**Large Vietnamese Banks Increase Capital to Strengthen Lending Capacity in 2025**

Capital increase activities enable commercial banks to enhance their credit expansion capabilities in 2025.

Large Bank Group Increases Capital by Trillions

According to documents presented at VietinBank’s 2025 Annual General Meeting of Shareholders, at the upcoming shareholders’ meeting, the bank will issue nearly 2.4 billion shares as dividends to shareholders, equivalent to a dividend payout ratio of 44.64% in shares.

VietinBank stated that it has received approval from competent authorities to use the source of dividend payment for this period from retained earnings after tax and after fund allocation for the period 2009-2016.

Thus, after the new issuance of nearly 2.4 billion shares, VietinBank’s charter capital will increase from VND 53,700 billion to VND 77,671 billion.

Along with the proposal to retain all annual profits for the period 2024-2028 to increase capital, it can be seen that in the next three years, VietinBank has a clear leeway to consolidate its financial cushion and expand credit growth. The bank’s shareholders are likely to continue receiving dividends in shares in 2026-2028.

Prior to VietinBank, two other banks in the “Big 4” group have also announced capital increase plans. Specifically, Vietcombank set the dividend payout ratio in shares at 49.5%. This is Vietcombank’s record-high dividend payout ratio since 2016. Accordingly, the bank plans to issue more than 2.76 billion shares from retained earnings after tax and fund allocation. After completion, Vietcombank’s charter capital will increase from VND 55,890 billion to VND 83,557 billion, becoming one of the banks with the highest charter capital in the system.

Regarding BIDV, although the plan for profit distribution and capital increase has not been disclosed in detail up to now, the bank has completed the payment of 2024 dividends in shares from post-tax profits after fund allocation in 2022 at a rate of 21% equivalent to a value of VND 11,971 billion. This year, the bank is expected to continue paying dividends of about 20% in shares while increasing capital to meet Basel III standards.

For the private bank group, according to records, about 15 units have announced plans to pay dividends in shares. Large and medium-sized banks such as VPBank, MB, ACB, SHB, Techcombank, HDBank, and VIB have set the dividend payout ratio in shares at the upcoming annual general meeting of shareholders this year, ranging from 14% to 30%.

Depending on their size and dividend payout capacity, banks will issue 417-670 million shares to increase their charter capital, implying a capital increase of VND 5,000-7,000 billion each.

|

Information on Capital Increase to Support Bank Stock Prices According to SSI Research, with commercial banks planning to increase their charter capital, the group of bank stocks is expected to continue its strong performance in 2025, including both credit growth and asset quality improvement. Stocks of large and medium-sized banks such as VietinBank, BIDV, Vietcombank, Techcombank, MB, and ACB are assessed to have high potential this year. Also, according to SSI Research, in the current context, the bank that can quickly dispose of stagnant assets, control bad debts well, and have a clear capital increase plan will have more room for growth in the future. In the short term, the net interest margin of the entire banking system is likely to remain flat or slightly decrease compared to 2024 (as banks need to support the economy). However, large banks will have more competitive advantages and higher profit growth than small-sized banks. |

Ensuring Multiple Financial Safety Indicators

According to most experts, banks prioritizing share dividends instead of cash dividends clearly shows their goal of increasing equity capital and improving the minimum capital adequacy ratio (CAR). This is a necessary step to meet the increasingly stringent requirements for capital adequacy under international standards.

In fact, up to now, according to statistics and comparisons by VIS Rating, the capital scale of the Vietnamese banking industry remains modest due to stable profits and limitations in mobilizing new capital.

According to VIS Rating, the ratio of tangible equity to total tangible assets (TCE/TA) of the banking system in 2024 remained stable at 8.5%. The loan loss coverage ratio (LLCR) of the entire industry improved from 83% in Q3/2024 to 91% at the end of last year. Meanwhile, the CAR of banks applying Circular No. 41/2016/TT-NHNN reached 12.51% (for state-owned commercial banks, it was 10.57%, and for private banks, it was 12.21%) – a fairly safe level compared to the plan of 10.5% in 2033 as directed by the State Bank of Vietnam.

According to experts at SSI Research, the focus of banks on retaining profits and issuing shares as dividends is a positive move. However, this form of capital increase does not bring new capital to the bank. Therefore, commercial banks need a more sustainable capital increase strategy by issuing private placement bonds to bring multiple benefits, helping to increase charter capital and improve the CAR ratio, thereby providing a large source of low-cost capital for lending and investment activities.

SSI Research said that in 2025, two large banks, BIDV and Vietcombank, have been allowed by competent authorities to increase their charter capital according to their plans through private placements (at rates of 9% and 6.5%, respectively). In Q1/2025, BIDV completed its capital increase through the method of offering private placement bonds to five professional securities investors at a price of VND 38,800 per share.

“After deducting expenses, the bank raised nearly VND 4,752 billion. This transaction increased BIDV’s charter capital from VND 68,975 billion to VND 70,213 billion, improving its capital buffer with the CAR ratio improving to about 10.5%, compared to 9.9% previously. This is one of the bank bond offerings that has attracted the attention of many large investors worldwide…”, SSI Research stated.

The New Interest Rate Cuts: A Strategic Move by Banks to Boost Their Economy.

As per the State Bank of Vietnam’s (SBV) update on deposit interest rate movements at commercial banks from February 25 to March 18, 2025, a significant 23 banks adjusted their deposit interest rates, with reductions ranging from 0.1% to 1% per annum, depending on the term. Notably, the SBV also recorded up to six instances of banks lowering their interest rates within this period.

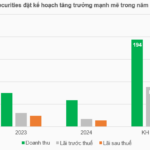

“VISecurities Rebrands as OCBS, Announces Capital Increase to 1,200 Billion”

Vietnam International Securities Joint Stock Company (VISecurities) is gearing up for its upcoming 2025 Annual General Meeting of Shareholders, scheduled for March 14. The company has ambitious plans on the agenda, including a proposed name change and a move to relocate its headquarters from Hanoi to Ho Chi Minh City. VISecurities is also setting its sights on achieving record-high revenue and profit targets, aiming to make this fiscal year the most successful in the company’s 16-year history.

The Ownership Structure Compliance Roadmap for Commercial Banks

The State Bank has issued Circular 52/2024/TT-NHNN, which directs commercial banks with shareholders, members, and related parties holding a higher percentage of shares than stipulated in Clause 55 of the Law on Credit Institutions No. 47/2010/QH12, amended and supplemented with certain provisions under Law No. 17/2017/QH14. The circular outlines a roadmap for these banks to align their ownership structures with the updated regulations set forth in the Law on Credit Institutions No. 32/2024/QH15.

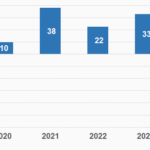

The Foreign Securities Firm on the Verge of a Thousand Billion Capital Increase

On December 6, the Ministry of Finance granted a certificate of registration for public offering of shares to Guotai Junan Securities Joint Stock Company (Vietnam) (HNX: IVS). The offering entails the issuance of 69.35 million new shares, maintaining a 1:1 ratio, thus increasing the company’s capital to VND 1,387 billion.