The VNIndex has been on a remarkable upward trajectory since late January, experiencing consecutive weeks of gains. Domestic investment flows have returned, with liquidity consistently improving since the beginning of March, and some trading sessions even witnessing market-wide liquidity surpassing 20,000 billion VND. For investors with a higher risk appetite, the current market conditions present an opportunity to leverage and optimize profits.

Accompanying investors on their leverage journey, Pinetree Securities announces an interest-free margin lending policy for the first 30 days for all new margin customers or existing customers who have not incurred debt in the past six months. Starting March 17, 2025, customers will not incur any margin lending interest for 30 days (P-Zero package) from the date of disbursement. Coupled with the lifetime zero-fee trading policy, this essentially means that investors can borrow funds at no cost during this period.

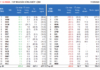

Additionally, customers have the option to choose the P-5.9% package, offering a discounted interest rate of 5.9% for margin lending up to 90 days. Selecting these promotional packages is quick and easy through the AlphaTrading trading application or Web Trading.

After the promotional periods, the margin lending interest rate is fixed at a competitive 9.9%/year. For more details on the promotional policy, please refer to this link.

Registration screen under the “Utilities” section of AlphaTrading

Pinetree is known for its strong focus on technology and digital product development, coupled with highly competitive fee policies. Earlier in March, the company announced a three-month free derivatives trading promotion for new account openings. For details on this promotion, please refer to this link.

Free derivatives trading for 30 days from the date of new account opening

Take advantage of the promotional fees for derivatives and margin trading, all within a single account. Open an account now by clicking here.

‘Money Flow into the Market is Not Fast Enough to Stimulate Growth’

“Domestic consumption and investment incentives currently contribute over 90% to GDP growth. With exports facing challenges, it is imperative to find solutions to stimulate and unleash these two drivers. However, as Dr. Can Van Luc, a renowned economist, points out, there is a prevailing issue of increasing money supply but slow velocity of money circulation. This results in a lag in the infusion of money into the market, hindering the desired growth trajectory.”

The Next Big Thing: Long An’s $10 Billion Mega-Project Unveiled

The southern province of Long An is set to welcome a new mixed-use residential and commercial project, Thanh Phu, spanning 85 hectares and boasting a total investment of VND 10,662 billion.