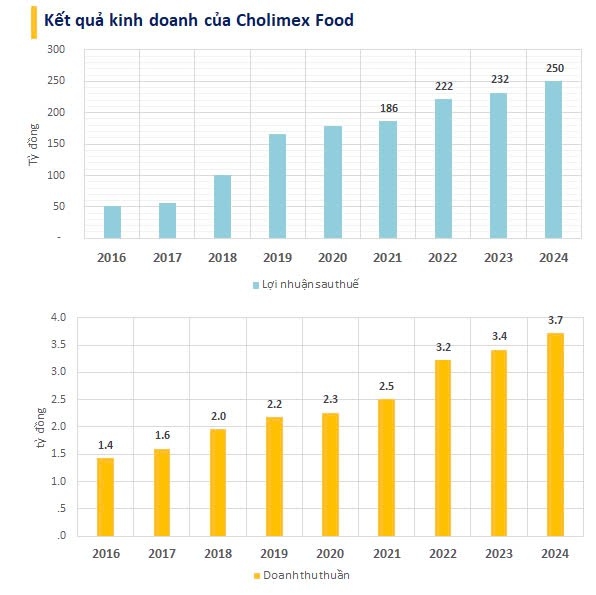

According to the audited 2024 financial statements, Cholimex Food Joint Stock Company (Cholimex Food – CMF) achieved net revenue of VND 3,717 billion, a 9% increase from 2023. On average, the company earned over VND 10 billion per day from its hot chili sauce, fish sauce, soy sauce, and other products.

Domestic market revenue accounted for VND 2,759 billion, or 74%, of total revenue, with the remaining coming from exports.

Net profit reached VND 250 billion, an increase of 8% compared to 2023.

This was also the highest business result ever achieved by Cholimex Food, marking a continuous 15-year growth streak.

Previously, the company set a target of VND 3,850 billion in revenue and VND 320 billion in pre-tax profit for 2024. Thus, Cholimex achieved 99% of its revenue target and exceeded its profit plan.

The basic earnings per share (EPS) stood at VND 29,283, one of the highest in the market. Cholimex Food’s equity capital at the end of the year was VND 1,179 billion, while its charter capital was only VND 81 billion, resulting in a book value per share (BVPS) of up to VND 145,000 – the highest in the market.

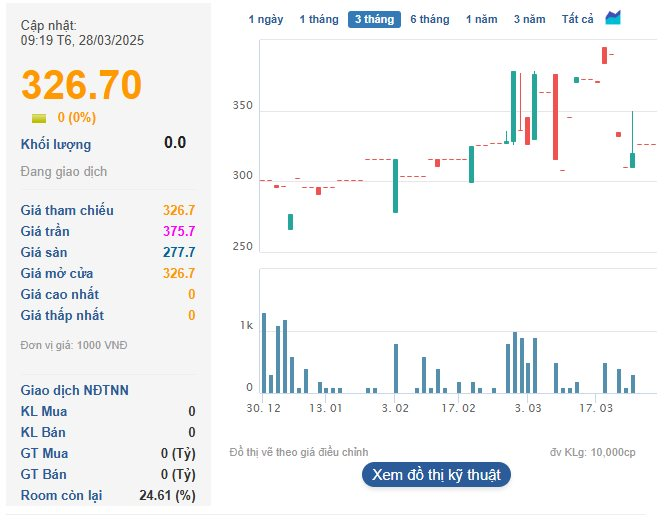

This explains why CMF is one of the stocks with the highest market price, currently trading at nearly VND 330,000 per share.

Recently, Cholimex Food announced that it will pay an interim cash dividend for 2024 at a rate of 50% (VND 5,000 per share). With 8.1 million shares currently in circulation, the company is expected to spend nearly VND 41 billion on dividend payments to shareholders. The payment is scheduled for May 8, 2025.

Since its listing on the stock exchange in 2016, Cholimex Food has never missed a year of cash dividend payments to its shareholders. Notably, the company has consistently paid dividends at a rate of 50% (VND 5,000 per share) for six consecutive years from 2019 to 2024.

Cholimex Food’s shareholder structure remains concentrated, with three major shareholders holding 92.55% of the capital. Specifically, Cholimex owns 40.72%, Masan Food holds 32.83%, and Nichirei Foods Inc. possesses 19% of the shares.

Having entered the hot chili sauce market in the late 1980s, Cholimex remains one of the leading companies in the industry, alongside Masan, Trung Thanh, and Nosafood. The company has established a distribution system in all 63 provinces and cities nationwide through popular channels such as Metro, Co.op Mart, BigC, as well as brands like The Pizza Company and Domino’s Pizza.

In 2014, Masan once attempted to increase its influence by making a public offer to purchase 49% of Cholimex Food’s shares at VND 90,000 per share, valuing the company at VND 730 billion. However, this offer was rejected by the existing major shareholders, Cholimex and Nichirei Food.

Following the refusal of Masan’s offer, Cholimex Food’s performance continued to improve in subsequent years, especially after achieving profits exceeding VND 100 billion in 2018.

During the trading session on March 28, 2025, shares of CMF of Cholimex Food Joint Stock Company were priced at VND 326,700 per share. With this price, CMF has surpassed HLB to become the second most valuable stock on the stock market, only after VNZ.

FPT Telecom (FOX) Aims for Record-High 2025 Profits, Targets 5,000 VND Cash Dividend per Share

FPT Telecom is taking a dynamic approach to capital expansion with a proposed 50% stock dividend. This strategic move will increase the company’s charter capital from 4,925 billion to approximately 7,388 billion VND. This stock issuance is a supplementary measure to the company’s cash dividend policy, demonstrating FPT Telecom’s commitment to rewarding its shareholders and fostering sustainable growth.