According to SSI Research’s analysis, the VNDiamond index is expected to undergo significant changes in its constituents, while the VN30 index will only update data and recalculate weights. Notably, the HOSE Index Ground Rules version 4.0 has come into effect, which will strongly impact the weight structure of VN30.

VNDiamond basket adds CTD, removes VRE?

For the VNDiamond basket, based on estimates as of March 14, SSI Research predicts that MWG will be included with a weight limit coefficient increased from 50% to 100%. At the same time, CTD is expected to be added to the basket for the first time with a weight limit coefficient of 50%.

VIB is at risk of being placed on the deletion watchlist after the bank reduced the maximum foreign ownership ratio from 20.5% to 4.99% from July 1, 2024, causing the FOL coefficient to fall below 65%. Under the new rules, VIB will be subject to a 50% weight reduction and may be completely removed in the next period if it fails to improve its FOL.

VRE is expected to be removed from the index as it does not meet the FOL condition, having failed to be in the Top 25 stocks with the highest FOL coefficients for the second consecutive time.

With these changes, the new VNDiamond portfolio will consist of 19 stocks, including 10 banking stocks that will be limited to a maximum weight of 40% for the group.

Currently, there are five ETFs using VNDiamond as a reference, with a total net asset value of approximately VND 12,400 billion as of March 14. The largest of these is the DCVFMVN Diamond fund, with a total asset value of approximately VND 11,800 billion, despite a 6.6% decline since the beginning of 2025 and a net capital withdrawal value of VND 418 billion.

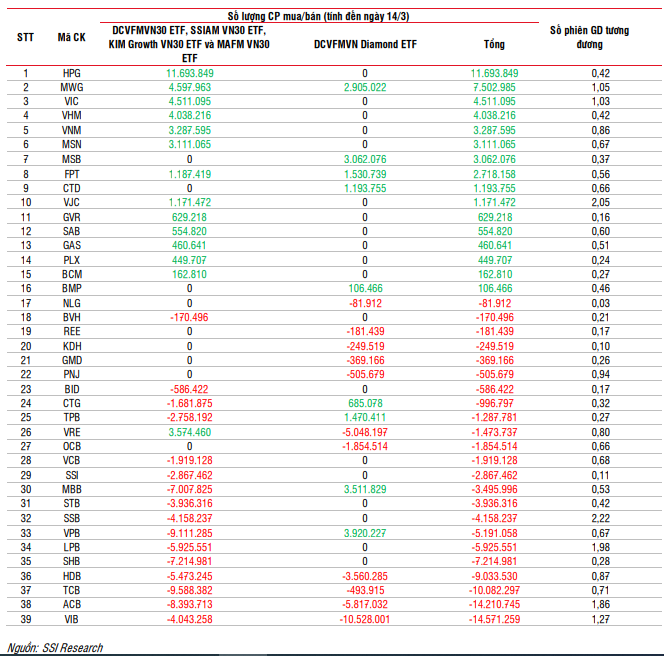

SSI Research estimates that DCVFMVN Diamond will buy 2.9 million MWG shares and 1.1 million CTD shares, 3.9 million VPB shares, 3.5 million MBB shares, and 3 million MSB shares. On the other hand, the fund may sell about 5 million VRE shares, 10.5 million VIB shares, 5.8 million ACB shares, and 3.5 million HDB shares.

Will the VN30 funds sell bank stocks heavily?

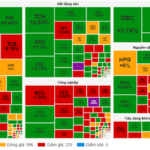

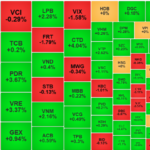

Regarding the VN30 index, the application of the new rule limiting the capitalization weight of a group of stocks in the same industry to 40% will reduce the weight of the financial group from 60% to 40%, leading to an increase in the weight of other industries. This regulation aims to ensure balance and prevent a single industry from dominating the index basket.

Among the ETFs in the market, there are currently four funds that use the VN30 index as a reference, including DCVFMVN30 ETF, SSIAM VN30 ETF, KIM Growth VN30 ETF, and MAFM VN30 ETF, with a total net asset value of approximately VND 9,100 billion as of March 14.

The DCVFMVN30 ETF currently has a total asset value of VND 6,200 billion. Specifically, since the beginning of 2025, the fund’s total assets have decreased by 7.4%, NAV has increased by 3%, and the net capital withdrawal value is VND 683 billion.

It is estimated that the funds will buy heavily into 11.6 million HPG shares, 4.5 million MWG shares, and 4.5 million VIC shares. On the selling side, the funds may sell 9.5 million TCB shares, 9.1 million VPB shares, and 8.3 million ACB shares.

Estimated buying and selling of funds tracking VNDiamond and VN30

Thus, on the buying side, the ETFs tracking the VNDiamond and VN30 indices will accumulate the most in HPG (11.7 million shares), MWG (7.5 million shares), VIC (4.5 million shares), VHM (4 million shares), and MSN (3.1 million shares).

On the selling side, VIB tops the list with a net selling volume of up to 14.6 million shares. Selling pressure is also high on bank stocks, with TCB (-10.1 million shares), ACB (-9 million shares), VPB (-5.2 million shares), and LPB (-5.9 million shares). In addition, VRE is also under significant selling pressure, with 5.5 million shares, mainly from the DCVFMVN Diamond ETF.

– 11:28 19/03/2025

VNM ETF: New Buy on NAB, VCB Stock Soars

For the period of March 10–17, 2025, the VanEck Vectors Vietnam ETF (VNM ETF) witnessed minimal fluctuations in its portfolio. Only two stocks experienced upward movement, including NAB, which was added to the portfolio following the first quarterly review of 2025 for the MarketVector Vietnam Local Index, the reference index for the VNM ETF.

“CEO of VanEck Shares Insights on Developing the Digital Asset Market, Proposes a Bitcoin Fund with SSI”

On March 17, 2025, VanEck Asset Management’s CEO, Jan van Eck, met with Permanent Vice Minister, Nguyen Minh Vu, at the Ministry of Foreign Affairs. The meeting marked a significant step forward in the transfer of international expertise and the development orientation of the digital asset market in Vietnam.

Market Beat 27/02: Stocks, Steel and Real Estate Surge to Keep VN-Index Above 1,300

The VN-Index took investors on a wild ride as it breached the 1,300-point threshold in the early afternoon session, only to swiftly rebound and close at 1,307.8 points, a gain of 4.84 points. This dramatic turnaround came after a pressured morning session that saw the index hovering just above the 1,300 mark.

Market Beat: Effort Rewarded, VN-Index Closes Above 1,270

The VN-Index extended its recovery efforts from the latter half of the morning session into the afternoon, posting a gain of 3.44 points to close at 1,270.35 on February 13. This came despite a notable corrective phase just before 2 pm. The HNX-Index and UPCoM also ended the session in positive territory, with the former climbing 0.2 points to 229.52 and the latter advancing 0.93 points to 97.74.

The Cash Flows into Mid and Small-Cap Stocks

Although the VN-Index closed today with a modest gain of 0.39%, nearly a hundred stocks outperformed, rising over 1% against their reference prices. The large-cap VN30 basket contributed only 6 tickers to this group, with the remainder being mid and small-cap stocks. Notably, several of these high-performing stocks also featured among the market’s leaders in terms of liquidity.