The suggestion was made by Ms. Doan Mai Hanh, Senior Director of Sales and Proprietary Trading at Techcom Securities (TCBS), during the seminar “Experiences and Operations of Crypto Exchanges” held on March 27.

The event took place as regulatory authorities are finalizing the dossier for a resolution on piloting the issuance and trading of crypto and digital assets. The resolution is expected to be submitted to the National Assembly for consideration at the upcoming session in May.

According to Ms. Hanh, once digital assets are recognized with a clear legal framework, TCBS will integrate them into their product offerings for clients. This is because they will provide an additional investment channel, helping to diversify portfolios and reduce risks for investors. However, the representative from TCBS acknowledged that digital assets are still novel and carry many risks and challenges. Therefore, she suggested that careful selection of digital assets to offer to customers is essential.

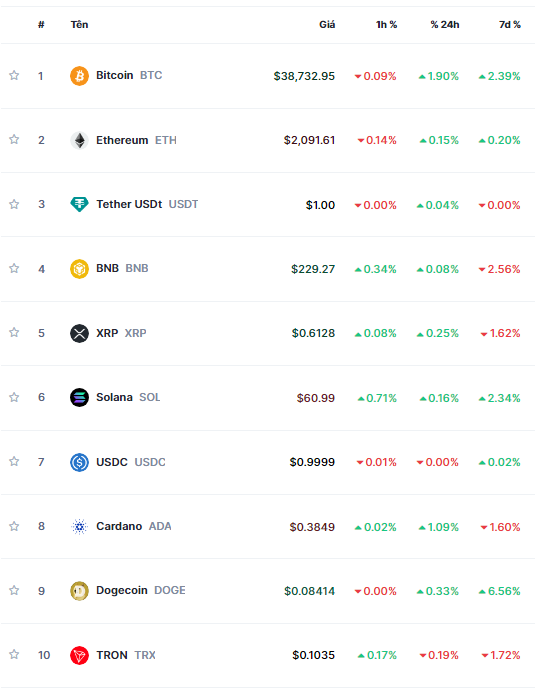

Currently, major global exchanges like Binance support trading for over 400 cryptocurrencies, while Coinbase offers more than 200. However, the leader of TCBS suggested that Vietnam should pilot a limited number of cryptocurrencies, possibly those with high value and liquidity that are recognized in multiple economies.

Ms. Doan Mai Hanh, representing Techcom Securities, speaks at the event on March 27 in Hanoi. Photo: Hoang Anh |

For other asset types, Ms. Hanh proposed piloting tokenized securities on this exchange. She explained that this type of product is very similar to traditional financial assets such as stocks, bonds, and fund certificates. Additionally, this type of token has the advantage of being divisible, unlike traditional securities.

“Service providers and investors have experience with traditional asset types, so introducing them into the digital finance space will be safer for all parties,” shared the TCBS representative.

A representative from the investment fund Dragon Capital also suggested piloting the tokenization of ETF (Exchange Traded Fund) products using blockchain technology. These financial products are backed by real assets (RWAs) and provided by reputable financial institutions under the supervision of regulators. This proposal aims to encourage individual investors to participate in the capital market by combining digital and traditional assets.

Accordingly, centralized exchanges in Vietnam, which handle large trading volumes, can play a crucial role in legal supervision, ensuring KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance.

Vietnam currently lacks a legal framework for crypto and digital assets, leading many businesses to choose to register in Singapore or the US and then operate in Vietnam. This situation results in a loss of competitive advantage and tax revenue for the country. From the user’s perspective, the lack of transparency leads to risks in transactions. Therefore, the early establishment of a legal framework for the identification and valuation of digital assets will enable businesses to access capital from banks and, consequently, have funds for investment.

However, many experts argue that strict regulations and limitations are necessary when piloting this new financial model in Vietnam. According to Mr. Pham Duc Trung, Chairman of the Vietnam Blockchain Association (VBA), the digital asset market still operates in a “gray area,” but many exchanges and innovative companies want to establish a presence in Vietnam. Mr. Trung believes that the government aims to standardize the market, and this will be a pilot project to gradually achieve that goal.

Therefore, the Chairman of the VBA suggested that entities should expect a limited number of exchanges and a market that may not be accessible to everyone during the pilot phase. Even if some entities cannot participate in the initial stage, Mr. Trung recommended that they collaborate with regulatory agencies in policy-making to promote a healthy market.

Last week, a representative from the State Securities Commission (under the Ministry of Finance) shared that in the draft resolution submitted to the government, the Commission proposed a pilot program with restricted scope in the initial phase. This approach will also allow authorities time to develop appropriate policies for managing crypto and digital assets. It was suggested that the Ministry of Finance, the Public Security, and the State Bank jointly manage the digital asset exchange to minimize financial security risks.

Mr. Duong Duc Hung, Deputy Head of Counter-Terrorism, Department of Internal Security, speaks at the event on March 27. Photo: Giang Huy |

According to VBA data, as of the end of 2024, Vietnam had approximately 17 million digital asset owners, ranking it among the top 7 countries globally. Last year, Vietnam received over 105 billion USD in crypto assets, a decrease from the 120 billion USD recorded in 2023. About 20 exchanges for these types of currencies operate in Vietnam.

Regarding anti-money laundering efforts in the context of piloting digital asset exchanges, Mr. Duong Duc Hung, Deputy Head of Counter-Terrorism at the Department of Internal Security (Ministry of Public Security), proposed establishing an inter-agency task force. This task force would include representatives from the Ministry of Public Security, the State Bank, the Ministry of Finance, and the VBA to supervise and share information on suspicious transactions.

While Vietnam has not recorded any cases of terrorist financing through crypto assets, Mr. Hung emphasized the potential risk. He noted that Vietnam’s location in Southeast Asia, close to countries previously affected by terrorist activities such as Indonesia, the Philippines, and Thailand, could make it a transit point for illegal cross-border funds, including those intended for terrorist financing.

The representative from the Ministry of Public Security also suggested strict penalties, including license revocation or criminal liability, for exchanges that fail to comply with regulations.

Anh Tu

– 16:11 27/03/2025

The Pi Network Launch Disaster: A Third of the Price and Technical Glitches Galore

After a long and highly anticipated 6-year wait, the official listing day of the Pi Network (Pi) fell flat, disappointing millions of users. The value of the coin plummeted, and technical glitches plagued the app and website.

The Crypto-Husband: Chasing the Dream, Losing a Fortune

My husband dabbled in a few different cryptocurrencies, but they were all obscure and potentially fraudulent. To sell these cryptocurrencies, he had to invest real money into the system. Time and time again, he was scammed out of hundreds of thousands of dollars, yet he remained convinced that he could strike it rich with these digital assets.

The Crypto Conundrum: Virtual Money, Real Losses

In recent times, a myriad of new scams has emerged, preying on the greed and ignorance of unsuspecting individuals. These scams lure people into investing and trading various forms of virtual currencies with promises of hefty future profits. However, blinded by these enticing promises, investors often overlook the inherent risks, ultimately losing their hard-earned money on worthless virtual “assets.”

![[IR AWARDS] June 2025 Disclosure Calendar: Mark Your Dates](https://xe.today/wp-content/uploads/2025/06/HinhT6_01-218x150.png)