On March 20, Thang Long Thermal Power Joint Stock Company (Thang Long Thermal Power) sent a document to the Hanoi Stock Exchange (HNX) to rectify information disclosed on March 27, 2024, regarding the 2023 financial report.

Accordingly, Thang Long Thermal Power has rectified the information “previous period” to “reporting period”.

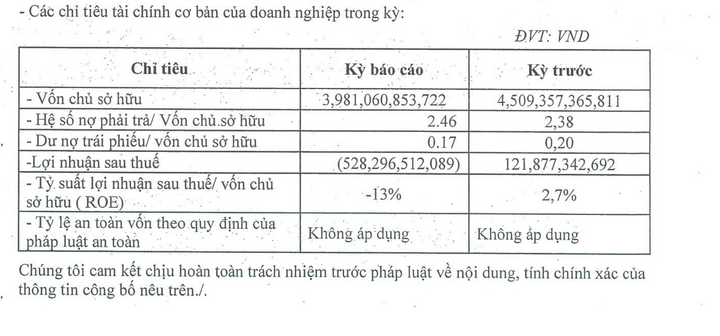

This means that for the reporting period of 2023, the company actually lost more than VND 528 billion but mistakenly reported a profit of nearly VND 122 billion from 2022.

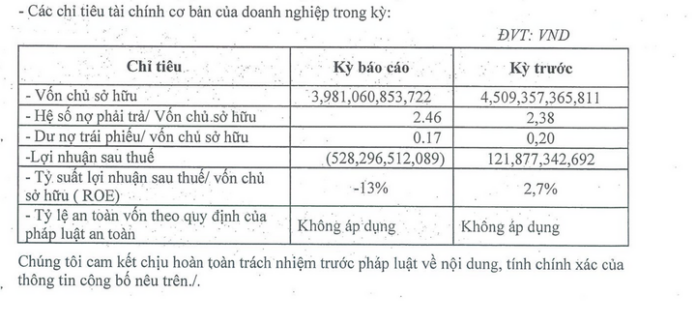

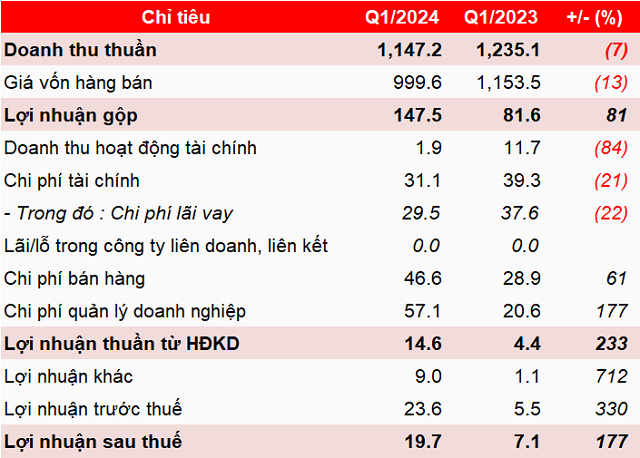

Thang Long Thermal Power’s report after rectification.

The actual owner’s equity at the end of 2023 decreased to VND 3,981 billion compared to the reported figure of over VND 4,509 billion.

The debt-to-equity ratio was also 2.46 times, instead of the lower rate of 2.38 times.

Notably, this mistake occurred just before Thang Long Thermal Power issued two new bond lots, totaling nearly VND 1,800 billion to the domestic market.

Commenting on this case, Mr. Nguyen Quang Huy, Executive Director of Finance – Banking, Nguyen Trai University, said that if the enterprise has transparently adjusted and the published documents reflect the truth, this may be a technical error in the process of data aggregation.

Through this case, investors, in addition to considering profits, also need to assess the financial history, reputation, and compliance of the enterprise to have a comprehensive view before making decisions.

Thang Long Thermal Power Company. (Photo: Vietnamprp)

Mr. Nguyen Anh Dung, a personal financial planning expert at FIDT Investment and Asset Management Consulting Company, also said that mistakes in financial reporting can happen. However, the consequence may be shifting the risk to investors. “For example, if a company issues bonds during the period of financial report mistakes and the business is not doing well, investors may face the risk of asset depreciation,” said Mr. Dung.

According to expert Nguyen Anh Dung, this may also create a domino effect, affecting the psychology of investors in the bond market. “Thang Long Thermal Power belongs to the ecosystem of a large enterprise. Therefore, when this incident occurs, it may make many people more cautious when choosing bond investments,” said Mr. Dung.

Meanwhile, analyzing the legal aspect, lawyer Tran Tuan Anh – Director of Minh Bach Law Firm, said: “Not only Thang Long Thermal Power but also any listed company, the disclosure of misleading information, especially changing the financial results from loss to profit, is a violation of the regulations on information disclosure of listed companies.”

According to the Securities Law and guiding documents, based on Article 8.2 of the Enterprise Law 2020, enterprises have the obligation to provide truthful and accurate information to protect the interests of investors and ensure market transparency.

At the same time, Article 12.1 of the Securities Law 2019 stipulates one of the prohibited acts in securities activities and the securities market, including “directly or indirectly committing fraudulent acts, deception, falsifying documents, creating false information or disclosing misleading information or concealing information or omitting necessary information that causes serious misunderstanding affecting the activities of offering, listing, trading, investing in securities, and providing services related to securities”.

What are the responsibilities of the involved parties?

According to Lawyer Tuan Anh, the Securities Law 2019 stipulates that the issuing enterprise has the obligation to disclose information truthfully, fully, and not misleadingly to investors.

If there is a violation, according to Clause 5, Article 8 of Decree 156/2020/ND-CP (amended by Decree 128/2021/ND-CP), the enterprise may be fined from VND 400 million to VND 500 million for the act of establishing and confirming the registration dossier for private placement of securities with misleading, untrue, or concealed information.

In addition, supplementary penalties include forcing the recall of issued securities, refunding the money for purchasing securities or deposits and interest on the certificates to investors.

“In serious cases, this act may be criminally liable, with a fine of between VND 100 million and VND 2 billion or imprisonment from 2 to 7 years depending on the level of damage. At the same time, the enterprise may also be banned from doing business, banned from operating in certain fields, or banned from raising capital for between 1 and 3 years,” said the Director of Minh Bach Law Firm.

In this case, Thang Long Thermal Power Company is responsible for explaining its act of disclosing misleading information, especially the role of the management board, chief accountant, and related individuals in providing inaccurate financial data.

The enterprise needs to cooperate with management agencies, provide truthful financial documents, and at the same time, take remedial measures, including rectifying information and compensating investors if requested.

The lawyer also said that besides the responsibility of the violating enterprise, the management agency also has a specific responsibility in ensuring market transparency and protecting the interests of investors.

According to regulations, management agencies such as the State Securities Commission, Stock Exchanges, and competent authorities are responsible for supervising, inspecting, and handling violations to protect investors’ interests. If any signs of violation are detected, they should promptly investigate the case, determine the level of violation, and take appropriate handling measures.

Mr. Tuan Anh also advised people to take multiple measures to protect their rights in similar incidents that may occur.

“First, they need to collect and keep all related documents, including financial reports, bond purchase contracts, and necessary vouchers as a basis for claiming compensation or filing a complaint. Next, investors can send a complaint to the State Securities Commission, the Stock Exchange, or the Ministry of Finance to request an investigation and handling of violations,” said Mr. Tuan Anh.

“If they can prove damage due to misleading information, they have the right to request the enterprise to explain, rectify the information, and compensate for losses,” he added.

In case the enterprise does not proactively remedy the situation, investors can consider filing a lawsuit to claim their rights.

FPT Telecom (FOX) Aims for Record-High 2025 Profits, Targets 5,000 VND Cash Dividend per Share

FPT Telecom is taking a dynamic approach to capital expansion with a proposed 50% stock dividend. This strategic move will increase the company’s charter capital from 4,925 billion to approximately 7,388 billion VND. This stock issuance is a supplementary measure to the company’s cash dividend policy, demonstrating FPT Telecom’s commitment to rewarding its shareholders and fostering sustainable growth.

The Secret Behind Eximbank’s Record Pre-Tax Profit of Over VND 4,000 Billion

“With a strategic focus on diversifying its revenue streams and financial services offerings, Eximbank has carefully structured its lending portfolio to prioritize safety and efficiency. This approach has been instrumental in driving impressive business results for the bank, setting it on a path towards a remarkable year in 2024.”