At the 2022 Annual General Meeting of Shareholders, the leadership of PC1 Corporation (HOSE: PC1) mentioned the industrial real estate market’s booming development and its massive investment appeal to domestic and foreign capital. This was also the year the Group unveiled its new brand identity.

Acquiring a series of industrial park enterprises

PC1’s leaders also shared, for the first time, their choice of Western Pacific Joint Stock Company (WP) – the investor of Yen Phong IIA Industrial Park in Bac Ninh province, spanning 159 hectares. This decision was influenced by WP’s strengths in industrial real estate development over the past years, including its land fund potential, human resources, well-trained personnel, qualifications, and experience in managing and operating logistics services, waterway ports, and smart warehouses. They also have a proven track record of successful collaborations with foreign partners.

In 2022, PC1 confidently ventured into the industrial real estate sector, anticipating profits. They also planned to raise VND 1,200 billion through bond issuance to invest in WP. In early April 2022, WP became a subsidiary of PC1 after the Company completed the purchase of 7 million shares from existing shareholders and contributed an additional 11.5 million newly issued shares, increasing its ownership stake to 30.08% in WP.

In November of the same year, PC1 acquired all the shares of NAIV Company (headquartered in Singapore), thereby becoming a joint venture partner and owning 70% of the capital of Nomura Industrial Park Development Joint Stock Company – Hai Phong (NHIZ, with a charter capital of over VND 880 billion), the investor of the 153-hectare Nomura Industrial Park in Hai Phong.

Source: PC1

|

Which industrial parks does Western Pacific own?

Stepping into 2023, PC1 candidly acknowledged the challenges faced by the energy industry, with the 8th Power Plan still awaiting issuance. EVN’s financial difficulties have impacted investment progress and debt collection plans. Additionally, the electricity load growth has been low, with some regions even experiencing negative growth.

The enterprise set a target to increase its industrial park land fund to 1,500 hectares by 2033.

After the FIT (Feed-in Tariffs) price for renewable energy in 2021, PC1’s leaders recognized that investment opportunities in this field had shifted by a five-year cycle. As a result, the Group adjusted its strategy to focus on industrial real estate with an investment in WP, marking a turning point. PC1 targets localities with competitive advantages and top FDI attraction potential.

Regarding the target of investing in a minimum of 1,500 hectares of industrial park land over ten years, PC1’s leaders assured shareholders that it is “absolutely feasible, even modest.” The Group is currently in negotiations for projects totaling over 1,000 hectares.

Additionally, the Nomura Industrial Park in Hai Phong is expected to generate VND 650 billion in revenue and VND 110-120 billion in after-tax profits annually.

Furthermore, the Group aims to expand its industrial park land fund in the southern region through the acquisition of a 36% stake in Phu Binh Warehouse Joint Stock Company. PC1’s leaders shared that this is just the first step, and they plan to acquire a minimum of 55% stake to implement projects in Vung Tau, each with a scale of approximately 300 hectares.

The leaders also confidently shared that the Yen Phong Industrial Park (Bac Ninh) of WP is currently renting at a rate of USD 158-160/m2, higher than initially planned, and is expected to welcome its first customers by the end of 2023.

The Company has also submitted to the government two industrial parks, Dong Van V and VI. The Yen Lu Industrial Park (Bac Giang), with an area of 230 hectares, is under development, along with the Yen Len Industrial Cluster (Ha Nam), which is being invested in to prepare for construction.

In 2024, PC1 contributed VND 405 billion to Hai Phong International Industrial Park Joint Stock Company through a private offering. This enterprise is implementing the Nomura 2 project, in which PC1 holds over 99% ownership.

Once again, at the 2024 Annual General Meeting of Shareholders, PC1 emphasized its investment priorities across different sectors. The top priority is currently to focus resources on industrial and residential real estate, aiming for green and smart developments by 2030. The Group’s long-term strategy involves industrial park infrastructure, and in the 2024-2025 period, PC1 will concentrate on becoming a leading general contractor for industrial park infrastructure, participating in projects invested by the Company itself, as well as FDI projects.

The second priority is the EPC general contractor block for large projects in Vietnam and abroad. The third priority, to a moderate degree, is mineral investment, which must be implemented cautiously and with certainty. The fourth priority is the power generation sector, a long-term investment direction, for which the Group is currently researching and seeking new investment opportunities. Other areas will be developed appropriately according to the orientation.

As of the end of 2024, in the industrial real estate segment, PC1 held 70% of the capital of Japan – Hai Phong Industrial Park Development Company, 99% of Hai Phong International Industrial Park Joint Stock Company, 36% of Phu Binh Warehouse Joint Stock Company, and 30.08% of WP, equivalent to respective values of VND 68.4 billion and VND 1,250 billion.

On the other hand, as of the end of 2024, PC1 had two bond lots with a total par value of VND 1,200 billion, which will mature in 2027. These bonds were issued to raise capital for the acquisition of WP shares and supplement working capital. The bonds account for about 15% of the Group’s long-term debt and are secured by PC1 shares owned by individuals and shares of Trung Thu Hydropower Joint Stock Company and Northern Energy Investment Joint Stock Company held by PC1.

| Total assets and liabilities of PC1 in the 2021-2024 period |

BOX:

|

It is known that Nomura 2 Industrial Park, with an area of 197 hectares, is located next to Nomura 1 and is developed following the eco-industrial park model. In late 2024, the project received approval from the Deputy Prime Minister for investment policy and investor selection for Hai Phong International Industrial Park Joint Stock Company. In 2024, the WP group became the investor for three industrial parks: the expanded Yen Lu Industrial Park (phase 1) in Bac Giang province, Dong Van 5 Industrial Park, and Dong Van 6 Industrial Park. Specifically, the expanded Yen Lu Industrial Park (phase 1) has an area of nearly 120 hectares and a capital investment of over VND 1,500 billion, belonging to WP. Dong Van V Industrial Park (phase 1) has an area of 238 hectares and a capital investment of over VND 2,900 billion, owned by Ha Nam Infrastructure Joint Stock Company – a company in which WP holds 51% stake, and the remaining shares are held by WP’s member companies and its Chairwoman, Pham Thi Bich Hue. As for Dong Van VI Industrial Park, with an area of 250 hectares and a capital investment of nearly VND 3,000 billion, it is owned by Ha Nam International Port Joint Stock Company – a company in which WP holds 36% stake, and the Chairwoman of WP holds 49%. |

How has the shift to industrial parks impacted financial performance?

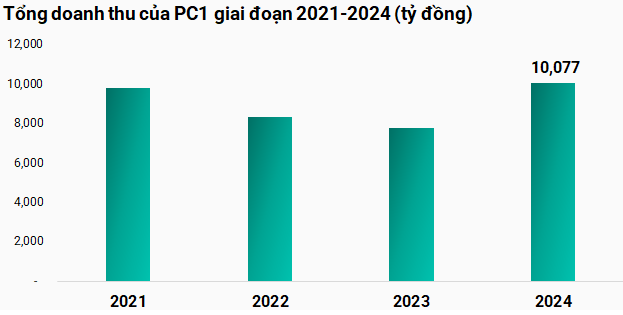

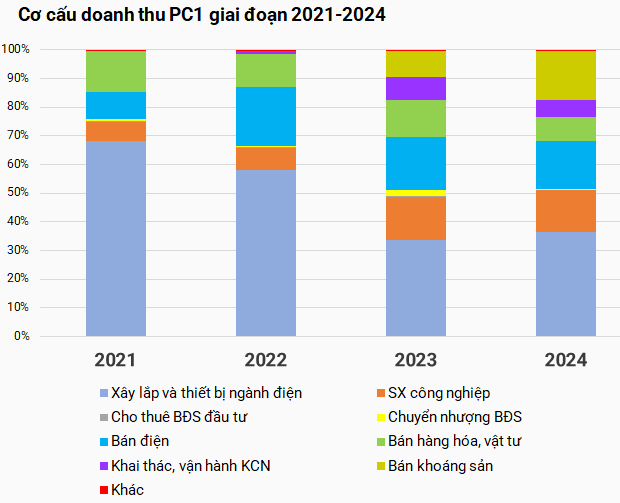

2024 witnessed PC1 achieving a record-high revenue of over VND 10,000 billion. Since 2021, there has been a gradual shift in revenue structure, with the traditional construction and electrical equipment sectors decreasing in value and contribution, while the industrial manufacturing, operation, and mineral sales sectors have grown.

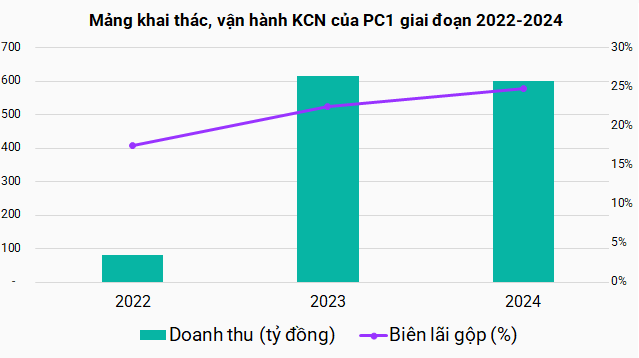

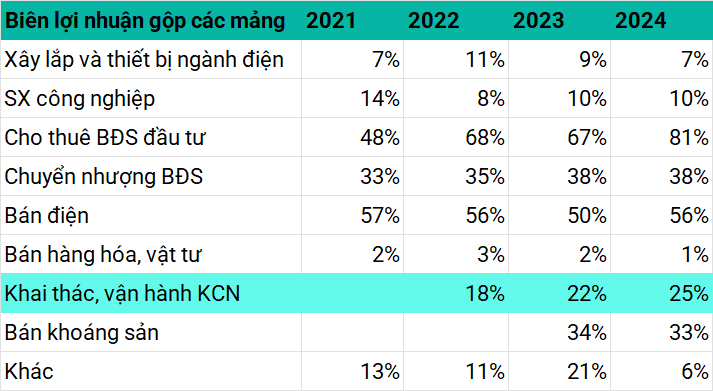

Industrial real estate officially generated revenue from 2022, contributing a total of VND 993 billion in revenue and VND 300 billion in gross profit over the past three years. The profit margin for this segment has increased gradually from 18% (in 2022) to 22% (in 2023) and 25% (in 2024). While this is about half of the profit margin in other segments, such as electricity sales, real estate transfers, and real estate leasing, it is higher than that of the construction and electrical equipment sectors, as well as industrial manufacturing.

Source: Author’s compilation

|

Thu Minh

– 08:14 20/03/2025

The Latest Developments at the $4 Billion ‘Super Project’ in the Central Coastal Province

The Nam Hoi An Resort in Quang Nam Province is exploring the addition of a new golf course to its offerings. The resort aims to enhance its appeal to golfers and sports enthusiasts by potentially introducing this new feature. With a focus on elevating the guest experience, the resort envisions a vibrant and active community for visitors seeking a luxurious and sporty escape.

The Stock Market’s Resilience Surges: Pinetree Unveils Interest-Free Margin and Derivatives Packages

In March, Pinetree introduced a range of interest-free and fee-waiving policies for margin loans and derivatives trading. These policies were designed to cater to the needs of experienced investors, offering them a more cost-effective way to leverage their investments and engage in more complex trading strategies.