Vietnam’s real estate prices have soared, according to a report by the Vietnam Association of Realtors (VARS). This means that if you don’t start planning your finances soon, the dream of owning a home will become increasingly out of reach.

Buying a home: A matter for “adults” or for yourself?

In the past, buying a home was often seen as something for those who were older, had a stable career, or had substantial financial means or a wealthy family background. However, for Gen Z, a generation that embraces exploration, challenges, and early financial literacy, owning their first home is not just about reaching a milestone but also about making a smart investment. This is especially true given that real estate is considered a profitable investment channel with good growth potential.

But how can Gen Z buy a home when their financial resources are limited? According to a survey by Batdongsan.com.vn, more than 70% of young people struggle to save enough money to buy a home, especially in large cities. For example, in Ho Chi Minh City, with an average income of about 15 million VND per month, it would take a young person 20-30 years of frugal saving to afford a 60m² apartment worth 3 billion VND, and that’s without accounting for rising property prices.

Moreover, Gen Z is a generation that values experiences and entrepreneurial ventures, making it even more challenging to set aside a substantial sum each month for a home purchase. So, is there a way for young people to own a home while maintaining financial flexibility? The answer lies in smart financial solutions that enable Gen Z to turn their homeownership dreams into reality without having to wait until they’ve saved up 100% of the property’s value.

Making homeownership a reality with flexible financial solutions

Tan Phat, a 28-year-old graphic designer, also grappled with the idea of buying a home. With a monthly income of 25 million VND and occasional project-based bonuses, Phat could save over 10 million VND each month after covering his living expenses. Last year, he set his sights on a two-bedroom apartment in Thu Duc City, featuring a beautiful design and developed by a reputable company, priced at just over 2 billion VND. Phat planned to borrow 1 billion VND from his family, and with diligent saving, he estimated it would take him about ten years to own the apartment outright. However, as property prices in Ho Chi Minh City continued to rise, the apartment’s price increased to 2.5 billion VND at the beginning of this year. This sudden price hike left Phat worried about when he would be able to afford it. “Aside from the financial aspect, I noticed that desirable projects or apartments tend to sell out quickly. Buyers also intend to stay for the long term, so resale opportunities are rare,” Phat shared.

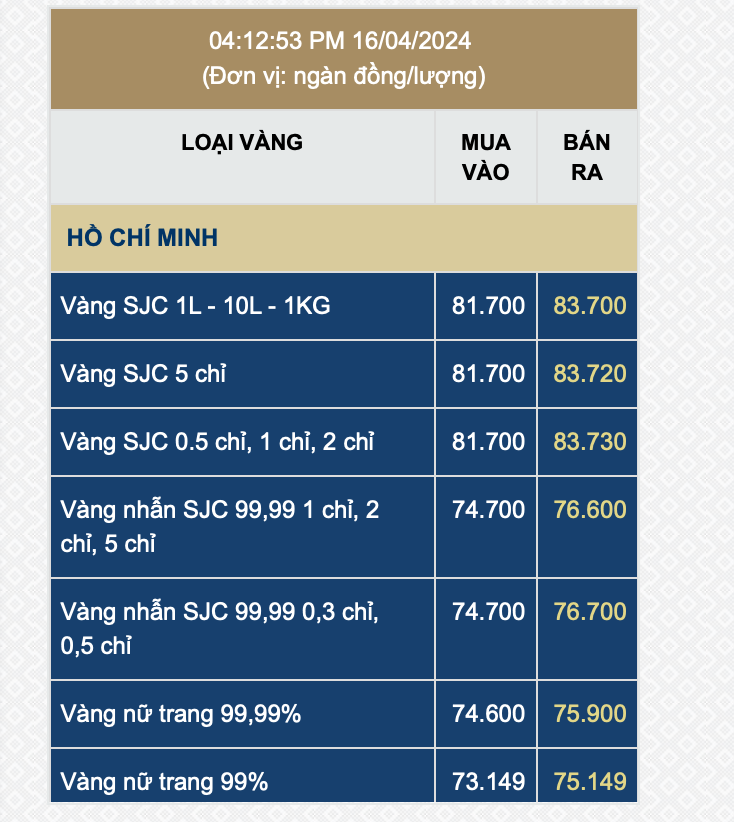

After much deliberation, he decided to explore home loan programs offered by banks. With current low-interest rates, some banks are offering home loans from as low as 6.5%/year. Phat calculated that if he took out an 800 million VND loan over 20 years, he would need to pay about 8 million VND per month for the first three years, covering both principal and interest. This amount wasn’t significantly higher than his planned monthly savings, and by owning his home, he would save on rental costs, leaving him with extra money to repay his family loan.

After consulting with the bank, Phat decided to proceed with the loan and made a deposit on his dream apartment. According to the bank’s lending policy, he only needed to pay a 30% down payment and could borrow up to 70% of the remaining value, with a flexible repayment schedule. With proper financial planning and spending, Phat could continue to make his mortgage payments while maintaining the quality of life he desired.

Now, the thought of returning to his own apartment every evening brings a smile to Phat’s face. “I’ve been paying rent for years, but now I’m paying for my own place. In two or three years, the value of my apartment might even increase,” he says proudly.

Banks partner with Gen Z to develop smart financial strategies

Understanding the aspirations and concerns of young people like Phat, Sacombank recently launched a 20,000 billion VND lending package for individual customers, offering home loan interest rates from as low as 6.5%/year and short-term business loan rates from 4%/year. This package not only aligns with the Vietnamese government’s initiative to support young people aged 18-35 in buying, building, or renovating homes but also offers a borrowing limit of up to 85%. It features flexible principal repayment options, allowing customers to pay as little as 10%-20% of the loan amount in the initial years, with a maximum grace period of five years and a repayment period of up to 30 years. This significantly reduces the financial burden on borrowers. In Phat’s case, if he took out a loan with Sacombank, his monthly payments would be as low as 4 million VND, leaving him with extra funds to furnish and decorate his new home. Additionally, customers who avail of this package will receive a bonus transaction account with a lucky number based on their phone number, date of birth, ID card, or anniversary date.

With flexible borrowing limits, simplified procedures, quick approval processes, and attractive interest rates, Sacombank is easing the financial burden on young homebuyers. The long repayment period and diverse payment options enable customers to create financial plans that align with their income and personal spending, empowering them to own their first home even without substantial savings.

For many young people, the decision to take out a loan to buy a home may seem daunting. However, with a clear financial plan and the right choices, owning a home before turning 30 is achievable. A home is not just a place to live but also a stepping stone to financial freedom and a more secure future. Ultimately, the question isn’t “When will I have enough money to buy a home?” but “How can I turn my dream of homeownership into a reality as soon as possible?” And with the right financial tools, the answer becomes much clearer.

The Art of the Flip: How “Insiders” Make a Quick Billion Off Land Auctions

“Following the auction results, numerous land lots in the auction area of Van Quan village, Do Dong commune (Thanh Oai district) have been resold at prices inflated by VND 200-500 million per lot, with some lots even advertised with a markup of VND 1 billion.”

The Conquest of the Coast: Gamuda Land’s New Venture in Hai Phong

Sharing the news with The Star in mid-January, Gamuda Land Vietnam’s Chairman, Angus Liew, revealed the company’s plans to invest 7.1 billion RM (equivalent to 40.7 trillion VND) in Vietnam over the next five years. The company aims for a gross development value of 14.3 billion RM (over 82 trillion VND).