After eight consecutive weeks of gains, the Vietnamese stock market faced corrective pressure in the last two trading sessions. Overall, the VN-Index dropped nearly 12 points to 1,324.63 points, although the upward trend remains intact, investor sentiment is wavering. So, has the market become attractively valued?

At the program “Vietnam and the Indices: Financial Prosperity,” Mr. Tran Hoang Son, Market Strategy Director of VPBank Securities Company (VPBankS), opined that whether a stock is expensive or cheap depends on individual stocks and their growth rates.

Considering the overall market, a P/E ratio above 15 times indicates expensive valuations, while a single-digit multiple below 10 suggests a bargain.

“The VN-Index’s current P/E is around 14 times, and for constituent stocks with lower valuations and profit growth rates of about 20-25%, a P/E of about 10 times could be reasonable for buying,” said the expert.

According to Mr. Hoang Son, valuations can fluctuate with market trends, price movements, and earnings dynamics, including expected profits. Therefore, investors can utilize both P/E and forward P/E (based on profit forecasts). Additionally, one can refer to the market’s average P/E and industry-specific P/E to assess a stock’s relative valuation.

Prioritize ‘Leading’ Stocks

Regarding penny stocks, the VPBankS expert noted that new market entrants or speculative investors often favor low-priced stocks, anticipating higher returns than average.

However, this approach contradicts the fundamental investment principle. When a significant market uptrend occurs, leading stocks in their respective sectors will surge first and strongly. Subsequently, speculative stocks with low prices and liquidity follow suit.

Investors should consider shifting away from low-priced stocks due to the risk of substantial volatility. When the market dips by 1%, these stocks can plummet by 5-7%, but they may not rise proportionately when the market rallies by 3-5%.

“During a bull market, the focus is typically on leading stocks within their sectors. Hence, it’s advisable to invest in sectors with high liquidity. When the tide rises, all boats float, so concentrate your portfolio on sectors and the best-performing stocks within those sectors,” the expert shared.

What’s Happening with FPT Stock?

Offering his take on FPT stock, the VPBankS specialist noted that in recent years, FPT’s share price movement, particularly Vietnamese tech stocks, has closely mirrored the trend of US tech stocks, specifically the Magnificent 7 group (including Apple Inc., Microsoft Corp., Nvidia Corp., Amazon.com Inc., Tesla Inc., Alphabet, and Meta), led by Nvidia.

FPT stock has soared in the last two years, climbing nearly 50% since the beginning of 2023. However, towards the end of 2024 and early 2025, the narrative surrounding DeepSeek and, more importantly, the lofty valuations of tech stocks in the US and Vietnam triggered substantial profit-taking.

Recently, Nvidia and the Magnificent 7 stocks have dipped below their 200-day moving averages (MA200). As of the close on March 19, FPT traded at VND 124,600 per share, slipping below its MA200 after a prolonged uptrend.

Compared to its peak last year, FPT has shed over 19% of its value. Consequently, the company’s market capitalization contracted by nearly VND 44,000 billion, falling to approximately VND 183,000 billion, and it is no longer the largest private enterprise on the stock exchange.

The VPBankS expert attributed this trend to two factors: stretched valuations after a period of rapid growth (with P/E nearing 30 times and P/B approaching 7.5 times) and foreign investors reducing their holdings following the heated rally.

Given the selling pressure from foreign investors, Mr. Son predicted that FPT’s downward trajectory could persist in the short term, and investors should monitor critical support levels, such as VND 120,000 per share.

Market Beat: Large-Cap Stocks’ Resilience Keeps the Market Afloat

The trading session on March 20th was an emotional rollercoaster, starting with a thrilling surge in the opening minutes, only to plummet and trade in the red for the remainder of the day. The efforts of the large-cap stocks group mitigated the losses, resulting in a mild decline for the market.

The Ultimate Headline: “The Looming Threat of Market Correction: Navigating the Storm”

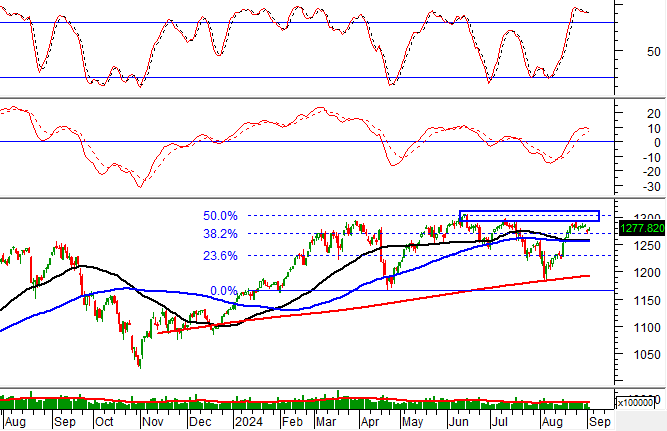

The VN-Index witnessed another day of decline with trading volume below the 20-day average. This indicates a heightened sense of caution among investors as the index approaches the old peak of June 2024 (1,290-1,310 points). Currently, the Stochastic Oscillator indicates a sell signal, departing from the overbought region. Similarly, the MACD indicator also suggests a sell signal. Investors are advised to exercise prudence in their investment decisions if the corrective phase persists.

The Market Beat – 28/02: Foreigners’ Robust Sell-off Continues in the Final Trading Session of February

The market closed with slight losses, as the VN-Index dipped by 2.44 points (-0.19%) to end the day at 1,305.36. Similarly, the HNX-Index edged lower by 0.2 points (-0.08%), finishing at 239.19. The market breadth tilted towards decliners, with 408 tickers in the red versus 390 in the green. The large-cap segment mirrored this sentiment, as reflected in the VN30 basket, where 18 stocks retreated, seven advanced, and five remained unchanged.

The Market Beat, February 18th: A Sea of Green, With a Hint of Differentiation

The VN-Index managed to stay in the green at the end of a volatile and tug-of-war afternoon session. While the market opened with a broad rally, it turned slightly “redder” as the session drew to a close.