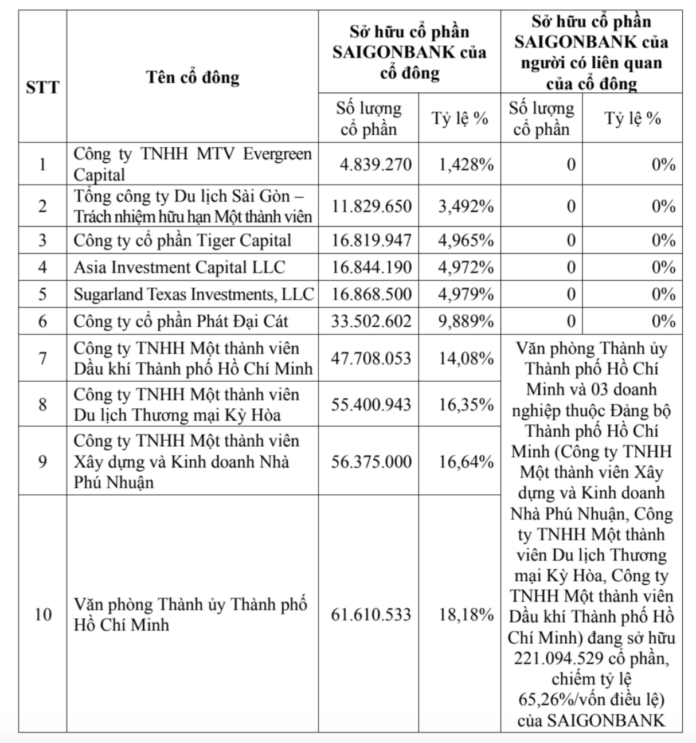

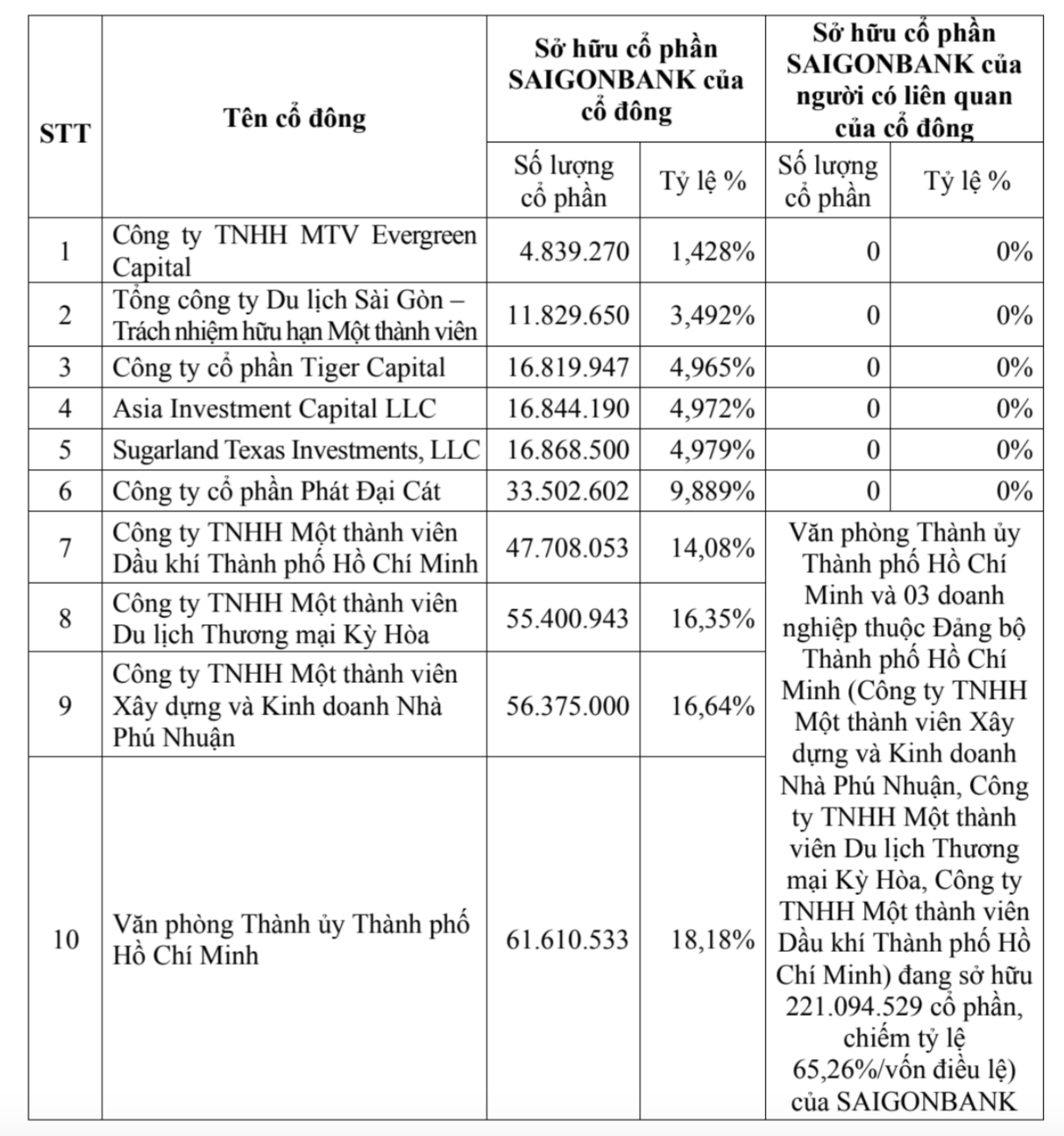

Saigon Commercial Joint Stock Bank (Saigonbank – Code: SGB) has recently disclosed information about its shareholders owning over 1% of its charter capital. Specifically, the list published by Saigonbank includes 10 shareholders, all of which are organizations, holding a total of nearly 321.8 million shares, equivalent to 94.98% of the bank’s charter capital.

Among them, the Ho Chi Minh City Party Committee Office is currently the largest shareholder of Saigonbank with over 61.61 million shares, corresponding to a 18.18% stake in the bank.

In addition, three enterprises under the Ho Chi Minh City Party Committee, namely Ho Chi Minh City Oil and Gas One Member Limited Company, Ho Chi Minh City Trading and Tourism One Member Limited Company, and Phu Nhuan Construction and Trading One Member Limited Company, own 47.7 million, 55.4 million, and 56.4 million shares, respectively; equivalent to ownership ratios of 14.08%, 16.35%, and 16.64%.

Thus, the four state-owned shareholders hold a total of over 221 million SGB shares, equivalent to 65.25% of Saigonbank’s charter capital.

Apart from the state-owned group, Phat Dai Cat Joint Stock Company is the fifth largest shareholder of Saigonbank with a 9.89% ownership stake. Previously, Phat Dai Cat Joint Stock Company had purchased more than 16.75 million SGB shares on January 8, 2025, increasing its ownership from 4.944% to 9.889%.

Regarding Phat Dai Cat Joint Stock Company, it was established in January 2022 with its headquarters located at 198 Nguyen Thi Minh Khai, Ho Chi Minh City. The company mainly operates in the real estate business.

Phat Dai Cat’s chartered capital stands at VND 321 billion. Its founding shareholders include Nguyen Kim Express & Logistics One Member Limited Company (2% capital contribution), Nguyen Kim Investment and Development Joint Stock Company (95% capital contribution), and Hoang Kim Investment and Construction One Member Limited Company (3% capital contribution).

The Chairman of the Board of Directors and General Director of Phat Dai Cat Company is Mr. Le Huynh Gia Hoang. He also serves as the legal representative of Hoang Kim Investment and Construction One Member Limited Company and is a pivotal figure in the group of enterprises associated with Nguyen Kim.

The Nguyen Kim group, with its core entity being Nguyen Kim Investment and Development Joint Stock Company, was established in 2007 with a chartered capital of VND 800 billion. The company is closely associated with its founder, Nguyen Van Kim, who built the once-famous Nguyen Kim electronics chain (later sold to Central Group).

Source: Saigonbank

Besides Phat Dai Cat Company, several other enterprises also hold more than 1% of Saigonbank’s charter capital, including Tiger Capital Joint Stock Company (holding 16.8 million shares, equivalent to 4.965%), Saigon Tourism Corporation – One Member Limited Liability Company (11.8 million shares, equivalent to 3.492%), and Saigon Tourism Corporation (4.8 million shares, equivalent to 1.428%).

The list published by Saigonbank also includes two foreign shareholders, Asia Investment Captial LLC and Sugarland Texas Investments LLC. These two shareholders respectively hold 16.84 million and 16.86 million SGB shares, corresponding to 4.972% and 4.979% stakes in the bank.

Saigonbank is currently the smallest bank in the Vietnamese stock market in terms of assets, loan balance, customer deposits, and charter capital.

As of the end of 2024, Saigonbank’s total assets reached VND 33,260 billion, an increase of 5.6% compared to the beginning of the year. Its loan balance stood at VND 21,835 billion, a 9.4% increase, while customer deposits amounted to VND 24,413 billion, a growth of 3.6%. The bank’s charter capital was VND 3,388 billion.

For the full year 2024, Saigonbank reported a pre-tax profit of over VND 99 billion, a 70% decrease compared to 2023, and achieved only 27% of its profit plan.

DongA Bank: A Troubled Institution’s Forcible Handover and the End of Shareholder Power?

Prior to being placed under special control, DongA Bank’s institutional shareholders included: Bac Nam 79 Construction, owned by Vu “Nhom”, which held 10%; PNJ with 7.7% of the charter capital; Ho Chi Minh City Party Committee Office with 6.9%; Ky Hoa Tourism and Trading with 3.78%; An Binh Capital with 2.73%; and Nha Phu Nhuan with 2.14%.

The Future of Banking: Reforming the Law on Credit Institutions

The most notable event of 2024 was arguably the passing of the amended Law on Credit Institutions by the National Assembly. The amendments aim to contribute to ensuring the financial stability and security of credit institutions.

The Golden Exodus: A Mining Company’s Leadership Transition

Despite a challenging economic landscape, Vàng Lào Cai has persevered through difficult times. From 2020 onwards, the company experienced a hiatus in sales and service revenue, culminating in a challenging year in 2023, with a loss of nearly 14 billion VND. As of the end of 2023, the cumulative loss exceeded 113 billion VND.