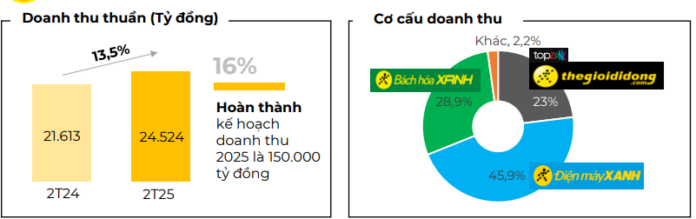

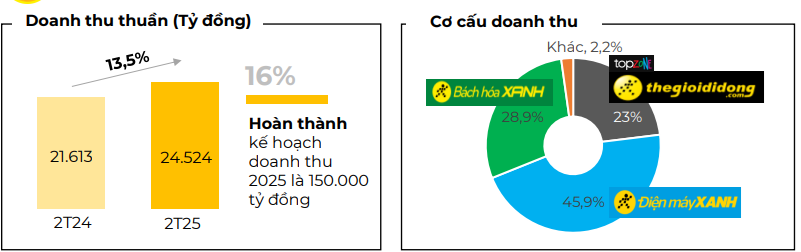

According to the Mobile World Investment Corporation (Ticker: MWG), the company’s revenue for the first two months of the year reached VND 24,524 billion, up 13.5% year-on-year, completing 16% of its 2025 revenue plan (VND 150,000 billion). This means that, on average, Mr. Nguyen Duc Tai’s retail business brought in VND 416 billion each day during the first two months.

The The Gioi Di Dong and Dien May Xanh chains contributed nearly VND 17,000 billion in revenue, up over 13% compared to the 2024 Lunar New Year season. Online revenue for the first two months reached approximately VND 1,000 billion, accounting for 6% of the total revenue of the two chains. MWG stated that this growth was achieved even with a reduction of 221 stores compared to the end of February 2024. This indicates that sales per existing store continued to grow steadily, while operational efficiency improved thanks to streamlined operations and optimized costs. As of the end of February 2024, the The Gioi Di Dong chain had 1,018 stores (including Topzone) and the Dien May Xanh chain had 2,027 stores.

Along with this, the well-prepared and synchronized business strategy, from diversifying product portfolios to offering comprehensive shopping choices and providing optimal financial solutions such as the “buy now, pay later” program, helped the two phone and appliance chains achieve positive results in maintaining growth momentum and expanding market share.

Regarding specific product categories, most recorded positive results, with the ICT group being the main growth driver. Despite the slow recovery of the technology retail market in general, the phone, tablet, and laptop categories saw strong growth of over 20% year-on-year.

According to MWG, from March 2025, the company has also started preparations for the peak season for the air conditioner category, including strategic partnerships with major partners to ensure supply and meet the high demand from the market.

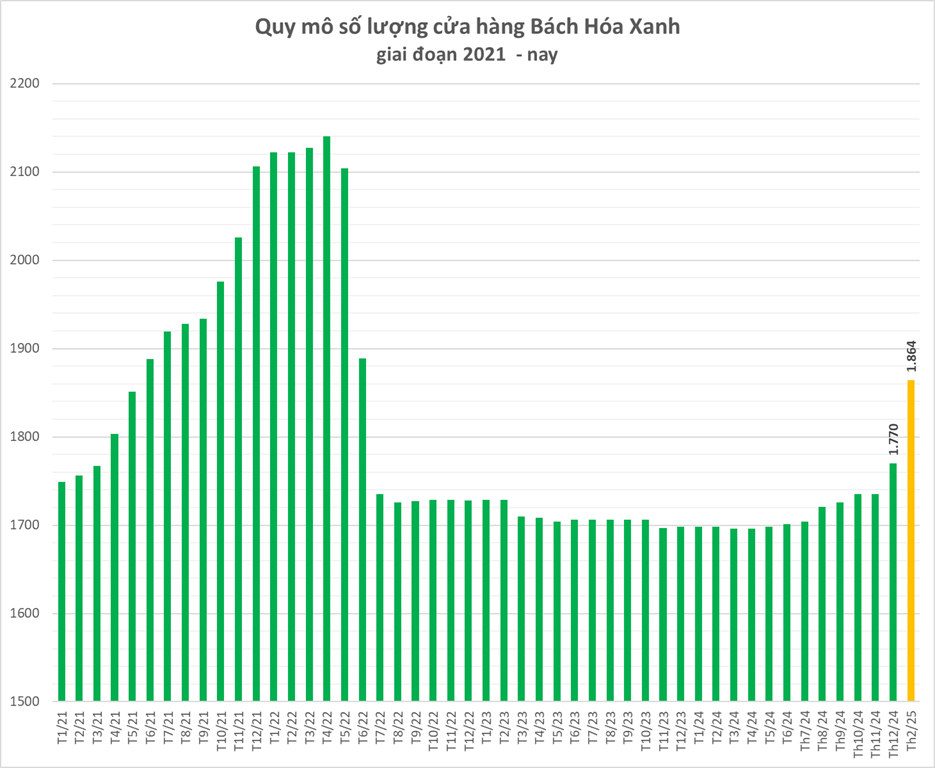

For the Bach Hoa Xanh chain, MWG increased its scale by 94 stores, bringing the total number of stores to 1,864. More than 50% of the new stores are located in the central provinces of Vietnam. In the following months, the company will continue its expansion plans.

After the first two months of the year, the Bach Hoa Xanh chain recorded more than VND 7,000 billion in revenue, up 16% year-on-year. The growth momentum came from both fresh food and FMCG categories, which maintained double-digit growth compared to the same period last year.

The An Khang chain remained at 326 pharmacies, unchanged from the end of 2024. Similarly, the Avakids system has 62 stores.

The EraBlue chain in Indonesia recorded an increase of 8 stores in the first two months, reaching 95 stores. Recently, MWG was one of the representative enterprises of the Vietnamese business community that accompanied the high-level delegation of the State to attend the Vietnam-Indonesia High-Level Economic Forum. At the event, The Gioi Di Dong and Erajaya signed a memorandum of understanding for a $50 million investment to promote the development of the Erablue chain in the coming years.

VNDiamond and VN30 Basket Re-balancing: Will There Be a Sell-off in the Banking Sector?

The upcoming portfolio restructuring of domestic ETFs in April 2025 is noteworthy, as the VN30 and VNDiamond indices undergo their periodic review. With a cut-off date of March 31st, the results will be announced on April 16th, and the restructuring will be completed by April 29th.

DHL: Vietnam to Join the World’s Fastest-Growing Trade Group Soon

Vietnam is projected to have a compound annual growth rate (CAGR) of 6.5% in the period 2024-2029, outpacing the 6.2% growth rate recorded in the previous period of 2019-2024.