Latest update: Hung Thinh Group JSC reported selling 6 million VTR shares of Vietnam Tourism and Transport Marketing Joint Stock Company (Vietravel). Following this transaction, Hung Thinh Group’s ownership decreased from 20.94% to 0%, and they no longer hold any shares in Vietravel. The transaction took place on March 13.

On the same day, Vietravel recorded an individual named Nguyen Thuy Tien reporting the purchase of 6 million shares. This individual is described as holding no position in the company and having no relationship with individuals or organizations related to Vietravel.

During the March 13 session, the market recorded a matching volume of 6 million shares in negotiated trading, with a value of VND 168 billion. The average price was VND 28,000/share, 25% higher than VTR’s closing price on the same day. Currently, VTR’s market price has recovered to VND 22,500/share as of the March 19 closing.

After the transaction, Ms. Nguyen Thuy Tien has replaced Hung Thinh Group as the largest shareholder of Vietravel, with an ownership ratio of 20.94%. This ratio is higher than that of Chairman of the Board Nguyen Quoc Ky (10.98%), Vietravel Group (14.28%), and VinaCapital (10%).

It is known that the relationship between Hung Thinh Group and Vietravel began in November 2021 when Vietravel borrowed VND 168 billion from Hung Thinh with an interest rate of 11.5% per annum and a term of 6 months. The collateral for this loan was the 6 million VTR shares. In February 2023, Vietravel completed the private placement of 6 million shares to convert this debt. The issuance price was set at VND 28,000 per share, with a condition of restricted transfer within one year.

Issuing nearly 29 million shares to existing shareholders

In a related development, Vietravel has sent a written request to the State Securities Commission and the Hanoi Stock Exchange regarding the termination of its subsidiary’s operations.

Accordingly, on January 10, 2025, Vietravel received a notice from the Ho Chi Minh City Department of Planning and Investment about the termination of the operation of Vietravel Investment and Development One-Member Limited Liability Company (Vietravel Invest).

The reason given for the dissolution was the impact of the Covid-19 pandemic, which led to a change in orientation and the need for restructuring.

In addition, the Board of Directors of Vietravel issued Resolution No. 460-NQ/HĐQT-VP, approving the implementation of the plan to offer shares to the public, the plan for capital use from the offering, and the plan to ensure that the offering of shares complies with regulations on foreign ownership ratio.

Vietravel plans to issue nearly 28.66 million shares to existing shareholders at a ratio of 1:1 (for every share owned, shareholders will receive one right, and for every right, they can buy one new share) at an offering price of VND 12,000 per share.

The total expected capital mobilization is nearly VND 344 billion. The offering is expected to take place in the first and second quarters of 2025, after obtaining the certificate of registration for public offering of securities from the State Securities Commission.

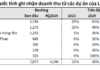

The entire amount of money expected to be raised from the offering will be used to repay the company’s debt; specifically, it will be used to repay loans to 4 banks, including: Vietinbank Branch 7 (VND 138 billion), BIDV Transaction Office 2 (VND 113 billion), TPBank (nearly VND 50 billion), and MBBank Transaction Office 2 (nearly VND 43 billion).

The debt repayment will be prioritized based on the order of maturity, with debts that are due earlier being repaid first.

The Billion-Dollar Group That Invested in Vinamilk and THACO Gets Greenlit for a Public Offer to Acquire REE at a Premium Above Historical Peaks

In 2023, JC&C achieved an impressive revenue of over $22.2 billion, marking a 3% growth compared to the previous year.

A Visionary Urban Expansion: Hưng Thịnh Proposes Two New Master-Planned Communities in Khánh Hòa, Spanning Over 940 Hectares

The People’s Committee of Khanh Hoa Province has proposed two new urban development projects in Ninh Hoa town and Nha Trang city. The proposal was directed to the Department of Planning and Investment, the Van Phong Economic Zone Management Board, and the Hung Thinh Group, showcasing the province’s commitment to fostering economic growth and urban expansion.