In just a month and a half (from February 2025 onwards), the global consumer goods market and the world’s export activities have been somewhat tumultuous due to fluctuations in trade policies and, more specifically, tariff regulations, particularly in the United States.

Recently, the US administration, led by President Donald Trump, issued a series of executive orders imposing higher tariffs (effective early March 2025) on various imported goods from countries such as China, Canada, and Mexico. There seems to be no end in sight to the unpredictability of America’s new tariff policies.

Moreover, to prevent the misrepresentation of exported goods, especially Chinese products disguised as those of other countries to circumvent high taxes, US authorities have intensified origin inspections. This includes surprise visits to production facilities and requests for more detailed supplementary documents. This new development will likely increase difficulties and pressure on businesses, as obtaining certificates of origin (C/O) may become a burden. This is considered a significant risk for many countries, including Vietnam. Meanwhile, Vietnam’s key export sectors (garments, leather footwear, high-tech products, seafood, wooden furniture, etc.) have set ambitious growth targets for this year, with many industries aiming for at least a 10% increase in export turnover compared to 2024.

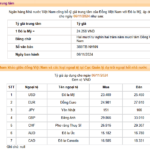

According to statistics, in 2024, Vietnam’s total import and export turnover reached 786.29 billion USD, a 15.4% increase compared to 2023. Exports grew by 14.3%, while imports increased by 16.7%, resulting in a trade surplus of 24.77 billion USD. Most export markets performed well compared to 2023, including ASEAN, the EU, South Korea, China, and the US. Notably, turnover with FTA partner countries witnessed high growth. For instance, according to the General Department of Customs, in 2024, Vietnam’s export turnover to the EU reached nearly 52 billion USD, a surge of 18.5% (equivalent to an increase of over 8 billion USD) compared to 2023. Vietnam also recorded a trade surplus of more than 35 billion USD with the EU, the highest among all FTAs that Vietnam has participated in. These achievements are largely attributed to the preferential tariffs and other trade advantages that the EU has granted to Vietnam under the FTA.

Visitors learning about pearl-made products for export by BLUSAIGON Joint Stock Company at an exhibition in early March 2025

|

Moving into 2025, Vietnam’s export activities are expected to become even more promising as the global economy and trade continue to recover and flourish. However, Vietnam’s exports still face risks and challenges, as mentioned earlier, due to their concentration in a few large markets, including the EU, the US, and China.

Given this context, in addition to regularly implemented solutions (investing in advanced technology, adopting green production processes, improving product quality, etc.), most economic experts believe that relevant agencies and businesses need to enhance trade promotion efforts by diversifying export markets and spreading risks. Firstly, we should maximize the benefits of the 17 FTAs that Vietnam has signed and joined to boost export volume and turnover. To better meet the demands of new markets, the state needs to continue refining the legal framework and policies to support businesses in transitioning to sustainable production models. It is also crucial to enhance the capacity for monitoring and enforcing environmental and labor commitments.

Notably, government agencies should promptly develop policies to support businesses in deeper integration into global value chains and better meet the sustainability standards of key and emerging markets. These policies should also encourage innovation, digital technology adoption, and process optimization to enhance businesses’ competitive advantage.

Additionally, relevant authorities and enterprises need to focus on thoroughly understanding and effectively exploiting markets with significant potential, such as the Middle East and the Halal market (Islamic countries). In this regard, Vietnam’s trade offices abroad must enhance their roles, responsibilities, and efficiency by providing timely information on global and local economic developments, especially policy changes in their host countries. Simultaneously, these trade offices should offer practical warnings and recommendations and strengthen their support for protecting trademarks and geographical indications for Vietnamese products in foreign markets. They should stand side by side with businesses in cases of trade defense.

– 10:14 17/03/2025

The Steel Industry’s Challenges: Exploring New Export Markets in 2025

The domestic steel industry is facing a challenging period with a surplus of supply for many locally produced steel products, coupled with a significant increase in steel imports. This will inevitably lead to intensified price competition for finished steel products, and a fiercer battle for market share in the domestic arena.

UOB: Vietnam’s GDP Growth Forecast to Hit 6.6% in 2025

UOB forecasts Vietnam’s GDP growth to reach 6.4% in 2024 and rise to 6.6% in 2025, underpinned by robust domestic fundamentals and improvements across various economic sectors.