Bui Cao Nhat Quan, son of Bui Thanh Nhon, Chairman of the Board of Directors of Novaland Group (NVL), has recently registered to sell 2.92 million NVL shares for personal reasons.

The transaction will be executed through matching and/or agreement from March 21 to April 18. If completed, Bui Cao Nhat Quan is expected to reduce his ownership in Novaland from 78.24 million units (4.012%) to 75.3 million units, equivalent to 3.862% of the group’s charter capital.

Chairman Bui Thanh Nhon

Bui Cao Nhat Quan, born in 1982, is the son of Bui Thanh Nhon, Chairman of the Board of Directors of Novaland. Quan previously served as Vice Chairman of the Board of Directors and Vice General Director of Novaland but resigned from both positions in May 2017.

As of the end of 2024, Chairman Bui Thanh Nhon owned 96.76 million NVL shares, or 4.962% of the capital. His wife, Cao Thi Ngoc Suong, held 50.75 million shares, or 2.6%.

Both children of the chairman also hold shares in Novaland. The daughter, Bui Cao Ngoc Quynh, holds 15.56 million units, or 0.798% of the capital.

In addition, the chairman’s sister, Bui Thi Le Thu, holds 15,007 shares, or 0.001% of the capital. Some other individuals hold insignificant amounts of shares.

No other family member of Bui Thanh Nhon holds any position at Novaland.

In addition to individuals, some organizations related to Bui Thanh Nhon also hold shares in Novaland. Specifically, Novagroup Joint Stock Company, where Bui Thanh Nhon is Chairman of the Board of Directors, holds 343.8 million shares, or 17.63% of the capital.

Another company chaired by Bui Thanh Nhon, Diamond Properties Joint Stock Company, holds 168.6 million shares, or 8.65% of the capital.

Thus, as of the end of 2024, the family of Chairman Bui Thanh Nhon and related organizations hold a total of 38.653% of NVL capital. As of 2:30 pm on March 18, NVL shares stood at VND 10,800/share, valuing the group’s stake at approximately VND 8,140 billion.

At its peak in 2021, the Nhon family and related organizations held a controlling stake in Novaland with over 61.4% of the capital. Chairman Bui Thanh Nhon was also included in the Forbes list of USD billionaires with a net worth of over VND 100,000 billion.

Along with the sharp decline in NVL share price, Mr. Nhon dropped off the Forbes billionaire list at the end of 2022.

In addition to the drop in NVL share price over the past two years, Mr. Bui Thanh Nhon’s wealth also decreased due to forced and voluntary sales of shares by related shareholders to settle Novaland’s debts.

In terms of business results, Novaland recorded net revenue of VND 9,073 billion in 2024, up nearly 91% compared to 2023. However, due to the increase in cost of goods sold and the decrease in gross profit margin, Novaland reported a loss after tax of VND 4,351 billion, far below the profit of VND 486 billion in 2023.

In another development, Novaland recently announced that March 25 is the record date for the annual general meeting of shareholders for the fiscal year 2025. The meeting is expected to be held on April 24. The venue and agenda will be announced later.

The Heir Apparent’s New Move

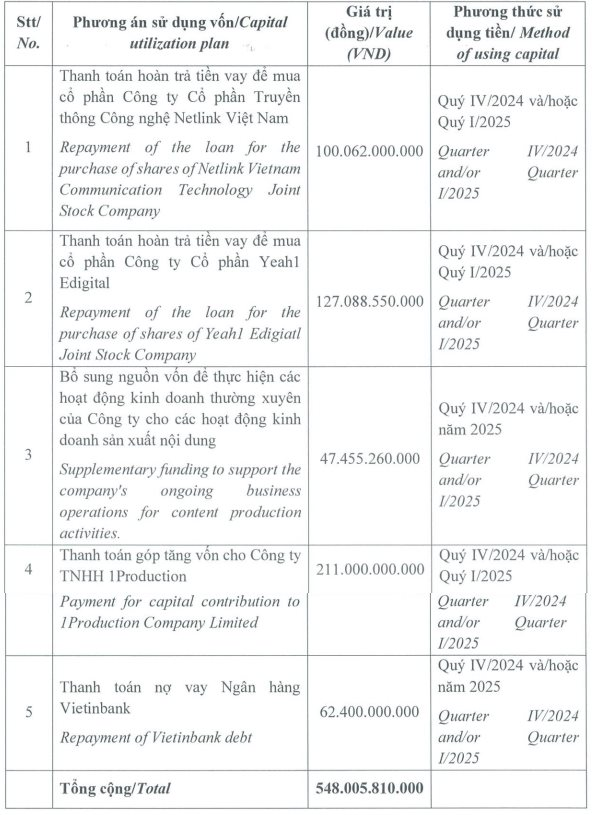

“In a recent development, Bui Cao Nhat Quan, the son of Novaland’s Chairman Bui Thanh Nhon, has registered to sell over 2.9 million NVL shares for personal reasons. This news comes as Novaland faces the task of repaying two bond batches, totaling over VND 1,200 billion in principal and interest. As the company navigates these financial obligations, the sale of a significant number of shares by a key insider has sparked interest within the investment community.”

Unleashing the Potential: NVL Skyrockets as Obstacles Cleared for Ben Van Don Project

The shares of No Va Real Estate Investment Group (Novaland, HOSE: NVL) soared to the ceiling during the February 20th session, following the National Assembly’s issuance of a resolution on special mechanisms to address obstacles at the project located at 39-39B Ben Van Don, Ward 12, District 4, Ho Chi Minh City.

The Ultimate Real Estate Venture: Novaland’s $470 Million Prime Project in Thu Duc City Gets Greenlit After Four Years

The project’s new owner boasts an impressive business with a former VPBank member at its helm. In a surprising turn of events, the company has reported substantial profits, but its debt consumes a staggering 93% of its total assets. This revelation raises questions and intrigue, leaving us wanting to know more about this intriguing business venture and its future prospects.

Unblocking the Years-Long Stalled Project: Real Estate Giants Novaland, Dat Xanh, Hoang Quan, Nam Bay Bay and More Are Back with a Bang

Aqua City, Gem Riverside and NBB Garden III have been stagnant for years, but now there’s a glimmer of hope as legal hurdles are finally being cleared. Could this be the breakthrough these real estate giants have been waiting for?