The stock market traded lower on March 19. The VN-Index closed down 6.34 points, settling at 1,324.63. Foreign investors offloaded Vietnamese shares, with a net sell value of VND1,516 billion, marking the strongest selling session since the beginning of the year.

Brokerage firms bought VND969 billion worth of shares on the stock market.

On the HoSE, brokerage firms net bought VND1,052 billion, including VND619 billion on the matching board and VND433 billion in negotiated trades.

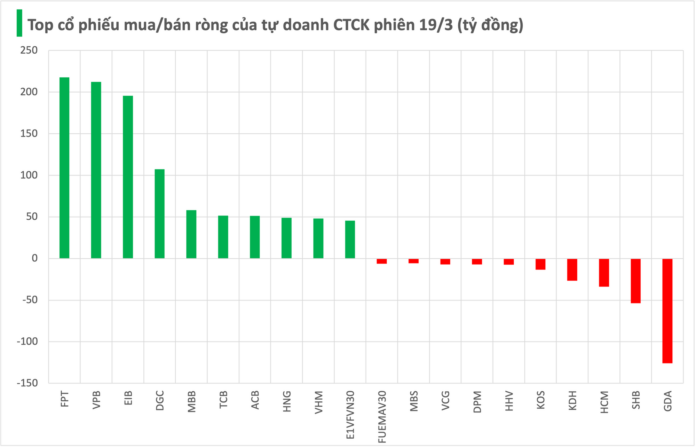

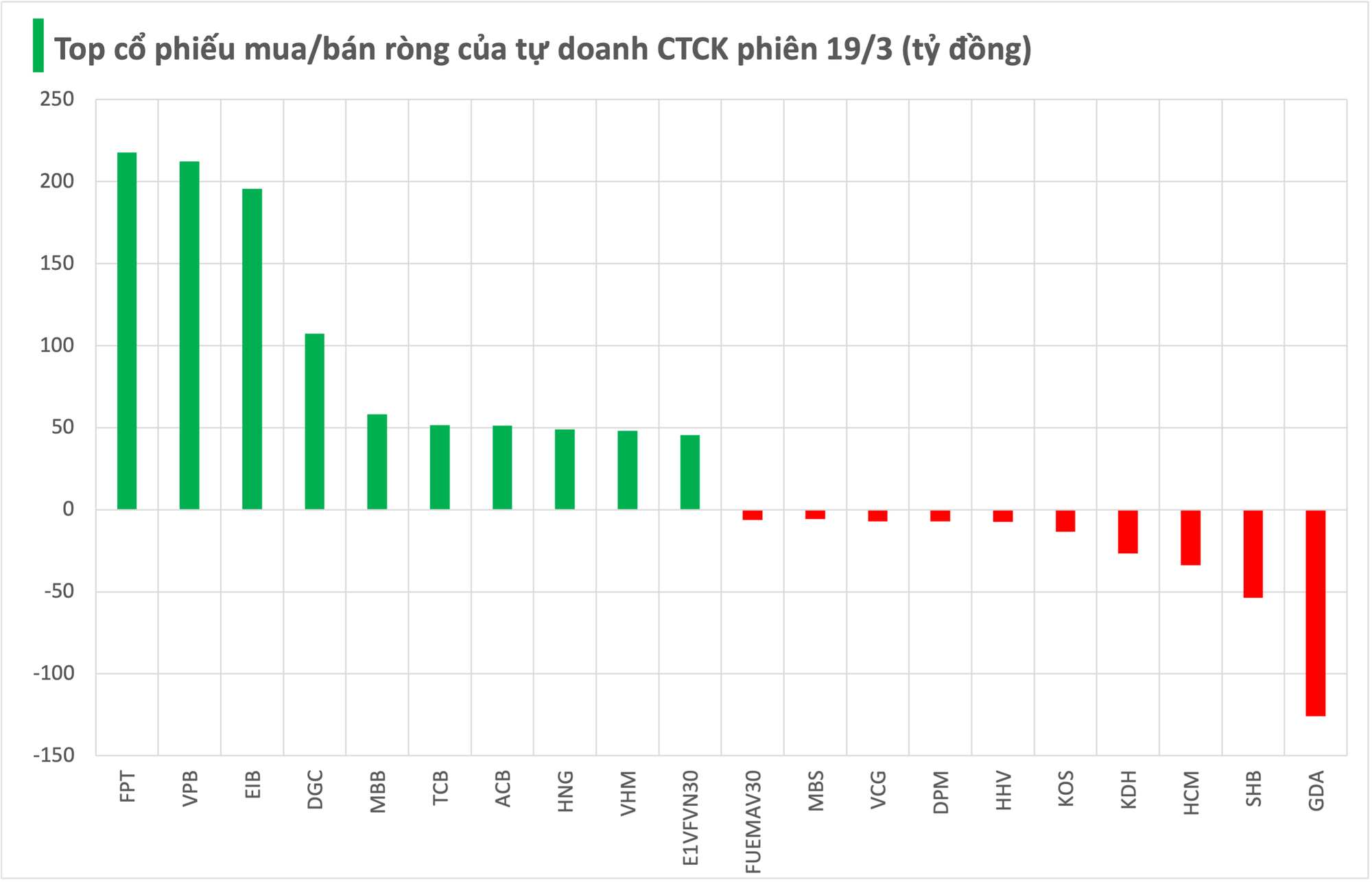

Specifically, securities companies bought FPT shares worth VND218 billion. Additionally, stocks like EIB, VPB, DGC, and MBB were also net bought on March 19.

On the other hand, SHB and HCM were among the most sold stocks by brokerage firms, with respective net sell values of VND54 billion and VND34 billion. KDH, KOS, and HHV were also offloaded by securities companies during the session.

On the HNX, brokerage firms net sold VND5 billion, with MBS experiencing a net sell value of nearly VND6 billion.

On the UPCoM, brokerage firms net sold VND77 billion, including GDA with a net sell value of VND126 billion. Conversely, HNG witnessed unexpected net buying of VND49 billion.

Market Beat: Foreign Investors Exit FPT, Leaving the Market in the Red

The market closed with the VN-Index down 6.34 points (-0.48%) to 1,324.63, while the HNX-Index fell 1.75 points (-0.71%) to 245.28. The market breadth tilted towards decliners with 466 losers and 300 gainers. The large-cap stocks in the VN30 basket painted a similar picture, with 20 stocks declining, 8 advancing, and 2 unchanged.

Market Beat on Feb 21st: VN-Index Sees Strong Tug-of-War at the Almighty 1,300 Resistance

The market closed with the VN-Index up 3.77 points (+0.29%) to 1,296.75, while the HNX-Index fell 0.45 points (-0.19%) to 237.57. The market breadth tilted towards decliners, with 423 stocks falling versus 359 advancing stocks. The sell-off was more pronounced in the VN30 basket, with 18 gainers, 11 losers, and 1 stock referenced.

The Stock Market Week of February 17-21, 2025: Navigating Intensifying Foreign Investor Pressure

The VN-Index sustained a positive upward trajectory this week, with trading volumes above the 20-day average, indicating brisk investor activity. However, foreign investors continued their selling spree, maintaining a net selling position. If this trend persists, it could significantly impact the market as the VN-Index approaches the crucial resistance level of 1,300 points.

Market Beat: Effort Rewarded, VN-Index Closes Above 1,270

The VN-Index extended its recovery efforts from the latter half of the morning session into the afternoon, posting a gain of 3.44 points to close at 1,270.35 on February 13. This came despite a notable corrective phase just before 2 pm. The HNX-Index and UPCoM also ended the session in positive territory, with the former climbing 0.2 points to 229.52 and the latter advancing 0.93 points to 97.74.

The Ultimate Headline:

“Vietstock Daily: Halting the Uptrend”

The VN-Index stalled its upward trajectory with a sharp decline, dipping below the 200-day SMA. If, in the upcoming sessions, the index falls below the Middle Band of the Bollinger Bands, the situation could turn more negative. However, the Stochastic Oscillator remains in bullish territory, and the MACD is echoing a similar signal, even hinting at a potential rise above the zero threshold. Should this transpire, the risks of a short-term correction would be mitigated.