Insider Stock Sale for Personal Reasons

Novaland Group (stock code: NVL) has announced the sale of stocks by insiders and related parties. Mr. Bui Cao Nhat Quan, son of Mr. Bui Thanh Nhon, Chairman of Novaland’s Board of Directors, has registered to sell over 2.9 million NVL shares for personal reasons.

The notice states that the transaction is expected to take place from March 21 to April 18, through matching or agreement methods. This stock volume accounts for approximately 0.15% of Novaland’s charter capital.

Novaland has to repay two bond issues with a total value of over VND 1,200 billion in principal and interest.

After the transaction, Mr. Quan’s ownership will decrease from 4% to 3.8% of Novaland’s charter capital, equivalent to approximately 75.3 million NVL shares. The reason for the divestment is personal financial needs.

Mr. Bui Cao Nhat Quan (43 years old), with a business administration degree, has been associated with Novaland since 2007. He currently holds no position at Novaland. Previously, Mr. Quan served as Vice Chairman of the Board of Directors and Vice General Director from 2015 to 2017.

In 2024, Mr. Nhon’s daughter, Ms. Bui Cao Ngoc Quynh, also reduced her ownership in Novaland from 1.26% to 0.8%. As of the end of 2024, the total number of shares held by Chairman Bui Thanh Nhon, his relatives, and related parties in Novaland exceeded 38% of the charter capital, with Novagroup Joint Stock Company holding the largest proportion at over 17.6%.

On the stock exchange, NVL shares have shown a significant recovery. From a historical low of VND 8,700 per share in mid-January 2025, NVL closed at VND 10,950 per share on March 18. With this price, it is estimated that Mr. Quan could reap approximately VND 30 billion from the transfer of shares.

Delayed Repayment of Trillion-Dong Bonds

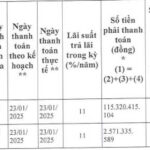

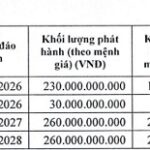

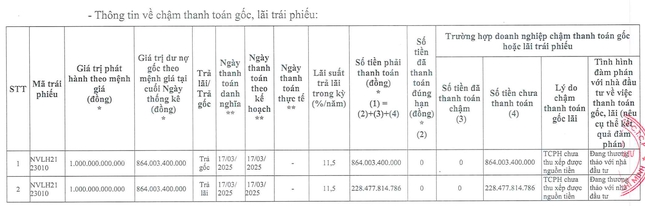

NVL also announced mandatory early repurchase of the NVLH2123010 bond issue valued at over VND 1,000 billion. The NVLH2123010 bond was issued on September 17, 2021, with a term of 42 months and an interest rate of 10.5%/year.

NVLH2123010 bond issue, NVL owes over VND 1,000 billion.

The total issuance value was VND 1,000 billion, and it was due on March 17, 2025. This bond was issued to both institutional and professional individual investors. The principal due on March 17 was VND 864 billion, along with interest of over VND 228 billion.

Military Commercial Joint Stock Bank Securities Company, as the representative of the bondholders, stated that Novaland must maintain a minimum asset ratio of 100% of the total face value of the circulating bonds. If this ratio falls below the specified level, NVL must supplement the assets within 30 days from the notification, while other assets must be supplemented within 10 working days. However, on January 10, 2025, the asset ratio of this bond issue fell below 100%.

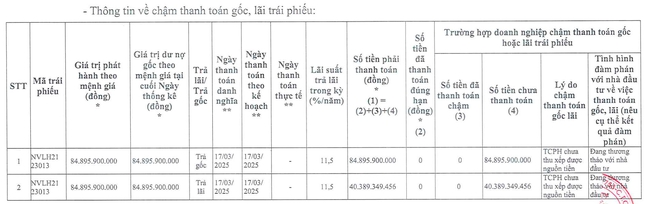

The NVLH2123013 bond issue, dated September 28, 2021, matured on March 16, 2025. The initial interest rate was 10.5%/year but was later fixed at 11.5%/year from March 16, 2023, until maturity. The value at the time of issuance was VND 430.7 billion and was also secured by NVL shares. The principal due is nearly VND 85 billion, along with interest of over VND 40 billion.

NVLH2123013 bond issue, NVL owes bondholders over VND 100 billion.

According to NVL, the two maturing bond issues, NVLH2123010 and NVLH2123013, have a total value of over VND 1,200 billion in principal and interest. Novaland stated that the reason for not being able to repay the bonds on time was the inability to arrange funds. The company is currently in negotiations with investors.

In addition to these two bond issues, Novaland’s subsidiary, Nova Final Solution Joint Stock Company, was also unable to repay the principal of nearly VND 450 billion for the NOVA FINAL SOLUTION.BOND.2019 issue. The reason given was the inability to arrange capital. Nova Final Solution Joint Stock Company is in negotiations with investors to buy back all the bonds in April.

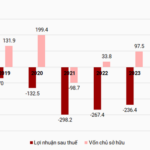

Unleashing the Potential: NVL Skyrockets as Obstacles Cleared for Ben Van Don Project

The shares of No Va Real Estate Investment Group (Novaland, HOSE: NVL) soared to the ceiling during the February 20th session, following the National Assembly’s issuance of a resolution on special mechanisms to address obstacles at the project located at 39-39B Ben Van Don, Ward 12, District 4, Ho Chi Minh City.

The Sun City’s Fate Post-Novaland

Sun City Real Estate Investment and Development Ltd. has been given the green light to develop a landmark project in An Khanh Ward, Thu Duc City. The project, boasting a staggering investment of over VND 10.5 trillion, encompasses a high-rise complex of residential, commercial, service, and office spaces. This venture stands out as a rare gem among the few projects in Ho Chi Minh City to secure investment approval this year.

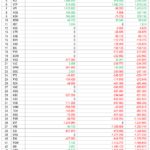

What Stocks Will Be Removed From the FTSE ETF and VNM ETF in the Q4 Review?

According to the latest report by SSI Research, the foreign ETF portfolio will undergo significant changes in the Q4 2024 reconstitution. The upcoming adjustments include the addition of promising new stocks and the rebalancing of existing holdings, setting the stage for a strategic shift in the portfolio’s composition.