VPS Securities Joint Stock Company (VPSS) approved its 2025 business plan at an extraordinary general meeting of shareholders (GM) held on January 16.

Accordingly, the leading brokerage firm aims to generate 8,500 billion VND in net revenue in 2025, up 31% from the previous year’s performance, with pre-tax and post-tax profits of 3,500 billion VND and 2,800 billion VND, respectively, an increase of 11%.

If these figures are realized, VPS will have the highest revenue in the past four years and set a new record in profits.

Vietcap Securities Joint Stock Company (VCI) has announced the agenda for the annual GM regarding its 2025 business plan, with expected total revenue of 4,325 billion VND, a 15% increase from 2024. Pre-tax profit is targeted at 1,420 billion VND, a 30% jump.

These figures indicate that the securities company chaired by Nguyen Thanh Phuong is aiming for its highest revenue in history. Simultaneously, the expected pre-tax profit is the second-highest in the company’s operating history, only surpassed by the 1,851 billion VND figure from 2021.

Vietcap’s Board of Directors (BOD) stated that the proposed 2025 business plan is based on the assumption that the global and Vietnamese macro-economy will remain volatile and complex, and the VN-Index is expected to fluctuate around 1,400 points by the end of 2025.

Illustrative image

At the upcoming annual GM on March 31, the Kafi Securities Joint Stock Company‘s BOD will present to shareholders a business plan targeting a pre-tax profit of 800 billion VND, triple the 2024 performance. The planned total asset size is 25,000 billion VND, up 56% from the end of 2024. Return on average equity is targeted at 10%, and the capital adequacy ratio is expected to exceed 180%.

Additionally, Kafi Securities proposed to get listed on UPCoM in 2025.

Aiming for a new business record, DNSE Securities Joint Stock Company (DSE) targets total revenue of 849 billion VND and post-tax profit of 262 billion VND in 2025, representing increases of over 2.4% and 44%, respectively, compared to 2024. If this business plan is achieved, it will be the most profitable year in DNSE’s operating history.

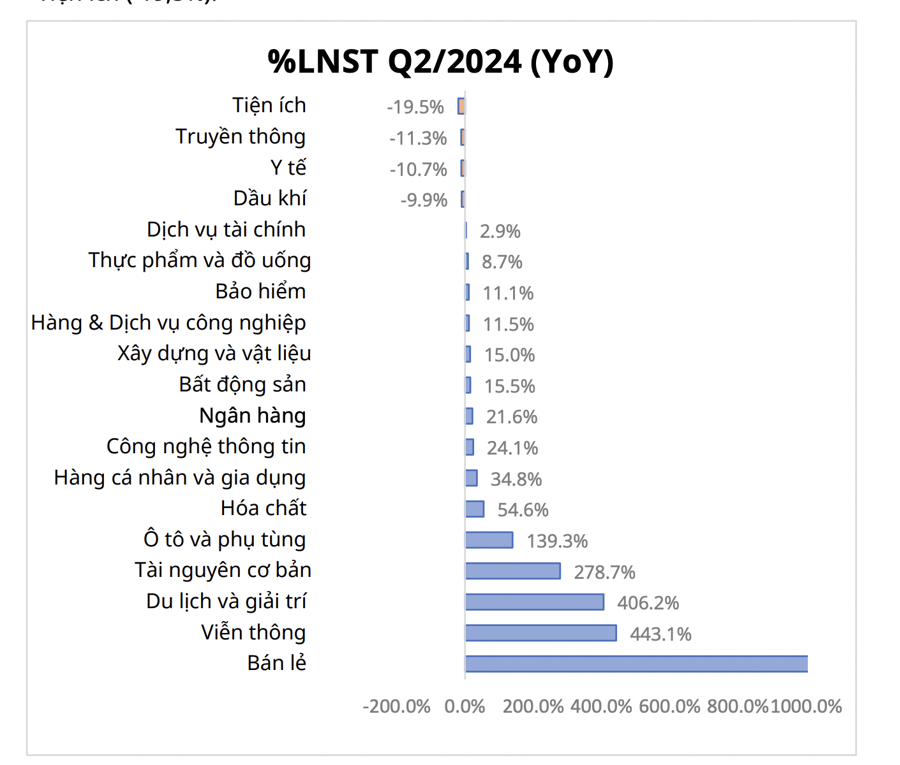

Assessing the prospects of Vietnam’s economy and stock market in 2025, DNSE’s BOD stated that the Vietnamese stock market has several positive supporting factors, including the recovery of the corporate bond market, improved liquidity after a 23% increase in 2024, and low-interest rates attracting capital from savings to securities, as evidenced by the peak margin debt of 180 trillion VND.

Additionally, there are macro factors such as expected positive GDP growth, stable inflation, monetary and fiscal policies continuing to support growth, potential for an upgrade to emerging market status by FTSE Russell, which would attract more foreign capital, and the new KRX trading system, which is expected to improve liquidity.

Meanwhile, ACB Securities (ACBS) targets 1,350 billion VND in pre-tax profit for 2025, about a 60% increase from 2024. The planned total asset size as of December 31, 2025, is nearly 32,900 billion VND.

On March 12, the Board of Managers of Maybank Securities Company Limited (MBKE) approved the 2025 budget and business plan.

Accordingly, the company sets a revenue target of over 1,136 billion VND, a 39% increase from 2024. The two largest sources of revenue are interest income from loans and receivables, expected at nearly 699 billion VND (up 48%), and securities brokerage revenue of over 317 billion VND (up 46%).

Total expenses are projected at nearly 714 billion VND, a 31% increase. Thus, the company expects a pre-tax profit of over 422 billion VND in 2025, a 55% increase and the highest in its operating history.