On March 17, 2024, Novaland Group, a leading real estate investment corporation in Vietnam, announced its inability to repay the principal and interest on two matured bond series, NVLH2123010 and NVLH2123013, totaling over VND 1,200 billion. Novaland attributed this to a lack of available funds and is currently in negotiations with investors.

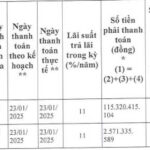

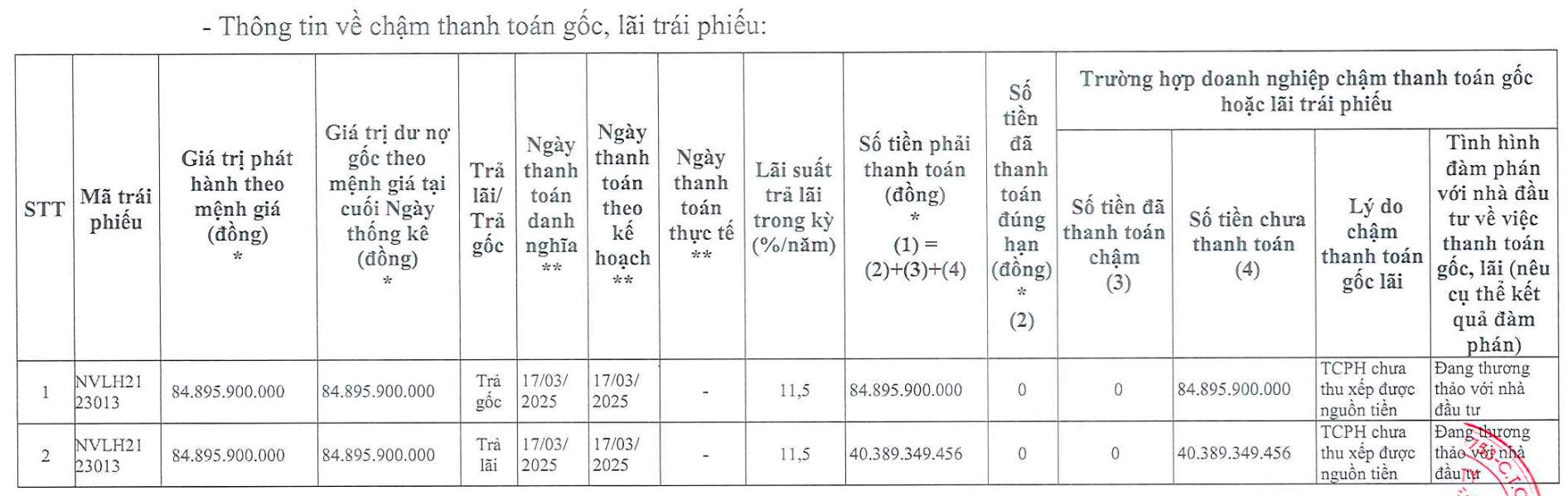

Prior to this, Novaland was obligated to repurchase NVLH2123010 ahead of its maturity date due to delays in completing the procedures for additional asset security. The company had until March 17, 2025, to make the repurchase. NVLH2123010 was issued on September 17, 2021, with a term of 42 months and a coupon rate of 10.5%/year. The total issuance value was VND 1,000 billion, secured by NVL shares. The matured principal amount due on March 17, 2025, was VND 864 billion, along with interest of over VND 228 billion.

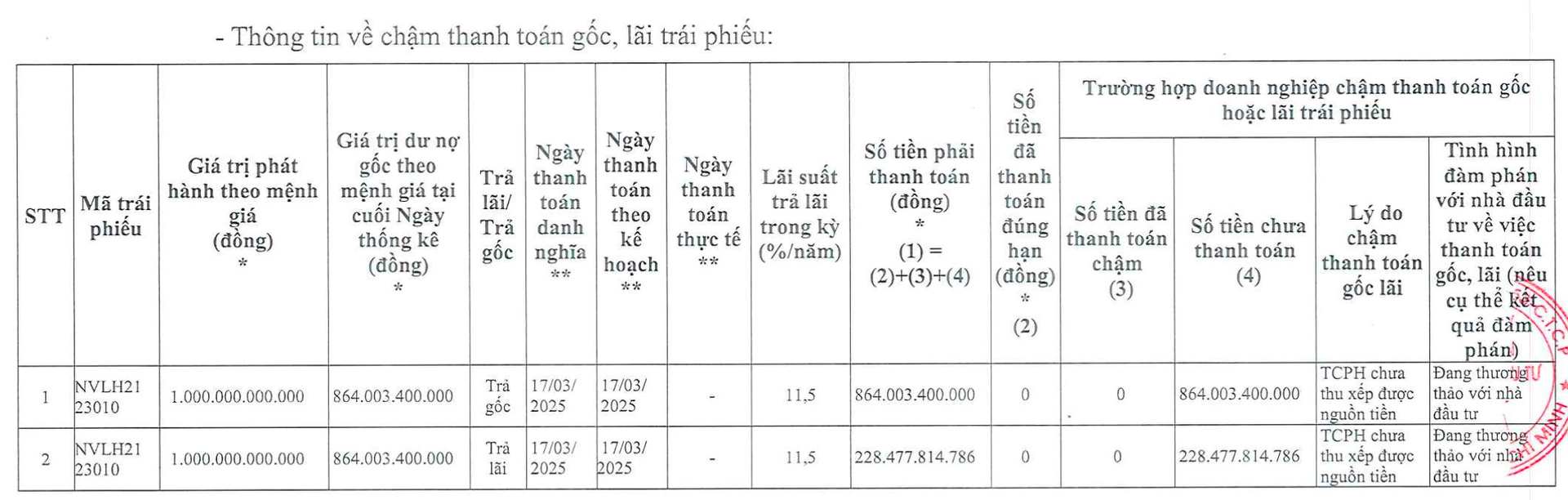

NVLH2123013 was issued on September 28, 2021, and matured on March 16, 2025. The initial coupon rate was 10.5%/year but was later fixed at 11.5%/year from March 16, 2023, until maturity. The issuance value at that time was VND 430.7 billion, also secured by NVL shares. The remaining principal amount due was nearly VND 85 billion, with interest of over VND 40 billion.

In addition to these two bond series, Novaland’s subsidiary, Nova Final Solution JSC, also faced challenges in repaying its NOVA FINAL SOLUTION.BOND.2019 series, with a principal amount of nearly VND 450 billion. The reason cited was similar—a lack of available funds. NFSC is in discussions with investors about repurchasing the entire bond series in April.

In the stock market, NVL shares are trading around VND 11,000 per share, the highest price range since November last year. This corresponds to a market capitalization of nearly VND 22,000 billion.

Recently,

In another development, Novaland announced that it had received an arbitral award regarding a dispute with Saigon Co.op Investment and Development JSC (SID). According to Novaland’s disclosure, on March 13, 2025, the company received an arbitral award dated March 11, 2025, from the Vietnam International Arbitration Center (VIAC) regarding Case No. 55/23 HCM between the claimants, Novaland and Nova An Phu, and the respondent, SID.

The arbitral tribunal upheld Novaland’s claim, obliging SID to fulfill its obligations under the Project Development Cooperation Agreement No. 01/2016/HDHTPTDA/SCID-NVLG, signed on December 30, 2016. If SID fails to comply, the claimants, Novaland and Nova An Phu, are entitled to directly initiate the necessary procedures with competent authorities to obtain a land allocation decision for the cooperative land, thereby safeguarding their legitimate rights and interests.

What Proportion of Novaland’s Shares Are Held by the Group of Shareholders Related to Chairman Bui Thanh Nhon?

As of the end of 2024, the group of shareholders related to Chairman Bui Thanh Nhon held over 750 million NVL shares, equivalent to a 38.65% stake in Novaland. This significant ownership showcases a strong commitment to the company’s growth and a belief in its long-term success. With such a substantial stake, the group has a vested interest in ensuring Novaland’s prosperity and a bright future ahead.

The Heir Apparent’s New Move

“In a recent development, Bui Cao Nhat Quan, the son of Novaland’s Chairman Bui Thanh Nhon, has registered to sell over 2.9 million NVL shares for personal reasons. This news comes as Novaland faces the task of repaying two bond batches, totaling over VND 1,200 billion in principal and interest. As the company navigates these financial obligations, the sale of a significant number of shares by a key insider has sparked interest within the investment community.”

Unleashing the Potential: NVL Skyrockets as Obstacles Cleared for Ben Van Don Project

The shares of No Va Real Estate Investment Group (Novaland, HOSE: NVL) soared to the ceiling during the February 20th session, following the National Assembly’s issuance of a resolution on special mechanisms to address obstacles at the project located at 39-39B Ben Van Don, Ward 12, District 4, Ho Chi Minh City.

The Ultimate Real Estate Venture: Novaland’s $470 Million Prime Project in Thu Duc City Gets Greenlit After Four Years

The project’s new owner boasts an impressive business with a former VPBank member at its helm. In a surprising turn of events, the company has reported substantial profits, but its debt consumes a staggering 93% of its total assets. This revelation raises questions and intrigue, leaving us wanting to know more about this intriguing business venture and its future prospects.