By 2:45 p.m., SJC gold and gold rings at some businesses continued to plummet, with an average decrease of nearly VND 1 million per tael compared to the early afternoon. If compared to the opening of the trading session this morning, gold prices decreased by an average of VND 3 million per tael. Currently, many places are offering buy-in prices below the VND 95 million/tael mark.

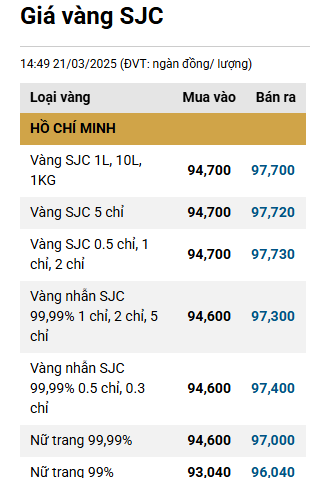

Specifically, SJC Company adjusted the price of gold rings to VND 94.6 – 97.3 million/tael, a decrease of VND 3.1 million/tael on the buying side and VND 2.7 million/tael on the selling side compared to the opening of the trading session this morning.

Gold prices listed at SJC Company on the afternoon of March 21st.

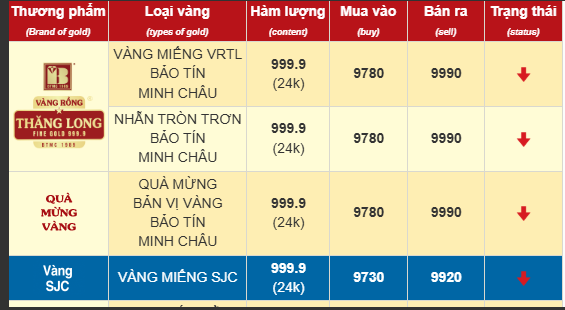

At Bao Tin Minh Chau, the price of gold rings decreased by nearly VND 2.6 million/tael on the buying side and VND 2.2 million/tael on the selling side, currently trading at VND 96 – 98.6 million/tael.

DOJI listed gold ring prices at VND 95.2 – 97.6 million/tael, a significant drop of VND 3.3 million/tael on the buying side and VND 2.7 million/tael on the selling side.

Gold bar prices at SJC Company and DOJI were both traded at VND 94.7 – 97.7 million/tael, while at Bao Tin Minh Chau, gold bar prices continued to fall to VND 94.8 – 97.7 million/tael.

As of 2:15 p.m., gold rings and SJC gold continued to plummet at many businesses. Specifically, at Bao Tin Minh Chau, the price of gold rings decreased by VND 1.75 million/tael on the buying side and VND 1 million/tael on the selling side compared to the beginning of the session, currently trading at VND 96.8 – 99.3 million/tael.

At PNJ, gold prices were also adjusted downwards, falling to VND 96 – 98.2 million/tael, equivalent to a decrease of VND 2.1 million/tael on the buying side and VND 1.7 million/tael on the selling side.

SJC Company recorded the biggest drop of the day, with buy-in prices falling by up to VND 2.4 million/tael and sell-out prices decreasing by VND 1.9 million/tael, currently trading at VND 95.3 – 97.8 million/tael.

DOJI also made significant adjustments to gold ring prices, which fell to VND 95.9 – 97.2 million/tael, a decrease of VND 2.6 million/tael on the buying side and VND 2.1 million/tael on the selling side.

At Mi Hong, gold ring prices are currently at VND 95.6 – 97.7 million/tael, after a decrease of VND 1.5 million/tael on the buying side and VND 2.1 million/tael on the selling side.

Gold bar prices at these businesses are currently listed at buy-in prices ranging from VND 95.4 – 97.2 million/tael, while sell-out prices are generally around VND 97.7 – 98.6 million/tael.

At 10:50 a.m., the price of gold rings at Bao Tin Minh Chau dropped significantly, falling to VND 97.8 – 99.9 million/tael, a decrease of VND 500,000 per tael compared to the opening of the trading session this morning.

Gold bar prices were also adjusted downwards to VND 97.3 – 99.2 million/tael, a decrease of VND 700,000/tael on the buying side and VND 600,000/tael on the selling side.

Gold ring and SJC gold prices listed at Bao Tin Minh Chau at 10:50 a.m.

Mi Hong Jewelry lowered the price of gold rings by VND 1 million/tael on the selling side and VND 300,000/tael on the buying side, with current trading prices at VND 96.8 – 98.8 million/tael. The company also adjusted the gold bar prices, decreasing the selling price by VND 1 million/tael and the buying price by VND 500,000/tael, resulting in a range of VND 97 – 98.8 million/tael.

At PNJ, gold ring prices decreased by an average of VND 200,000 – VND 400,000/tael compared to the beginning of the morning session, currently trading at VND 97.9 – 99.5 million/tael. SJC Company made more significant adjustments, decreasing the buying price by VND 1.4 million/tael and the selling price by VND 900,000/tael, resulting in a range of VND 96.3 – 98.8 million/tael.

DOJI currently lists gold ring prices at VND 97.7 – 98.7 million/tael, a decrease of VND 800,000/tael on the buying side and VND 600,000/tael on the selling side compared to the previous session.

Meanwhile, gold bar prices at major businesses such as DOJI, PNJ, and SJC Company were listed uniformly at VND 97.2 – 99.2 million/tael.

At the opening of the trading session this morning, at 8:30 a.m., Mi Hong adjusted the buy-in price of gold rings downwards to VND 97.1 million/tael, a decrease of VND 500,000 compared to the previous session’s close. The company also reduced the gold bar buy-in price by VND 300,000/tael, resulting in a current price of VND 97.5 million/tael. Both gold rings and gold bars are offered at a sell-out price of VND 99.8 million/tael at Mi Hong.

Similarly, Bao Tin Minh Chau currently lists gold ring prices at VND 98.55 – 100.3 million/tael, a decrease of up to VND 600,000/tael on the selling side compared to yesterday’s peak. The company also adjusted gold bar prices to VND 98 – 99.8 million/tael.

Meanwhile, major brands such as PNJ, SJC, and DOJI maintained their gold ring prices from the previous session’s close but had decreased them by nearly VND 1 million per tael compared to the day’s peak. Specifically, gold ring prices at PNJ are currently at VND 98.1 – 99.9 million/tael, SJC at VND 97.7 – 99.7 million/tael, and DOJI at VND 98.5 – 99.3 million/tael.

Gold bar prices at these businesses are uniformly listed at VND 97.8 – 99.8 million/tael.

In the global market, world gold prices fluctuated around $3,041/ounce. When converted according to the USD rate, the world gold price is approximately VND 94.2 million/tael, excluding taxes and fees.

Gold futures contracts experienced a volatile trading session yesterday, with prices initially surging to a new all-time high before dropping due to profit-taking and then recovering most of the losses by the end of the session.

The April gold futures contract opened at $3,058/ounce and quickly rose to $3,065.20 in the first hour of trading, setting a new record high. However, the upward momentum of the precious metal quickly reversed as traders took advantage of the rally to lock in profits.

“Speculators are trying to take advantage of the market to cash in on their gains,” said Alex Ebkarian, CEO of Allegiance Gold. “I think that every time gold hits a new high, the market encounters some resistance.” Mr. Ebkarian also noted that gold has not yet fully played its traditional role as a safe-haven asset.

This development came just a day after the US Federal Reserve (Fed) concluded its March meeting of the Federal Open Market Committee. During this meeting, Fed members unanimously decided to maintain the current interest rate range of 4.25% – 4.50%. In the subsequent press conference, Fed Chairman Jerome Powell addressed concerns related to the current administration’s trade policies, suggesting that these policies may have contributed to slowing US economic growth while increasing inflationary pressures.

In their official statement, Fed officials predicted that economic growth would slow down alongside rising inflation, particularly highlighting concerns about the current administration’s approach to trade. They described these policies as “ambitious but often unpredictable,” concluding that they are putting strain on both the economy and the Fed’s ability to maintain stability.

Just a few hours after the Fed’s decision, President Donald Trump posted on Truth Social, criticizing the central bank: “Fed would do well to get their act together. There is no inflation except they are creating it. We will win anyway, but it is unnecessary to have a Fed that is hostile.” This swift reaction demonstrates the President’s willingness to exert pressure on the Fed, despite the long-standing tradition of the central bank’s independence from political influence.

Currently, investors have shifted their attention from monetary policy to the administration’s trade measures and their potential consequences. With import tariffs from Canada and Mexico set at 25% and a 20% tariff on goods from China, global investors are bracing for the inevitable impact of rising prices and potential retaliatory actions from other countries.

Selling a House at the Peak: A Golden Opportunity. A year on, gold profits soar by 60 million, while the old house appreciates from 3 billion to 5 billion, and the desired home now costs 7 billion.

The price of gold has been on a record-breaking rally, surging past 99 million VND per tael on March 18th, sparking frenzied discussions on social media. This surge has been a boon for early buyers, but it has also left many who attempted to ride the wave struggling. The rapid rise in gold prices pales in comparison to the skyrocketing housing prices, leaving some “peak chasers” in a precarious position.

The Highest Gold Price in History

The investor community remains vigilant in the face of ongoing uncertainties surrounding President Donald Trump’s tariff plans. The potential impact of these tariffs continues to loom large, heightening the focus on risk mitigation strategies. As the trade landscape evolves, investors are keenly aware of the need to navigate potential pitfalls and protect their portfolios. This heightened awareness underscores the critical importance of staying informed and proactive in today’s dynamic market environment.