On March 21, 2025, in Tien Giang, the State Bank of Vietnam (SBV) Branch of Region 13 organized a conference on “Promoting Bank Credit to Contribute to Economic Growth in Long An, Tien Giang, Ben Tre, and Tra Vinh Provinces.”

Speaking at the conference, Mr. Pham Minh Tu, Acting Director of SBV Branch of Region 13, said that as of now, there are 96 credit institutions operating in Long An, Tien Giang, Ben Tre, and Tra Vinh provinces with a network of 592 transaction offices. As of February 2025, the total outstanding loans of credit institutions in the region reached nearly VND 369,000 billion, up 1.4% compared to the end of 2024. This growth rate is significantly higher than the credit growth rate of the whole Mekong Delta region (0.53%) and the national level (0.8%).

In the past time, the system of credit institutions in Region 13 has focused strongly on a number of preferential credit programs with interest rate incentives as directed by the Government and the SBV. Accordingly, the outstanding loans for the five priority sectors in the whole Region 13 reached about VND 274,500 billion by the end of February 2025, accounting for 75.4% of the region’s total outstanding loans.

In 2024 alone, the credit institution system in Region 13 organized nearly 10 conferences to connect banks and enterprises. At these conferences, the banking industry coordinated and solved capital difficulties for thousands of business customers in various sectors. The accumulated outstanding loans (with interest rate support) through the bank-business connection programs in Region 13 reached about VND 14,800 billion.

At the conference, representatives of many enterprises and cooperatives in the tourism, agricultural and aquatic product processing and export sectors in Tien Giang and Long An provinces highly appreciated the proactive cooperation of credit institutions in the region in the process of capital financing, supporting short-term floating interest rate loans for seasonal raw material procurement, and rescheduling debt payment during difficult times for businesses due to the pandemic, market, and cash flow disruptions.

The representative of the Tien Giang Tourism Enterprises Association appreciated the fact that many conferences were organized by banks with separate themes for each industry, which helped enterprises access loans and solve specific financial difficulties of each sector and field during difficult and volatile market periods.

Governor of the State Bank of Vietnam, Nguyen Thi Hong, gives directions at the conference. (Photo: SBV)

Speaking at the conference, Governor Nguyen Thi Hong highly appreciated the efforts of the SBV Branch of Region 13 and nearly 100 credit institutions in the provinces of Long An, Tien Giang, Ben Tre, and Tra Vinh in implementing preferential credit policies and preferential loan interest rate packages for key sectors in the Mekong Delta region, such as rice, seafood, and agricultural product processing for export.

The Governor requested that the SBV Branch of Region 13 continue to promote positive results, closely follow the SBV’s monetary policy orientations and the economic growth targets of the provinces in Region 13 to direct credit institutions to proactively increase credit growth, focus on solutions to apply technology and reduce costs to strive to further lower lending interest rates and support customers.

Regarding the orientation of monetary policy management, the Governor said that the SBV would continue to manage it flexibly, closely following macroeconomic and inflation trends to manage interest rates and exchange rates stably. Regarding credit programs for the economy, the banking industry will continue to accompany and provide maximum capital for production and business, import and export, priority sectors, and strengths of each region and locality. As suggested by some localities and commercial banks, in the coming time, the SBV will also direct the banking system to prioritize and encourage lending to the private enterprise sector and increase the proportion of lending to small and medium-sized enterprises to support the business community together with localities to overcome difficulties and create a driving force to achieve economic growth targets in 2025.

Extraordinary General Meeting of Eximbank: Awaiting State Bank Approval to Relocate Head Office and Elect Three New Supervisory Board Members

On February 26, 2025, the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Eximbank, HOSE: EIB) held an extraordinary general meeting to elect new members to its Supervisory Board and amend the bank’s charter.

DongA Bank: A Troubled Institution’s Forcible Handover and the End of Shareholder Power?

Prior to being placed under special control, DongA Bank’s institutional shareholders included: Bac Nam 79 Construction, owned by Vu “Nhom”, which held 10%; PNJ with 7.7% of the charter capital; Ho Chi Minh City Party Committee Office with 6.9%; Ky Hoa Tourism and Trading with 3.78%; An Binh Capital with 2.73%; and Nha Phu Nhuan with 2.14%.

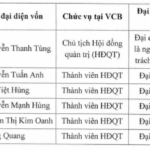

Unlocking a New Chapter: Vietcombank’s Journey Begins

As of January 17, 2025, Construction Bank (CB) officially transformed into Viet Nam Foreign Trade Digital Bank (VCBNeo).