|

Stock Changes in VNM ETF during the 10-17/03 Period

|

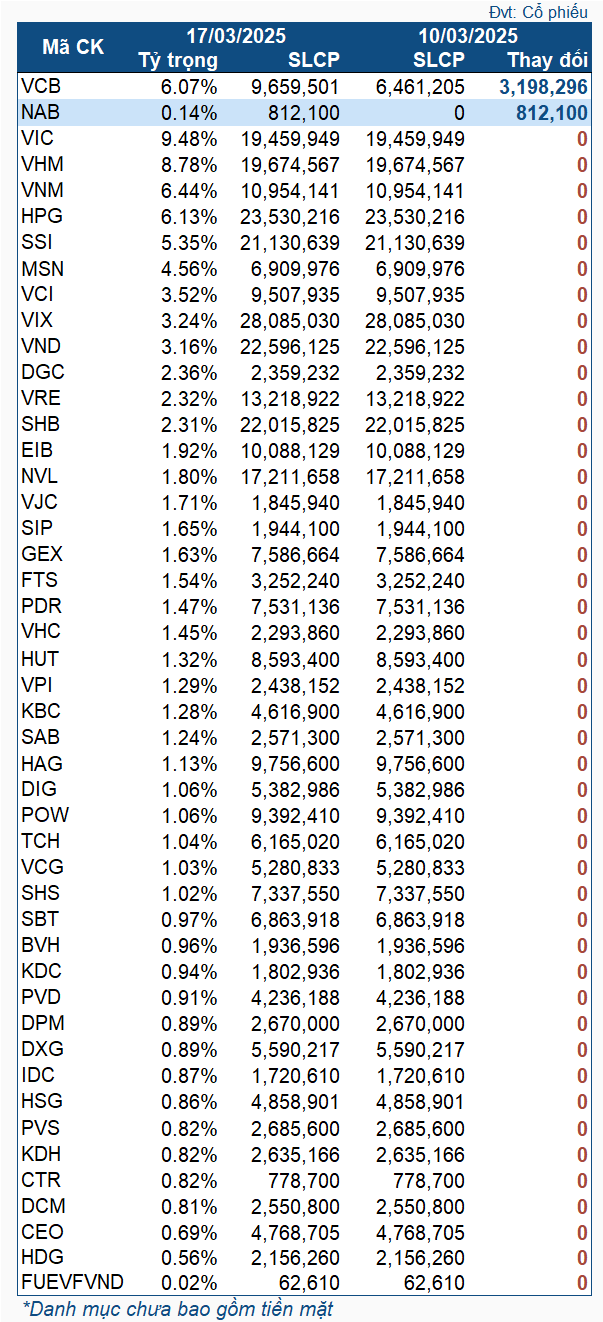

During this period, VCB witnessed the most significant increase, with an additional 3.2 million shares. However, this surge did not result from net purchases by the Fund but was due to VCB paying dividends in shares at a ratio of 1000:495 (49.5%, meaning that shareholders holding 1,000 shares received 495 new shares).

Additionally, the Fund purchased over 812,000 new shares of NAB. It is worth noting that NAB was the only newly added stock in the first quarter of 2025’s review of the MarketVector Vietnam Local Index – the reference index for VNM ETF (announced on the morning of March 15, effective after the March 21 session). It is predicted that the Fund may add nearly 8.6 million more NAB shares, leading to active buying of this stock in the next phase.

According to the review results, the Fund is expected to buy large quantities of HPG and sell substantial amounts of VIC and VHM in terms of value. However, these stocks remained unchanged during the period.

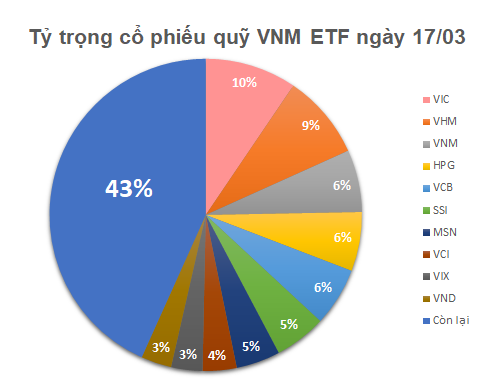

As of March 17, the total asset value of VNM ETF reached nearly 421 million USD, a notable increase from the 408 million USD recorded on March 10. These assets are allocated across 46 stocks and one fund certificate. The top weights belong to VIC (9.48%), VHM (8.78%), VNM (6.44%), HPG (6.13%), and VCB (6.07%).

– 11:08 19/03/2025

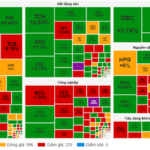

Market Beat: Green Dominance, VN-Index Nears 1,270 Points

The market ended the session on a positive note, with the VN-Index climbing 4.93 points (0.39%) to reach 1,269.61; the HNX-Index also rose, by 1.37 points (0.6%), closing at 227.98. The market breadth tilted slightly in favor of the bulls, with 451 gainers against 255 decliners. The VN30 basket saw a relatively balanced performance, with 15 gainers, 14 losers, and 1 stock finishing unchanged.

Market Beat on Feb 24th: VN-Index Surges Past 1,300 Points as Trading Volume Improves

The market closed with strong gains, as the VN-Index rose by 7.81 points (+0.6%), finishing at 1,304.56; while the HNX-Index climbed 0.92 points (+0.39%) to close at 238.49. The market breadth was relatively balanced, with 377 gainers and 373 losers. The large-cap stocks in the VN30 basket painted a positive picture, as 21 stocks advanced, 6 declined, and 3 remained unchanged, tilting the basket towards a green close.

Market Beat: Caution Creeps In at the 1,300-Point Threshold

The market closed with the VN-Index down 0.2 points (-0.02%), settling at 1,302.96, while the HNX-Index gained 0.29 points (+0.12%), closing at 238.6. The market breadth tilted slightly in favor of advancers, with 411 gainers against 365 decliners. However, the large-cap stocks in the VN30 basket witnessed a dominance of red, as 18 stocks fell, 10 advanced, and 2 remained unchanged.

Market Beat 27/02: Stocks, Steel and Real Estate Surge to Keep VN-Index Above 1,300

The VN-Index took investors on a wild ride as it breached the 1,300-point threshold in the early afternoon session, only to swiftly rebound and close at 1,307.8 points, a gain of 4.84 points. This dramatic turnaround came after a pressured morning session that saw the index hovering just above the 1,300 mark.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)