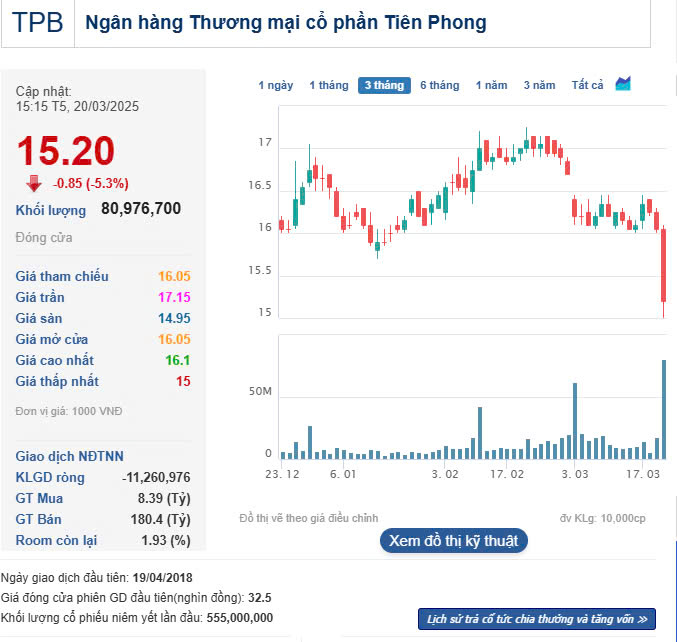

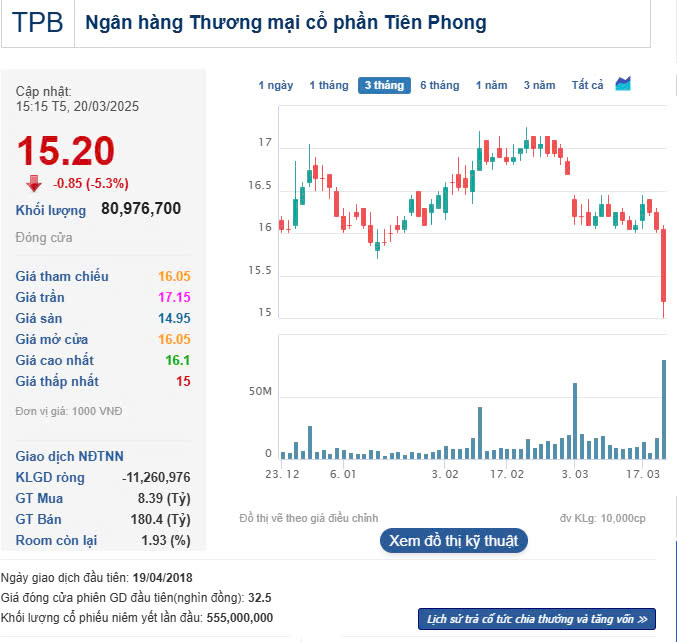

March 20th’s trading session witnessed a sell-off in TPB shares of TPBank, as the stock plummeted by 5.3% – the biggest loss in the banking sector – with a record trading volume of nearly 81 million units.

This was the sharpest decline for TPB shares in almost a year. At the close of the trading session on March 20th, TPB shares settled at 15,200 VND – the lowest price since September 2024.

The plunge in TPB shares caused a market capitalization loss of over 2,200 billion VND for TPBank, bringing it down to 40,157 billion VND at the end of March 20th. Consequently, the value of TPB shares held by family members of Mr. Do Minh Phu (Chairman of TPBank) and Do Anh Tu (Vice Chairman of TPBank) also took a hit.

At TPBank, Chairman of the Board of Directors, Do Minh Phu, does not directly own TPB shares. However, his two children, Ms. Do Vu Phuong Anh and Mr. Do Minh Duc, each hold over 29.38 million TPB shares. With this ownership ratio, the value of TPB shares held by Mr. Phu’s children decreased by nearly 50 billion VND in the March 20th session.

Vice Chairman of the Board of Directors of TPBank, Do Anh Tu, the younger brother of Do Minh Phu, holds over 97.94 million TPB shares, equivalent to 3.71% of TPBank’s capital.

Additionally, Mr. Tu’s wife, Ms. Trung Thi Lam Ngoc, currently owns more than 2.35 million TPB shares, equivalent to a 0.09% ownership ratio. Their two children, Do Quynh Anh and Do Minh Quan, respectively hold 81.1 million shares and 88.2 million shares, equivalent to ownership ratios of 3.07% and 3.34%.

Thus, the total number of TPB shares held by the family of Do Anh Tu is nearly 269.6 million, equivalent to 10.21% of TPBank’s charter capital. Currently, these shares are valued at nearly 4,100 billion VND, a decrease of nearly 230 billion VND compared to the previous session’s closing price.

Combined, the value of TPBank shares held by the families of Do Anh Tu and Do Minh Phu decreased by approximately 280 billion VND after the March 20th trading session.

The sharp decline in TPBank shares comes as today is the last day of trading to be eligible to attend the Annual General Meeting of Shareholders (AGM) for 2025. Accordingly, TPBank plans to hold its 2025 AGM on the morning of April 24, 2025, at the Dragon Hall (12th floor, DOJI Tower, No. 5 Le Duan, Ba Dinh, Hanoi). The record date for shareholders to attend is March 21, 2025.

The meeting agenda includes: Approving the 2024 activity report and 2025 plan of the Board of Directors (BOD), Supervisory Board, and Executive Board; the 2024 audited financial statements; the 2024 profit distribution plan, and other matters within the competence of the General Meeting of Shareholders.

For the year ending 2024, TPBank’s pre-tax profit reached nearly 7,600 billion VND, up 36% compared to 2023 and exceeding the plan set at the General Meeting of Shareholders. The return on equity (ROE) ratio of TPBank remained at over 17%. Total assets exceeded 418,000 billion VND, up 17% from the previous year and exceeding the plan by 7%. TPBank’s charter capital increased to 26,420 billion VND.

As of the end of 2024, TPBank’s credit balance, including customer loans and corporate bonds, reached 261,500 billion VND, equivalent to a growth rate of more than 20% compared to the previous year, far surpassing the average growth rate of the banking industry.

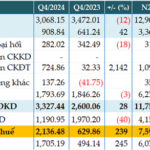

Reaping Rewards from Investment Securities: TPBank’s Q4 Pre-Tax Profits Surge 3.4x YoY

For the fourth quarter of 2024, the Joint Stock Commercial Bank Tien Phong (TPBank, HOSE: TPB) reported a profit before tax of over VND 2,136 billion, a 3.4-fold increase compared to the same period last year. This impressive performance is attributed to a significant reduction in risk provisions and a surge in investment securities income.

“TPBank: Proud to be a National Brand of Vietnam in 2024”

For two consecutive years, TPBank has been bestowed with the prestigious title of Vietnam National Brand, a testament to the bank’s unwavering commitment to developing innovative financial products and services. This recognition highlights not only the convenience and digital accessibility that TPBank offers to its customers but also its significant contribution to the country’s economic landscape.

“TPBank Offers Omnichannel Support for Customers Updating Their Facial Recognition Data for Seamless Transactions”

“With TPBank’s LiveBank, customers can now update their facial recognition data at their own convenience. No need to visit a physical branch or struggle with app updates; our remote tellers are available 24/7 to guide you through the process seamlessly. Experience the future of banking with TPBank – where your time and preferences are always respected.”

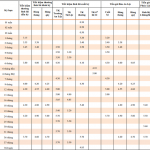

“TPBank Boosts Savings Rates Effective Today, June 3rd”

TPBank, a leading commercial joint-stock bank in Vietnam, has announced a significant hike in savings interest rates across all tenors, effective from June 3rd.