On March 27, Gelex Joint Stock Corporation (GEX) held its 2025 Annual General Meeting of Shareholders.

According to Mr. Nguyen Trong Hien, Chairman of the Board, in the first quarter of 2025, Gelex’s revenue increased by 16% compared to the same period in 2024. Pre-tax profit also reached approximately VND 600 billion, up 58% from the first quarter of 2024.

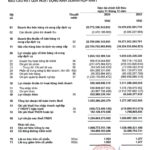

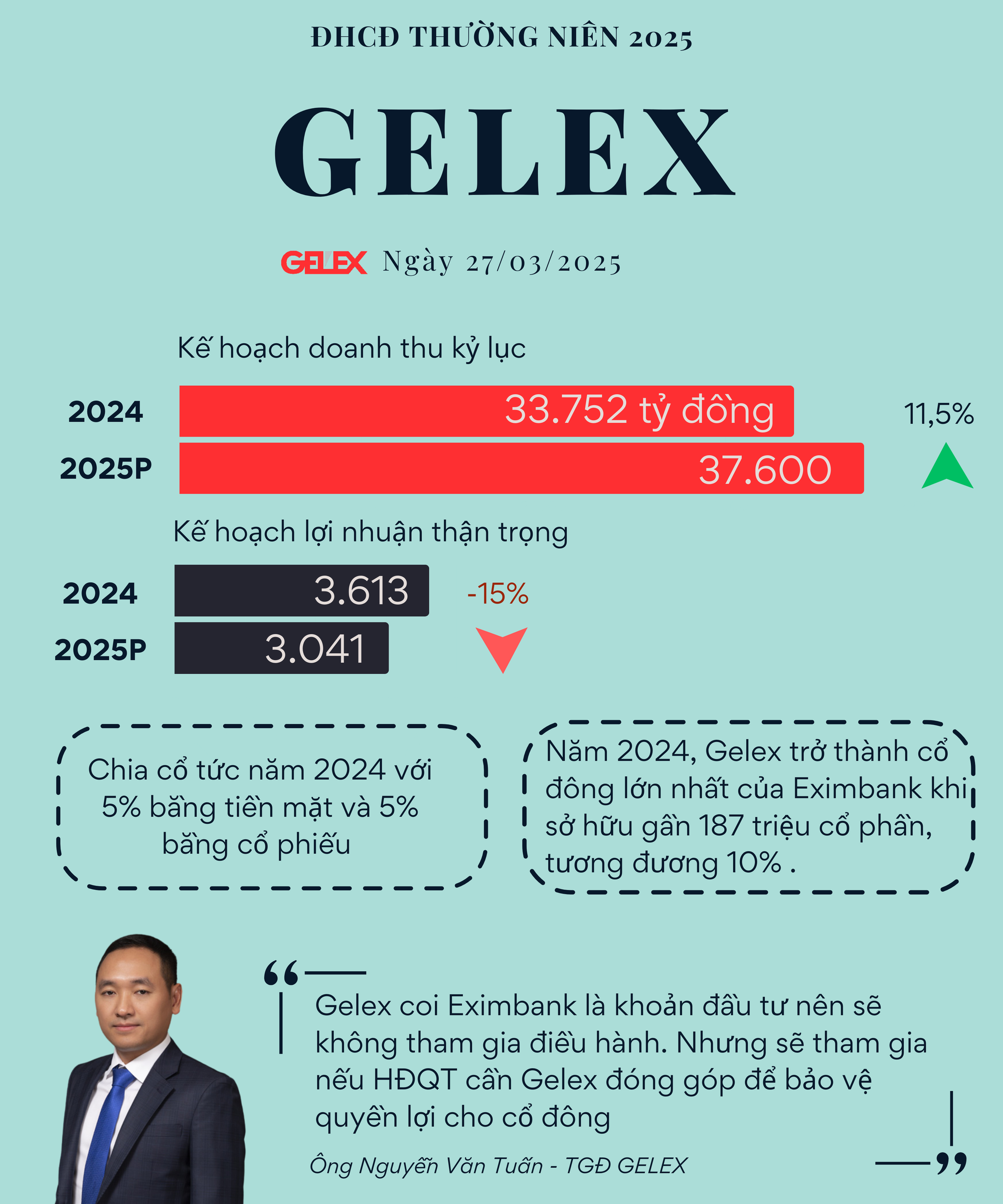

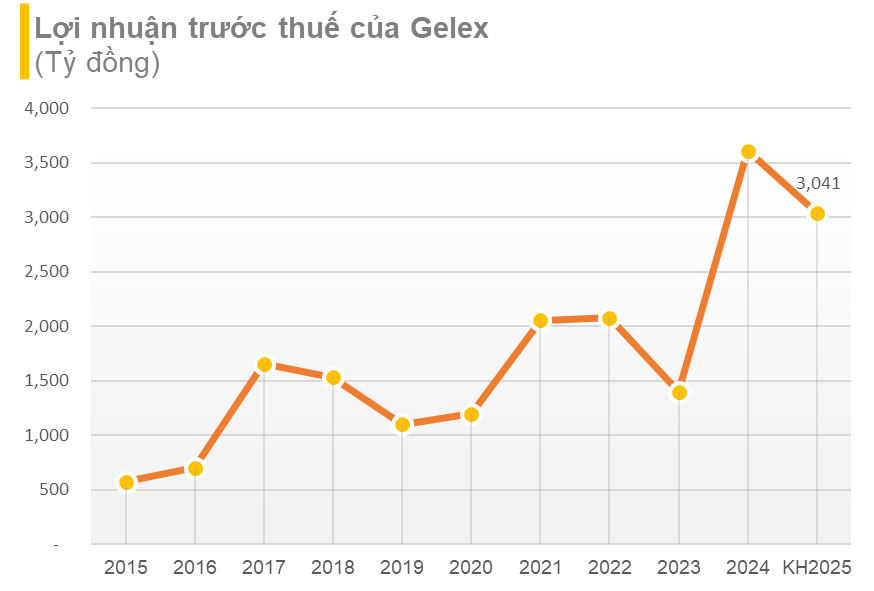

In 2024, Gelex’s consolidated net revenue reached VND 33,752 billion, and pre-tax profit reached VND 3,613 billion, exceeding the targets set by the AGM by 4.5% and 88.1%, respectively.

The company attributed the 12.5% increase in revenue compared to 2023 to the strong growth in the electrical equipment sector, driven by public investment in the electricity industry in 2024 and the recovery of the general market from the second quarter.

Other sectors of the Group, such as construction materials, industrial parks, and real estate, and Infrastructure Utilities, recorded decreases in revenue compared to 2023.

Consolidated pre-tax profit for the full year 2024 reached VND 3,613 billion, up 158.6% from the previous year due to strong profit growth in the core sectors of Electrical Equipment, Construction Materials, Industrial Parks, and Real Estate; cost reduction and optimization; and increased financial profits from divestment of energy projects and lower borrowing costs.

WILL NOT PARTICIPATE IN EXIMBANK’S MANAGEMENT

In 2024, Gelex also expanded its investment in the financial and banking sector by increasing its ownership to nearly 187 million shares, equivalent to 10% of the charter capital, at the Vietnam Export Import Commercial Joint Stock Bank (Eximbank), becoming the largest shareholder of the bank.

Gelex General Director Nguyen Van Tuan

Responding to this issue, General Director Nguyen Van Tuan stated that Gelex is a leading investment group, and its investment strategy in Eximbank is a long-term one. The goal of this investment is not to add the financial and banking sector to its ecosystem. The investment in Eximbank is considered a long-term investment to bring effective profits to the Group in the future.

Regarding Gelex’s participation in Eximbank’s management, Mr. Tuan said that Gelex considers Eximbank as an investment, so it will not participate in its management. However, if the Board of Directors needs Gelex’s contribution to protect the interests of shareholders, Gelex will participate if it aligns with the company’s strategy.

2025 PLANS WITH RECORD REVENUE

At the meeting, the Board of Directors proposed to the shareholders a business plan with a consolidated total revenue target of VND 37,600 billion, up 11.5% compared to 2024, and a pre-tax profit target of VND 3,041 billion, down 15% compared to 2024.

The Board of Directors also proposed a dividend plan of 10% for 2024, with 5% in cash and 5% in shares, and a dividend plan of 10% for 2025.

Regarding the change in the 2024 dividend plan to 5% cash and 5% shares, Mr. Nguyen Van Tuan explained that due to the many fluctuations in 2023 and 2024, Gelex needed to maintain a sufficient cash reserve for potential adverse situations. From 2024 onwards, the Group’s dividend policy will be a minimum of 10%, including 5% in cash and 5% in shares.

In 2025, for the electrical equipment and construction materials sectors, Gelex plans to continue expanding its domestic market while developing export markets. In particular, the company will focus on R&D to develop new products and cooperate with foreign partners.

In the energy sector, Gelex will continue to research and selectively invest in potential renewable energy projects in its development pipeline.

In the clean water sector, the company will continue to invest in and complete the Son Da Water Supply Project Phase 2 on schedule and research investment opportunities in water supply projects in various localities, including industrial parks.

In the industrial park and real estate sector, Gelex plans to expand its land fund in many provinces through joint ventures and joint-stock companies; develop new forms of industrial parks such as smart industrial parks and integrated eco-industrial cities; continue to focus on social housing projects while developing land funds for commercial real estate projects; and expand investments in ready-built factories (RBF) and ready-built warehouses (RBW) through the joint venture with Titan Corporation.

SUPPLEMENTARY MEMBER OF THE BOARD OF DIRECTORS ELECTED

At the Annual General Meeting of Shareholders of Gelex Group (stock code: GEX), held on the morning of March 27, the shareholders approved the dismissal of Mr. Nguyen Van Tuan from the position of member of the Board of Directors, according to his resignation letter dated March 3, 2025. The meeting also elected Ms. Nguyen Thi Minh Giang as a supplementary member of the Board of Directors for the term 2021-2026.

Notably, despite stepping down from the Board of Directors, Mr. Nguyen Van Tuan remains in the position of General Director of Gelex.

In response to a shareholder’s question about the reason for his resignation from the Board of Directors while remaining as General Director and the largest shareholder, along with related parties holding nearly 27% of the shares, Mr. Tuan provided candid feedback.

He stated that Gelex has been building itself as a transparent and efficiently managed corporation for many years. He emphasized that the leadership has established a well-structured management system from the Group to its subsidiaries, accompanied by a robust risk management framework.

Mr. Tuan cited his previous withdrawal from leadership positions at subsidiary companies such as Cadivi and Dien Luc Gelex (GEE), after which these companies recorded significant profit growth.

Providing further explanation, Mr. Tuan expressed his belief that, in international businesses, major shareholders typically do not directly participate in the Board of Directors or executive management, although such involvement can have positive aspects. He asserted that it is best for major shareholders to maintain a supervisory role rather than direct management when the company already has a robust system in place, including information technology, internal auditing, and monitoring.

Mr. Tuan confirmed that Gelex is focused on strengthening its systems by investing in information technology and digital transformation; seeking independent Board members with strong capabilities; enhancing internal auditing; investing in human resources; and creating development incentives for its subsidiaries.

GELEX WILL NOT INCREASE OWNERSHIP IN VIGLACERA

Regarding the increase in ownership in Viglacera, Mr. Nguyen Van Tuan stated that Gelex invested in the company in 2019 when the share price was around VND 23,000. Currently, the price of VGC shares has doubled. Mr. Tuan noted that the current valuation of Viglacera is not suitable for increasing ownership as the share price is already too high.

Gelex will continue to look for capable partners with strong management and financial capabilities to join in the purchase of Viglacera shares. If no buyers are found, Gelex will proceed on its own. Gelex has been involved in restructuring Viglacera, not to place representatives or take over management but to find better ways to operate the company.

Similarly, with Dong Anh Electrical Equipment, the Group has no intention of increasing its ownership as the valuation is too high and does not align with the Group’s strategy.

Regarding HEM, Mr. Tuan shared that Gelex no longer sees potential in this company. Gelex has separated the electric motor business, and revenue has continuously declined for many years, making further investment in this sector unviable. Therefore, Gelex has spun off the production business while retaining the real estate and joint ventures.

Mr. Tuan acknowledged that HEM was a learning experience for Gelex regarding the timeliness of divestment decisions. He also shared that Gelex will soon have tools to evaluate and discipline its investments.

Mr. Luong Thanh Tung, Vice Chairman of the Board of Directors, stated that Gelex currently holds 65% of the charter capital of Petroleum Long Son Industrial Park and Urban Area Joint Stock Company (Code: PXL). The project has obtained an investment certificate and adjustments to its investment policy. It is in the process of adjusting the planning and preparing for investment. Gelex is expediting the investment preparation process, with construction expected to commence in 2026.

Mr. Nguyen Trong Hien, Chairman of the Board of Directors, shared that the project at 10 Tran Nguyen Han is a leased land from the state, covering an area of approximately 10,000 m2. The Group is developing a complex that includes a 5-star hotel with 242 rooms, 9,000 m2 of office space, 300 m2 of commercial space, and 38,000 m2 of construction, including 8 floors, 1 tum, and 4 basements, with a total investment of approximately VND 5,000 billion.

Currently, 100% of the office space has been leased, and the commercial area of the project is expected to be operational in 2025.

Regarding Viglacera’s land fund, the company operates 14 industrial parks with a total land area of approximately 3,700 hectares, of which 2,700 hectares are commercial land, and 1,700 hectares have been leased. Viglacera does not hold 100% ownership of the industrial park projects.

The Lucrative Paycheck: Unveiling the Remuneration Secrets of a Top Oil and Gas Group’s Entity

Although the company witnessed double-digit growth in its 2024 financial results, PVS stock has declined by 21% in the past six months.

The Art of Asset Allocation: A Guide to the Portfolio Strategies of Top Fund Managers

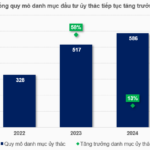

As of the end of 2024, the total scale of the entrusted investment portfolio of 43 fund management companies (FMCs) in the market reached nearly VND 586.5 trillion, a 13% increase from the beginning of the year and 59 times the scale of the industry’s total assets, equivalent to 8.2% of the capitalization of the Vietnamese stock market.

The Central Bank’s Aggressive Reduction of Funds Through Bill Channels

In the week following the Lunar New Year celebrations (03-10/02/2025), the State Bank of Vietnam (SBV) reduced the issuance of treasury bills while ramping up lending through the channel of pledging valuable papers.