In his latest letter to investors, Petri Deryng, the head of Finnish-based PYN Elite Fund, highlighted Vietnam as a bright spot in the midst of a volatile global financial market. With a clear focus on attractive, low-valuation investment potential, Vietnam stands out with its robust economic growth and stable political environment.

Alongside the long-term prospects, Deryng pointed out some short-term tactical considerations for investment decisions. Firstly, the trade protectionism and tariff policies of the Trump administration towards Vietnam, expected to be announced in early April 2025, are drawing attention. A trade agreement with the US could reverse the foreign investor net-selling trend in Vietnam’s stock market, providing a significant boost.

Additionally, a potential announcement from FTSE Russell on their progress in reviewing Vietnam’s market classification is anticipated in early April. The implementation of the new KRX trading platform in Vietnam, expected in early May, should enhance transparency and efficiency, further boosting investor confidence. April will also see the release of Q1 earnings reports, providing investors with insights into the growth potential of listed companies.

Deryng also noted some interesting aspects of the recent tech stock sell-off in the US. Specifically, the sharp decline in US markets did not trigger a similar downward trend globally. Instead, there has been a shift in capital towards Asian and European markets. Notably, the US dollar, which typically strengthens during financial market turmoil, has weakened against other major currencies in recent months.

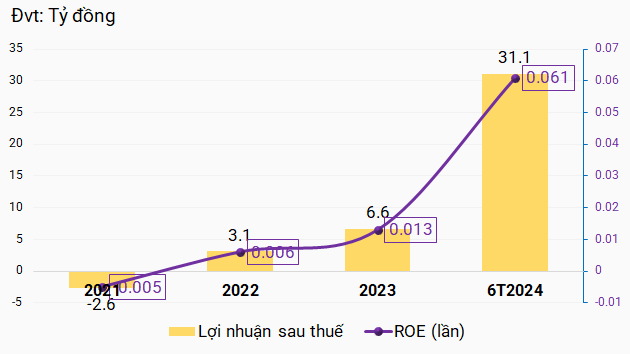

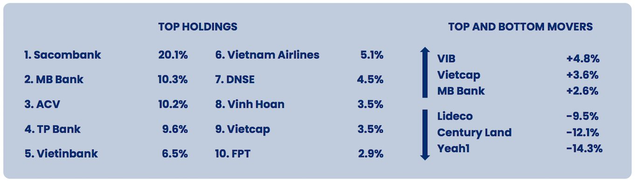

Regarding PYN Elite Fund’s performance, the fund modestly gained 0.1% in January 2025, outperforming the 0.14% decline of the VN-Index. The fund’s portfolio size stood at EUR 820 million (approximately VND 21,550 billion) at the end of January. Among the top 10 investments, bank stocks dominated with 4 out of 5 names in the top 5: STB, MBB, TPB, and CTG.

PYN Elite Fund’s portfolio holdings as of the end of January 2025

Streamlining Red Tape: The Prime Minister’s Pledge for Limitless Reform

Prime Minister Pham Minh Chinh concluded the meeting of the Steering Committee for Science, Technology, and Innovation, Digital Transformation, and Scheme 06, emphasizing the need to accelerate national digitalization and develop a comprehensive digital citizen. He instructed an unlimited drive to cut and simplify administrative procedures, urging to do as much as possible. The Prime Minister also called for a decisive shift in mindset, from passively receiving and processing administrative procedures to proactively serving the people and businesses.

Unlocking Affordable Housing: 3 New Projects Eligible for the VND 120,000 Billion Loan Package

The Binh Dinh province welcomes three new social housing projects, all of which meet the criteria to benefit from the VND 120,000 billion credit program. With a combined loan requirement of over VND 800 billion, these projects are set to make a significant impact on the region’s affordable housing landscape.