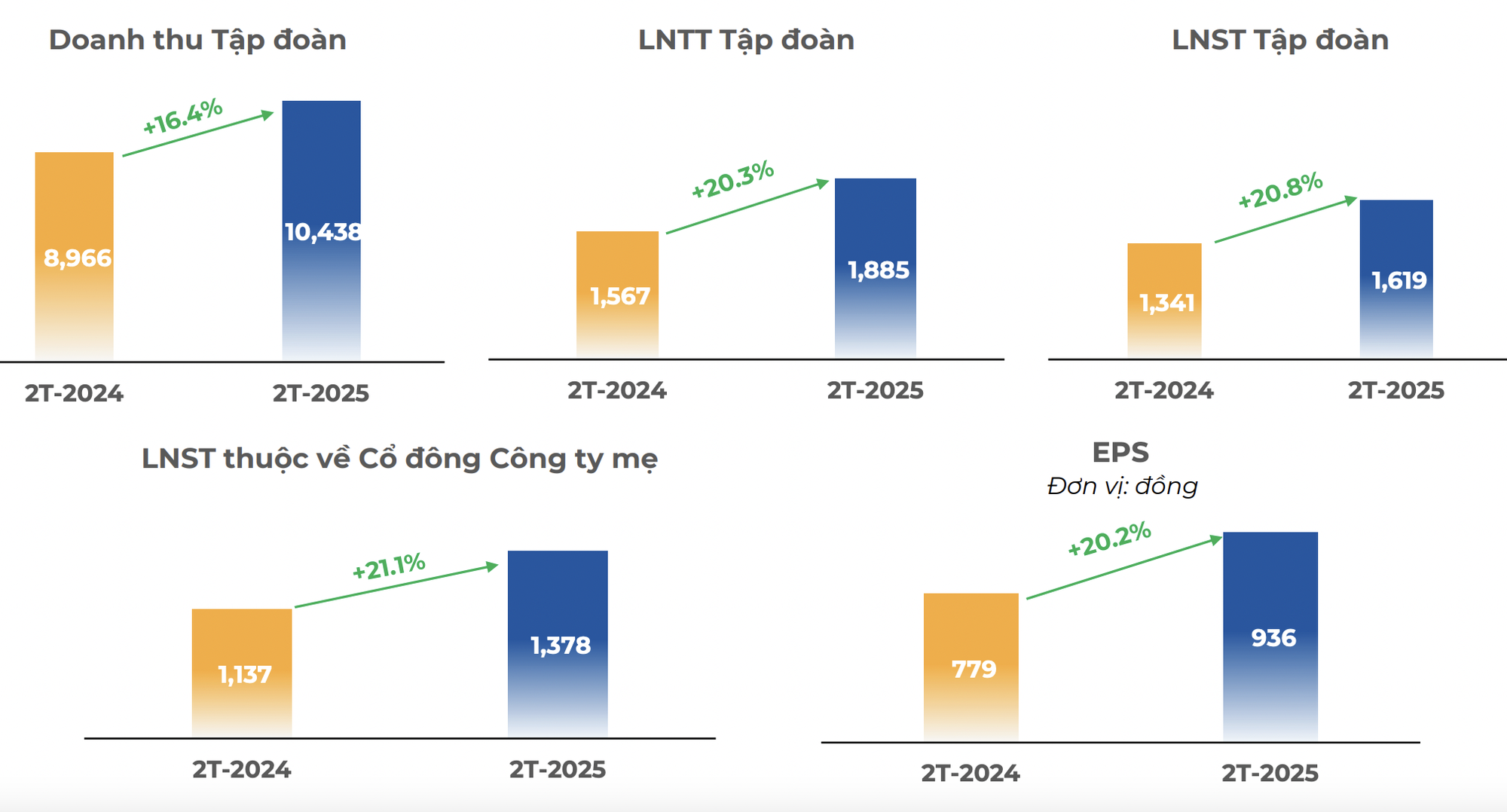

FPT Group has just announced its business results for the first two months of 2025, with revenue reaching VND 10,438 billion and PBT reaching VND 1,885 billion, up 16.4% and 20.3% year-on-year, respectively. Profit after tax for the parent company’s shareholders (net profit) increased by 21.1% to VND 1,378 billion, corresponding to an EPS of VND 936 per share.

Entering 2025, FPT sets ambitious business plans with revenue and pre-tax profit targets of VND 75,400 billion and VND 13,395 billion, respectively, up 20% and 21% compared to 2024. If achieved, this will be the fifth consecutive year of over 20% growth for the leading Vietnamese technology enterprise.

With the results achieved in the first two months, the Group has accomplished 14% of its set plans.

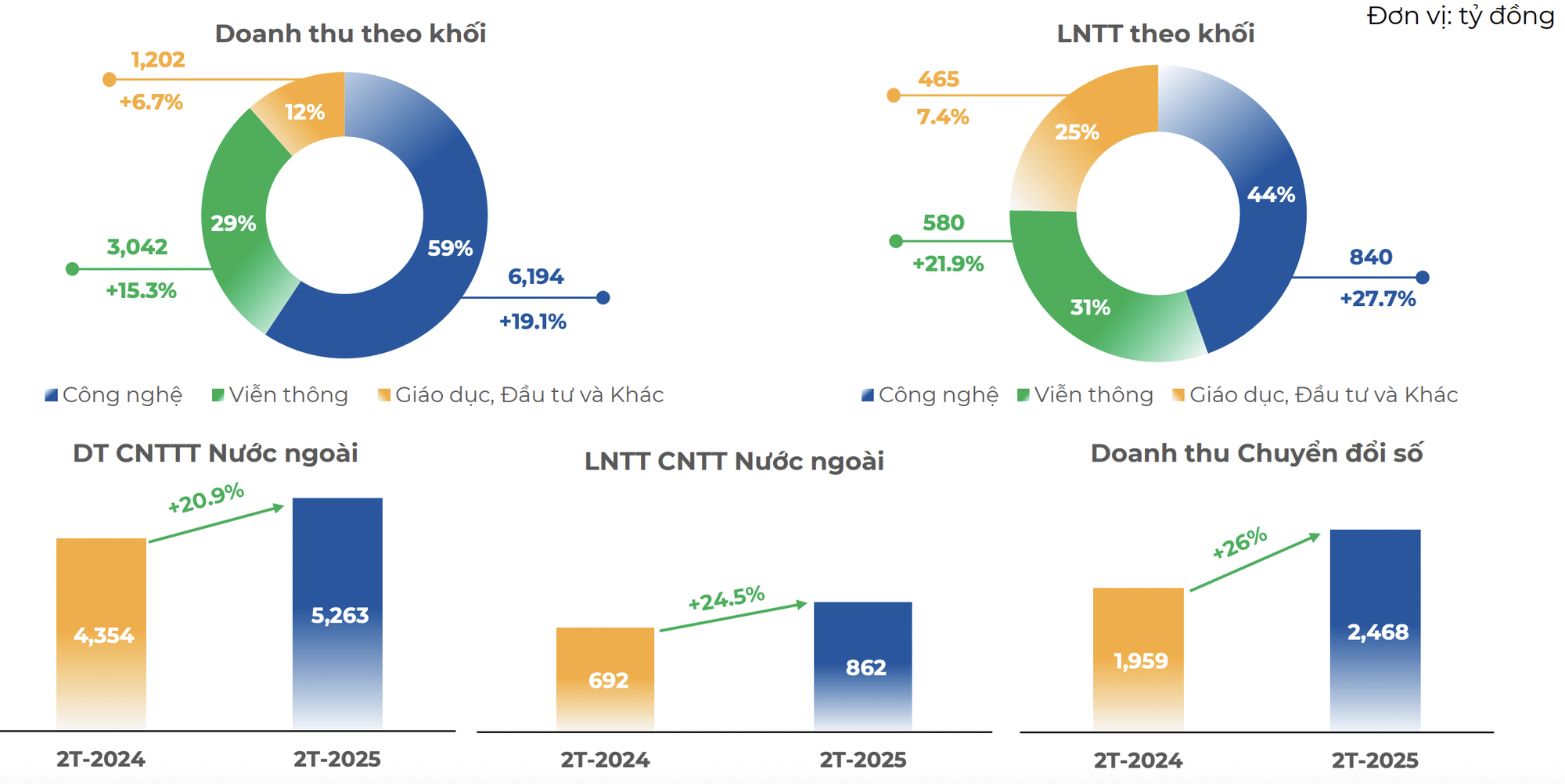

The IT Services for Overseas Markets segment continued its growth momentum, with revenue reaching VND 5,263 billion, equivalent to a 20.9% increase. The main market in Japan maintained a 30% growth rate, achieving revenue of VND 2,169 billion. However, in the US market (+8.3% YoY), FPT has not seen positive signs due to economic and geopolitical uncertainties, causing businesses there to be more cautious in their IT spending decisions. The volume of new orders in overseas markets reached VND 8,147 billion, up 13.7%.

In the first two months of 2025 alone, FPT won five large projects with a scale of over USD 10 million each, affirming FPT’s technology provisioning capabilities.

Thanks to enhanced sales activities and optimized internet service packages, the Telecommunications Services segment recorded positive growth in both revenue and pre-tax profit, increasing by 15.3% to VND 3,042 billion and 21.3% to VND 580 billion, respectively.

In the Education, Investment, and Other segment, revenue grew by nearly 7% to VND 1,202 billion in the first two months of 2025, with PBT reaching VND 465 billion.

In the market, FPT shares have experienced a strong correction since the beginning of 2025. The closing price on March 19 reached VND 124,600 per share, the lowest since August 2024. Compared to the peak at the end of last year, FPT has lost more than 19% in share price. Accordingly, FPT’s market capitalization has also decreased by nearly VND 44,000 billion, to about VND 183,000 billion, and is no longer the largest private enterprise on the stock exchange.

On March 20, the share price of FPT recovered slightly, closing the morning session at VND 125,200 per share, up 0.5%.

The Art of Digital Transformation: A High-Level Discussion between Vietnam Air Traffic Management Corporation and FPT Group

Recently, FPT Corporation and the Vietnam Air Traffic Management Corporation (VATM) hosted an exclusive summit focused on digital transformation. The goal was to identify cutting-edge technological solutions to enhance VATM’s operational safety and efficiency.

Is There Still an Opportunity for Investors in the Real Estate Stock Surge?

The VN-Index is predicted to surge back to the 1,300-point mark, with a particular boost from soaring real estate stocks.