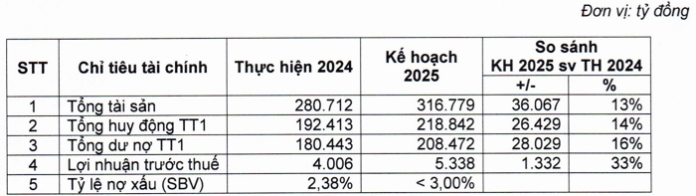

The Board of Directors of the Orient Commercial Joint Stock Bank (OCB) recently approved the business plan for the year 2025.

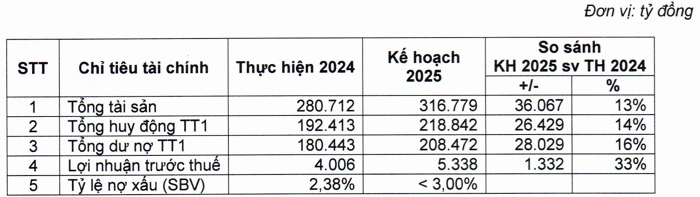

Specifically, OCB aims to achieve a pre-tax profit of VND 5,338 billion in 2025, up 33% from the previous year’s performance.

The bank sets a target for total assets of VND 316,779 billion by the end of 2025, an increase of 13% from the end of 2024. Total mobilization and total outstanding loans in the market 1 are expected to grow by 14% and 16%, reaching VND 218,842 billion and VND 208,472 billion, respectively. At the same time, the bank aims to maintain its non-performing loan ratio below 3%.

This business plan is expected to be presented to the Annual General Meeting of Shareholders in 2025 for approval. Recently, OCB has finalized the list of shareholders attending the Annual General Meeting of Shareholders for the year 2025, which will be held on March 20, 2025. The meeting is scheduled to take place on April 22, 2025. The details of the meeting have not yet been announced.

OCB’s business plan for 2025. (Source: OCB)

With this business plan, OCB is currently the bank with the highest profit growth target. Previously, banks such as ACB, VPBank, HDBank, VIB, and Nam A Bank expected profit growth of less than 30% for 2025.

In 2024, OCB’s pre-tax profit reached VND 4,006 billion, a decrease of 3.2% from 2023 and fell short of its target.

As of the end of 2024, OCB’s total assets amounted to VND 280,712 billion, up 16.9% from the previous year. Market 1 credit growth reached nearly 20%, higher than the industry average of 15.08%. Market 1 mobilization reached VND 192,413 billion, up 14.5% compared to 2023.

Anticipating EVF’s 2024 Audit Results

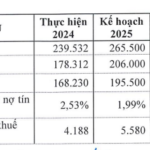

Electricity Finance Corporation (EVNFinance – HOSE: EVF) is set to release its 2024 audited financial statements in late February 2025.

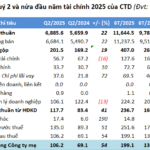

Coteccons Profits Soar to $85 Million in H1 of 2025 Fiscal Year

The first half of the 2025 financial year (July 1st to December 31st, 2024) saw the Construction Joint Stock Company Coteccons (HOSE: CTD) achieve impressive financial results. The company recorded a net profit of nearly VND 200 billion, a remarkable 47% increase compared to the same period last year, and successfully fulfilled 46% of its annual plan. Additionally, new contract wins amounted to VND 16.8 trillion, showcasing the company’s strong performance and promising future prospects.