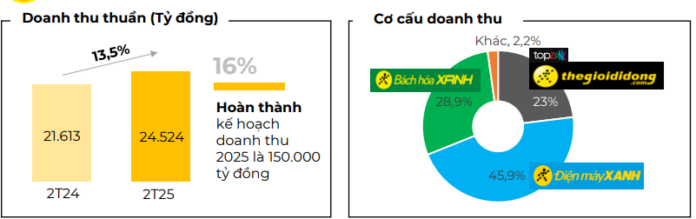

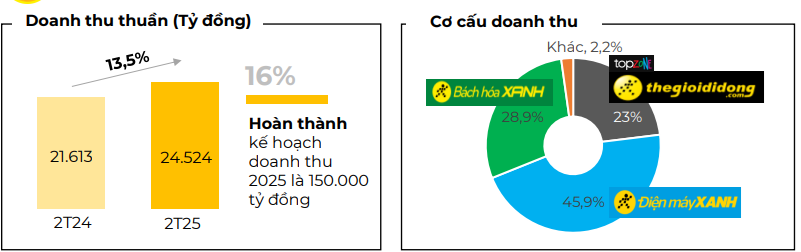

According to the announcement from Mobile World Investment Joint Stock Company (Code: MWG), the company’s revenue for the first two months of the year reached VND 24,524 billion, up 13.5% over the same period last year and completing 16% of the 2025 revenue plan (VND 150,000 billion). This means that, on average, Mr. Nguyen Duc Tai’s retail business brought in VND 416 billion per day during the first two months of the year.

Among this, the The Gioi Di Dong and Dien May Xanh chains contributed nearly VND 17,000 billion in revenue, up over 13% compared to the 2024 Tet season. Online revenue for the first two months reached approximately VND 1,000 billion, accounting for 6% of the total revenue of the two chains. MWG stated that this growth was achieved even though the number of stores decreased by 221 compared to the end of February 2024. This indicates that sales per existing store continue to grow steadily, while operational efficiency has improved thanks to streamlined operations and optimized costs. As of the end of February 2024, the The Gioi Di Dong chain had 1,018 stores (including Topzone) and the Dien May Xanh chain had 2,027 stores.

Along with this, the well-prepared and synchronously implemented business strategy, from diversifying product portfolios to offering comprehensive shopping choices and providing optimal financial solutions such as the “buy now, pay later” program, has helped the two phone and appliance chains achieve positive results in maintaining growth momentum and expanding market share.

In terms of specific product groups, most have recorded positive results, with the ICT group being the main growth driver. Despite the slow recovery of the technology retail market in general, the sales of phones, tablets, and laptops grew strongly by over 20% compared to the previous year.

According to MWG, from March 2025, the company has also started preparations for the peak season for the air conditioner product group, including signing strategic cooperation agreements with major partners to ensure supply and meet the high demand from the market.

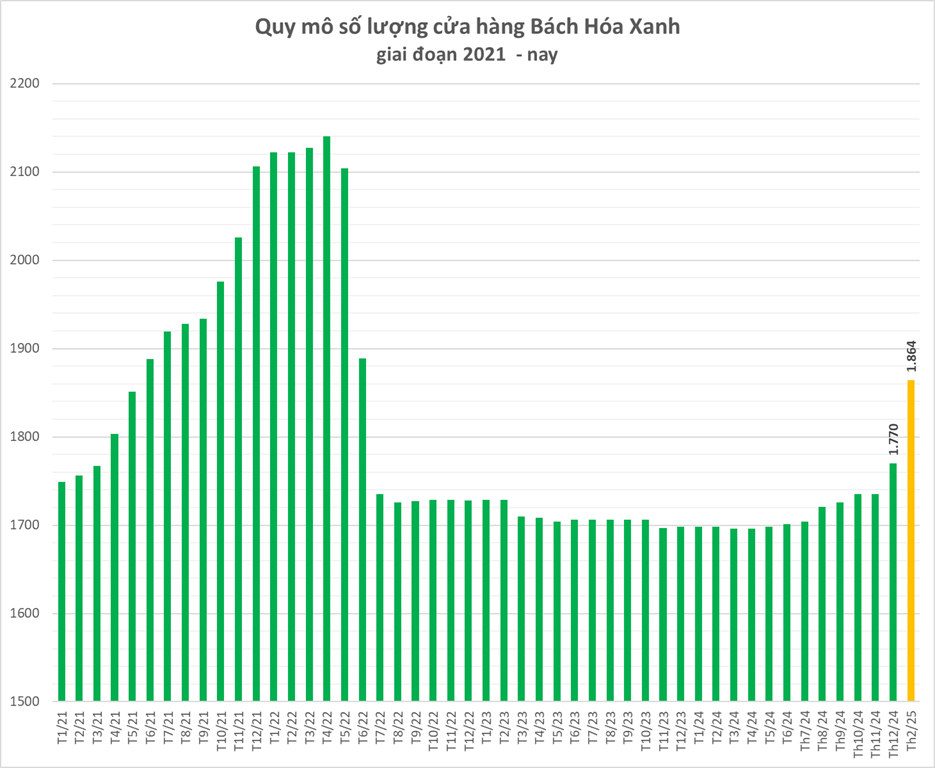

For the Bach Hoa Xanh chain, MWG increased its scale by 94 stores, bringing the total number of stores to 1,864. More than 50% of the new stores are located in the central provinces of Vietnam. In the following months, the company will continue its expansion plans.

After the first two months of the year, the Bach Hoa Xanh chain recorded more than VND 7,000 billion in revenue, up 16% over the same period. The growth momentum came from both fresh food and FMCG product groups, which maintained double-digit growth compared to the previous year.

The An Khang chain remained at 326 pharmacies, unchanged from the end of 2024. Similarly, the Avakids system has 62 stores.

The EraBlue chain in Indonesia recorded an increase of 8 stores in the first two months, reaching 95 stores. Recently, MWG was one of the representative enterprises of the Vietnamese business community accompanying the high-level delegation of the State to attend the Vietnam-Indonesia High-Level Economic Forum. At the event, The Gioi Di Dong and Erajaya signed a memorandum of understanding on a $50 million investment to promote the development of the Erablue chain in the coming years.

FPT Telecom (FOX) Aims for Record-High 2025 Profits, Targets 5,000 VND Cash Dividend per Share

FPT Telecom is taking a dynamic approach to capital expansion with a proposed 50% stock dividend. This strategic move will increase the company’s charter capital from 4,925 billion to approximately 7,388 billion VND. This stock issuance is a supplementary measure to the company’s cash dividend policy, demonstrating FPT Telecom’s commitment to rewarding its shareholders and fostering sustainable growth.

The Magic of Words: Crafting a Captivating Title

“Unleashing the Power of Dược Hải Dương: An Ambitious HOSE Listing with an 8-Million Share Offering”

For 2025, Hai Duong Medical Supplies JSC (Hai Duong Pharma) is targeting a 26% increase in revenue, with a slight dip in profits, according to the company’s AGM documents. The company also plans to propose a bonus share issuance and a roadmap for listing on the Ho Chi Minh Stock Exchange (HOSE).