However, choosing the right credit card line, enjoying life, and effectively managing finances is crucial.

Choose a Card That Fits Your Needs

With an income of nearly VND 20 million/month and a good financial transaction history, it was easy for Ms. Ngoc Ha (28, Hue City) to obtain a credit card with a stable limit.

The “office lady” shared that she uses different cards for different purposes to maximize her benefits. For instance, when hunting for sales or shopping online, Ha usually opts for a cashback card. But when it comes to traveling, booking flights, or reserving hotel rooms, she chooses a card that offers reward points or miles.

As an illustration of this “strategy,” Ms. Ngoc Ha explained that during the post-Tet shopping stimulus program, she purchased some personal items at AEON Mall and chose to pay with her SHB Mastercard Cashback credit card to enjoy an additional 10% cashback on her purchases. Thanks to this offer, the actual amount she spent on those items was minimal, and some products were almost like getting them for free. All it took was knowing the exact promotion to take full advantage of it.

On the other hand, Mr. Duc Thinh (35, Can Tho City) pays attention to the “fees and interest” aspect. Being an engineer, he is interested in owning high-value items and, therefore, focuses on installment plans to reduce financial pressure. So, whenever a bank offers a reasonable policy, he applies for their card. During the recent Lunar New Year holiday, he bought his parents a new refrigerator by swiping his credit card.

“With the SHB Mastercard Truly Free card, I was able to split the purchase into three monthly installments at 0% interest, making the monthly payments very manageable. Moreover, making payments through the app is convenient and eliminates the worry of late payment interest,” shared Mr. Thinh.

Experts assert that using credit cards today is not merely about spending now and paying later, as was traditionally the case. Instead, customers should identify their actual needs and make informed choices, as banks offer specialized card lines.

Choose a Bank with Generous Benefits

According to these experts, when the competition in card features and segment differentiation is no longer significantly varied, customers should also consider the banks’ promotional programs and discounts offered from time to time. These may include reward points, discount codes for spending and payments, annual fee waivers for the first year, and more, to maximize the post-purchase experience.

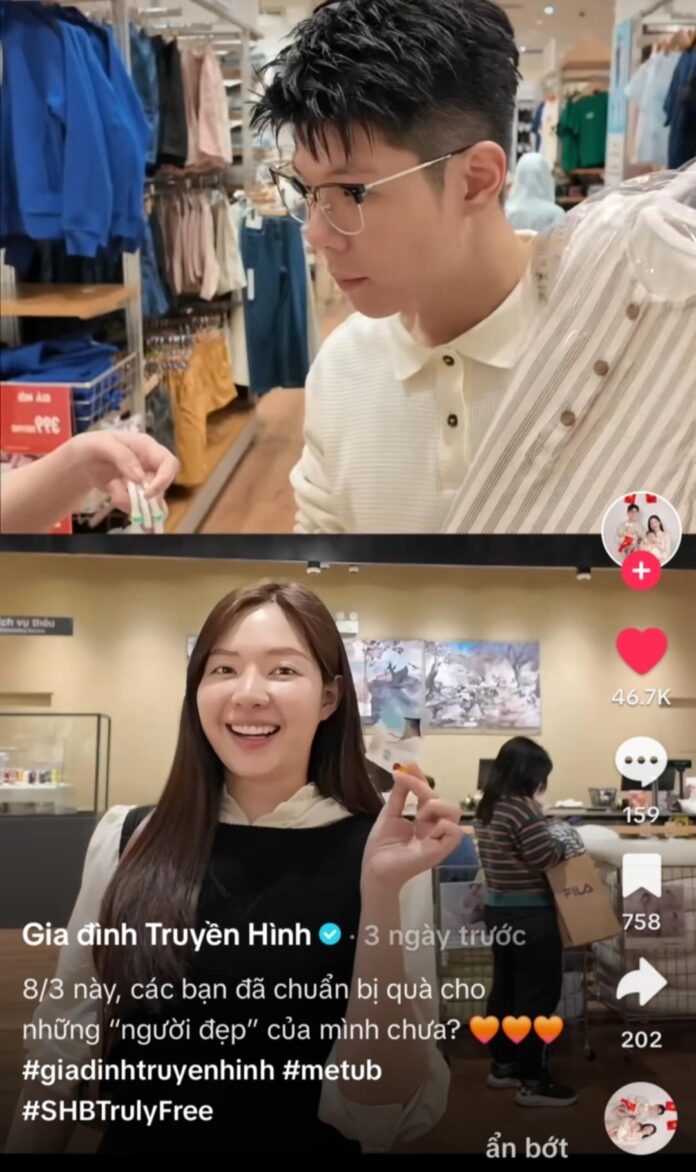

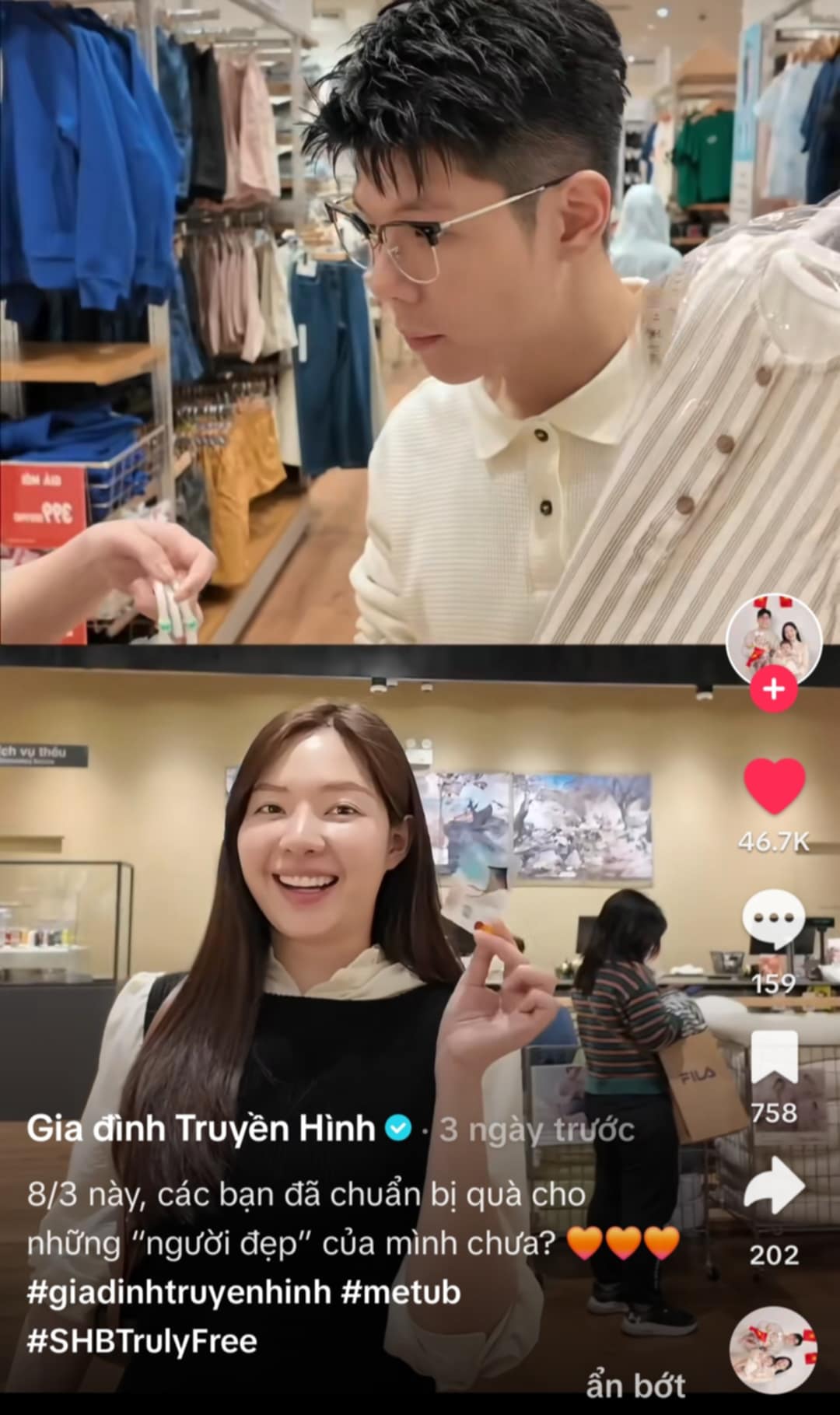

On TikTok, the well-known “TV family” couple, Manh Cuong and Huong Giang, shared their fascinating experience using a credit card at one of the largest shopping mall chains in the country.

“At the beginning of the new year, when you use SHB Truly Free or SHB International cards to pay at Payoo POS counters at Aeon Mall, you get an instant 20% discount, up to VND 200,000. This promotion is valid until March 31, 2025, and each card is eligible for four discounts per month. If you have two cards, you get double the number of discounts, and if you have three cards, you get triple the number of discounts. So, if you’re planning to go shopping or buy gifts for your loved ones, keep this in mind! And the best part? You get to enjoy all these benefits with a 100% lifetime annual fee waiver.”

This information received an overwhelming response from the online community, with over 46,700 likes and 202 shares, along with numerous positive comments. Many people agreed that smart spending involves taking advantage of the card issuer’s promotions, especially during challenging times. Some young people even humorously commented that husbands who practice frugal spending are already a “great gift” for their wives on International Women’s Day.

SHB’s program, valid from now until March 31, 2025, offers SHB credit and debit cardholders a chance to receive cashback of up to VND 1 million and an instant 20% discount when spending and shopping at over 800 food, fashion, cosmetics, and electronics stores in Aeon Mall, a famous Japanese shopping mall chain, in Hanoi, Hai Phong, Hue, and Ho Chi Minh City.

Specifically, each transaction made with an SHB-branded debit or credit card, including newly issued and existing cards, with a value of VND 200,000 or more, will receive an instant 20% discount (up to VND 200,000) on Payoo POS. Cardholders are entitled to four discounts per card per month and a total of 12 discounts per card throughout the program. This offer is valid on the 5th and 20th of each month and on Wednesdays, Saturdays, and Sundays.

SHB representatives shared that, in addition to the “rain of gifts” at Aeon Mall, depending on the card type, customers would also enjoy exclusive benefits such as unlimited access to the luxurious SHB First Club gold-plated airport lounge at Noi Bai airport, complimentary access to the Le Saigonnais lounge at Tan Son Nhat airport, cash withdrawals of up to 50% of the credit limit at ATMs worldwide, exclusive golf or fine dining experiences, and cashback of up to 10%, up to VND 1 million.

Since its launch, SHB’s credit card ecosystem, including the SHB Mastercard World and the “Family Card” series (SHB Visa Platinum/Visa Platinum Star, SHB Mastercard Cashback, SHB Mastercard FCB, and SHB Truly Free), has been well-received by consumers. Holding one of these cards allows customers to enjoy discounts when making payments, cashback of up to 10% in various fields like supermarkets, insurance, tuition, healthcare, transportation, and online shopping. This essentially means “earning money while spending money.”

Additionally, SHB offers ways to accumulate reward points that can be redeemed for shopping vouchers or travel miles. With a 45-55 day interest-free period for credit card payments, young people can balance their expenses and efficiently manage their finances for different purposes.

Moving forward, SHB will continue to develop new card lines integrated with cutting-edge technology and tailored promotional programs to enhance convenience and improve the customer experience for various segments. This contributes to promoting cashless payments and comprehensive financial inclusion, aligning with the government’s vision of a cashless society.

The Ultimate Samsung Phone Deals: Z Fold6 at a Massive Discount, Almost 30 Million, and S23 Ultra at an Unbelievable 21 Million

Early December brings great deals on Samsung phones, from affordable to high-end models, at retailers across the country.

The Ultimate Guide: Unlocking the Best Year-End Deals with Your Nam A Bank JCB Card

The Nam A Bank JCB Credit Card has just launched an incredible range of benefits for its users. With this card, you can enjoy discounts of up to 50% on transportation and food delivery apps like Grab, Be, and Xanh SM. But that’s not all; cardholders also receive up to VND 1,000,000 in benefits when they shop and up to VND 320,000 in discounts at select restaurants. It’s a whole new level of exclusive perks that will elevate your everyday experiences.