The U.S. Securities and Exchange Commission (SEC) has taken a significant step by dropping its lawsuit against Coinbase, the largest cryptocurrency exchange in the country. This move signals a shift in regulatory approach under the Trump administration, as the SEC withdraws its legal battle against the crypto giant.

|

The digital currency, Bitcoin. (Photo: Fortune/ VNA)

|

The SEC’s lawsuit, filed in 2023, accused Coinbase of violating its regulations and facilitating trading for at least 13 types of digital currencies that the SEC considered unregistered securities. Last week, Coinbase revealed the SEC’s plans to drop the lawsuit.

Coinbase’s defense argued that cryptocurrencies, unlike stocks and bonds, do not constitute an “investment contract,” a stance shared by most companies in the digital asset industry.

According to a case heard by the U.S. Supreme Court, an investment product is deemed a security if it meets the condition of people collectively investing in a common enterprise with a profit expectation.

The SEC also took issue with Coinbase’s “staking” program, where customers deposit their digital currencies with the exchange. Coinbase would then pool these assets and use them for transaction validation on blockchain networks. In return for successful validation, Coinbase received rewards, kept a portion as a commission, and distributed the rest to customers participating in the “staking” program. The SEC asserted that this program required registration with the agency.

Additionally, the SEC filed a lawsuit against Coinbase’s rival, Binance, in 2023. That case was temporarily halted by a court following a joint request, citing reasons related to the SEC’s new task force on digital currencies, established shortly after Trump took office last month.

Republican officials at the SEC have swiftly begun altering the agency’s policies on digital currencies, even before Paul Atkins, Trump’s pick to chair the SEC due to his crypto-friendly stance, officially takes office.

The re-evaluation of lawsuits against digital currency companies, particularly those that violated SEC regulations but were not accused of investor fraud, aligns with expectations held by many.

Khanh Ly

– 12:50 28/02/2025

The Crypto-Husband: Chasing the Dream, Losing a Fortune

My husband dabbled in a few different cryptocurrencies, but they were all obscure and potentially fraudulent. To sell these cryptocurrencies, he had to invest real money into the system. Time and time again, he was scammed out of hundreds of thousands of dollars, yet he remained convinced that he could strike it rich with these digital assets.

The Crypto Conundrum: Virtual Money, Real Losses

In recent times, a myriad of new scams has emerged, preying on the greed and ignorance of unsuspecting individuals. These scams lure people into investing and trading various forms of virtual currencies with promises of hefty future profits. However, blinded by these enticing promises, investors often overlook the inherent risks, ultimately losing their hard-earned money on worthless virtual “assets.”

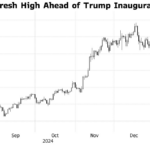

The Rise of Bitcoin: Cryptocurrency Soars Past $109,000 to Reach New Heights Ahead of Trump’s Inauguration

“The world’s largest cryptocurrency, Bitcoin, soared to a new all-time high as the United States prepared for Donald Trump’s second presidential inauguration.”

What are Meme Coins and Why are They Taking the Crypto World by Storm?

In the ever-evolving world of cryptocurrencies, meme coins have emerged as one of the hottest trends, capturing the imagination of global investors and attracting hundreds of millions of enthusiasts. But what exactly are meme coins, and why have they become such a phenomenon in the digital asset space?