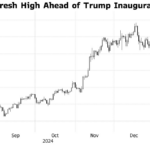

Illustrative image of Bitcoin cryptocurrency. (Photo: Reuters/ VNA)

|

The Bitcoin cryptocurrency could surge to $110,000 per BTC before correcting to $76,500, according to entrepreneur Arthur Hayes, co-founder of BitMEX.

He believes that this price rally will be fueled by the US Federal Reserve’s shift from quantitative tightening (QT) to quantitative easing (QE), injecting more liquidity into the financial markets.

“I’m betting Bitcoin hits $110,000 before it returns to $76,500. For government bonds, the Fed is moving from QT to QE,” wrote Hayes on social media platform X.

Bitcoin recently broke past the $86,000 mark on March 23, reaching $88,000 the following day. It is currently trading around $87,480. Bitcoin’s market capitalization stands at $1.727 trillion, with a 24-hour trading volume surge of 93% to $18.2 billion.

Despite the positive outlook, some experts warn that QT is still ongoing, albeit at a slower pace. “QT will not ‘basically be over’ on April 1,” said Benjamin Cowen, CEO of IntoTheCryptoVerse.

However, expectations of future QE continue to bolster market sentiment. In the past, QE cycles have triggered significant Bitcoin rallies, notably the 1,000% increase from March 2020 to November 2021.

Markus Thielen, founder of 10x Research, suggests that Bitcoin may have bottomed out and is now recovering. He attributes this to the Fed’s softer stance and President Donald Trump’s flexible policies on tariffs.

Additionally, selling pressure has eased as US Bitcoin spot ETFs saw net inflows of $744 million last week, with BlackRock alone contributing $537 million, according to Farside Investors.

Cryptocurrency analyst Ali Martinez points out that Bitcoin trading volume has dropped from $87 billion to $42 billion in the past month, indicating a trend of holding rather than selling among investors.

Previously, in late February, Hayes predicted significant Bitcoin volatility. Soon after, the digital currency dropped below $80,000 – its lowest level in over three months – due to tariff concerns, triggering a market-wide sell-off. Bitcoin, ethereum, XRP, solana, and dogecoin all lost 20-25% in a single week.

Following the Federal Open Market Committee (FOMC) meeting, Bitcoin’s surge past $85,000 is seen as a positive sign.

Analyst Emmanuel Cardozo predicts that liquidity conditions and discussions about a strategic US Bitcoin reserve could push prices to $110,000. However, he cautions that $76,500 remains a potential correction level due to market volatility.

With Bitcoin hovering around $87,000, investors continue to closely monitor monetary policies and liquidity trends. Despite the positive long-term outlook, the market remains susceptible to sharp corrections as prices fluctuate.

– Phuong Nga

16:48 25/03/2025

The New Wind of Change for Crypto Exchanges: America’s Shifting Stance

The U.S. Securities and Exchange Commission (SEC) has filed a motion to dismiss the lawsuit against Coinbase, paving the way for the growth of the digital asset market in the United States.

The Crypto-Husband: Chasing the Dream, Losing a Fortune

My husband dabbled in a few different cryptocurrencies, but they were all obscure and potentially fraudulent. To sell these cryptocurrencies, he had to invest real money into the system. Time and time again, he was scammed out of hundreds of thousands of dollars, yet he remained convinced that he could strike it rich with these digital assets.

The Crypto Conundrum: Virtual Money, Real Losses

In recent times, a myriad of new scams has emerged, preying on the greed and ignorance of unsuspecting individuals. These scams lure people into investing and trading various forms of virtual currencies with promises of hefty future profits. However, blinded by these enticing promises, investors often overlook the inherent risks, ultimately losing their hard-earned money on worthless virtual “assets.”

Trump Adds 5 Cryptos to Strategic Reserve, Bitcoin Surges 10%, Cardano Skyrockets 60%

President Donald Trump has officially announced the inclusion of five cryptocurrencies in the United States’ strategic reserve. Within hours of this announcement, the total market value of cryptocurrencies surged by over $300 billion, an impressive 10% increase.

![[IR AWARDS] June 2025 Disclosure Calendar: Mark Your Dates](https://xe.today/wp-content/uploads/2025/06/HinhT6_01-218x150.png)